Canadian PM Justin Trudeau’s government has put a stop to CCCC’s planned Aecon buyout

China’s overseas acquisition drive has suffered another blow amid scrutiny by foreign regulators, with the Canadian government rejecting the proposed $1.2 billion acquisition of Aecon Group, one of Canada’s largest builders, by state-owned CCCC International Holding Limited (CCCI).

Canada’s national security agencies have conducted a multi-step national security review of the deal, according to Navdeep Bains, Canada’s Minister of Innovation, Science and Economic Development. “Based on their findings, in order to protect national security, we ordered CCCI not to implement the proposed investment,” Bains said in a statement. “Our government is open to international investment that creates jobs and increases prosperity, but not at the expense of national security.”

Under the deal first announced in late October last year, CCCI, the overseas investment platform of state-owned China Communications Construction Company Limited (CCCC), would purchase Toronto-based Aecon Group at a 42 percent premium to Aecon’s share price on August 24, 2017.

This past February, the takeover plan was pushed back a month to March 30 after Canada’s federal cabinet ordered a national security review.

China Urges Canada Not to Demonise SOEs

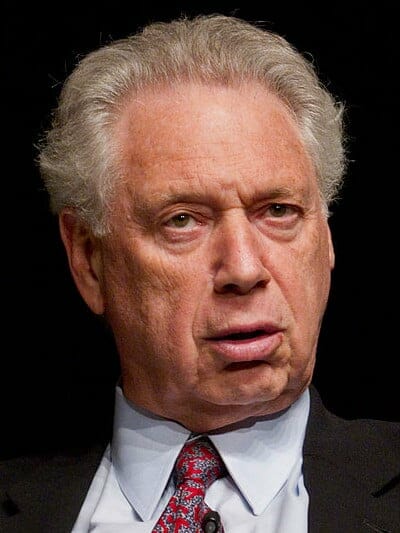

Aecon group president and CEO John Beck was let down by the Canadian government’s rejection

Aecon, the builder of landmarks including Toronto’s CN Tower and Vancouver’s SkyTrain, expressed its disappointment with the government’s rejection. “Through our proposed transaction with CCCI we had outlined a vision in which Aecon would be better able to compete with the many large global construction companies actively working in Canada. The deal offered considerable benefits to Aecon and its various stakeholders,” said President and CEO of Aecon Group in a statement.

Concerns over the proposed takeover centred on Aecon’s role as Canada’s largest builder of telecommunications networks, as well as the company’s alleged access to information that could compromise national security if it fell into the wrong hands. “We know Aecon has been awarded numerous sensitive Canadian government contracts, including working with our military and in the nuclear sector,” Conservative MP Tony Clement said in February. Aecon responded that it is not involved in sensitive military installations in Canada, and does not own any intellectual property related to nuclear energy or other sensitive proprietary technology.

Last month, China’s envoy to Canada Lu Shaye rebuked the concerns in Ottawa, saying that it is “immoral” for Canadians to oppose Chinese government-controlled businesses taking over Canadian companies. The diplomat also denounced national security scrutiny of those acquisitions.

Lu urged Canada to “adjust its mindset” and embrace the idea that China’s state-owned enterprises are not a national security threat to the North American country.

Chinese Acquisitions Under Scrutiny

The US government has also scrutinised acquisition proposals made by Chinese companies over the past few months. Earlier this month, Chinese airliner-turned-conglomerate HNA Group dropped its bid for most of US hedge fund SkyBridge Capital, as the deal had been under review by US regulators for over a year.

The aborted deal followed Ant Financial’s failed plan to acquire MoneyGram International in January. The Committee on Foreign Investment in the United States (CFIUS) shot down the attempt by Alibaba’s financial arm to take over the American money transfer company.

Transportation Builder Hits a Roadblock

The Canadian government’s rebuff deals a blow to CCCC’s global expansion drive, which has seen the Beijing-based firm — ranked as a top-three international contractor by Engineering News-Record last year — invest or commit over $1.9 billion on major overseas projects in recent years.

The company has been building up a global presence as both an infrastructure builder and a real estate developer, through projects such as a $1.4 billion Sri Lanka port facility and a $290 million investment in the mixed-use Grand Avenue complex being developed by Related in Los Angeles.

The mainland giant has also been adding overseas construction firms to its shopping cart, buying Houston-based offshore engineering company Friede & Goldman in 2010 and picked up Aussie engineering and construction firm John Holland in 2015 for $879 million. In the following year, John Holland announced a A$1.1 billion ($779 million) CCCC-funded budget for development and investment focussed on residential and hotel projects, and the company bought the former ANZ Bank Building in downtown Sydney in a deal worth A$80 million ($60 million) last June.

CCCC is primarily engaged in the design and construction of transportation infrastructure, dredging and heavy machinery manufacturing, according to its corporate website.

Leave a Reply