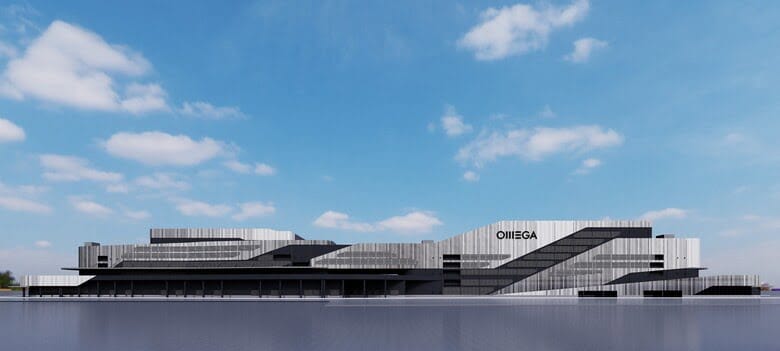

Omega 1 Bang Na near Bangkok will be operated by Taiwan’s Ally Logistic Property (Image: ALP)

Singapore’s CapitaLand Investment announced this week the acquisition of four properties, led by a greenfield warehouse project in Thailand, and the closing of a core logistics private fund in Japan.

The investment manager in December acquired Omega 1 Bang Na, a 20 hectare (49.4 acre) freehold site near Bangkok, on behalf of its Southeast Asia logistics fund with Thai developer Pruksa Holding and Taiwan-based Ally Logistic Property, it said Wednesday in a release. Plans call for developing the site into Thailand’s biggest stand-alone warehouse with 2.47 million square feet (229,471 square metres) of gross floor area.

In Singapore, CapitaLand Investment’s C-Well healthcare property fund — another partnership with Pruksa — and the Ascott lodging division last month bought the Hotel G near Bugis and Bencoolen MRT stations from Hong Kong’s Gaw Capital Partners for a reported S$240 million ($180 million). The firm is also nearing the purchase of two industrial assets in the city-state to add 320,000 square feet of GFA to its Extra Space Asia self-storage platform.

“Despite the challenging market conditions, we have made tremendous progress in deploying capital strategically across Southeast Asia over the past year into assets catering to self-storage, logistics and wellness-hospitality sectors,” said Patricia Goh, CEO of Southeast Asia investment at SGX-listed CapitaLand Investment, which is controlled by state holding firm Temasek.

Seed Asset Set to Rise

No deal values were disclosed, but CapitaLand Investment said the completion of the Thailand development would bring the total investment value of the four announced acquisitions to S$700 million, boosting the firm’s funds under management to S$1.2 billion.

Patricia Goh, CEO of Southeast Asia investment at CapitaLand Investment

Located along the Bang Na-Trat Highway in Bangkok’s neighbouring Samut Prakan province, Omega 1 Bang Na is the seed asset of CapitaLand SEA Logistics Fund and marks CapitaLand Investment’s first logistics property in Thailand.

The built-to-suit campus will comprise one building each of ambient and cold storage, with construction set to begin in the first half of 2024 and first-phase completion scheduled for 2026. Ally Logistic Property will operate the finished campus.

C-Well and Ascott plan to reposition the 308-unit Hotel G under the Lyf brand, tying into that chain’s promise of experience-led social living. The property will remain operational throughout the renovation period and be unveiled as Lyf Bugis Singapore in mid-2024, CapitaLand Investment said.

Targeting Japanese Investors

On Monday, CapitaLand Investment revealed the closing of a core logistics private fund in Japan targeting domestic investors, with the new vehicle to increase the firm’s funds under management by JPY 16.5 billion ($110 million).

CapitaLand Investment holds a minority stake in the closed-ended fund, which has attracted several institutional capital partners in Japan, the firm said in a release.

The fund is seeded with the Sagamihara Minami Hashimoto Logistics Centre in Greater Tokyo and the Ibaraki Saito Logistics Centre in Osaka, two operational properties with a combined gross floor area of 49,300 square metres (530,661 square feet).

“Establishing this domestic core logistics private fund in Japan aligns with our house view that there are significant growth opportunities for logistics real estate in markets like Japan and Korea,” said Simon Treacy, CapitaLand Investment’s CEO of private equity real estate. “Driven by growing demand from industries such as ecommerce, and wholesale and consumer goods manufacturing, the long-term outlook for the logistics sector in Asia remains positive.”

Leave a Reply