Lendlease took a 49% stake in the redevelopment of the Singtel headquarters in June (Image: Singtel)

Investment in Singapore real estate climbed to S$20.2 billion ($14.5 billion) in the first half of 2022, up by 89 percent from the same period last year as investors continued to pursue commercial assets in the city despite growing uncertainty globally.

The half-year total was helped along by big ticket commercial deals including Lendlease’s acquisition of a 49 percent stake in the S$798.7 million redevelopment of Singapore Telecommunications’ Comcentre headquarters in June, according to a report by Knight Frank.

“Investment sales picked up pace in Q2 2022 even with the impending threat of global stagflation, rising interest rates and political tensions, with investors seeking core and core-plus targets in a stable Singapore,” said Daniel Ding, head of the land and building division of Knight Frank’s Singapore capital markets team. “

Based on the first half performance and expectations of sustained “keen interest” from both local and foreign investors, the property agency estimates that investment sales in 2022 may reach S$35 billion, which would surpass last year’s level by 32 percent.

Commercial Dominates

Private commercial deals dominated the market last quarter as they accounted for 76 percent of total investments by value.

Daniel Ding of Knight Frank

“Against the backdrop of current economic conditions, with the prolonged Russia-Ukraine war, hiking interest rates and inflation, coupled with increased raw materials and construction costs, many investors increasingly diverted their focus towards commercial assets,” Knight Frank said in its report.

Beyond the redevelopment of the Singtel Building, other big ticket commercial acquisitions within the core or core-plus bracket during the past three months included AEW’s June purchase of the Westgate Tower in Jurong East from Sun Venture for S$677.5 million and KKR’s S$599 million buy of the Twenty Anson office block in April. Also in June, a Boustead Projects-led consortium secured a commercial development in the Orchard Road area for S$515 million.

Knight Frank said investors continue to view the city’s commercial assets as a “defensible asset class against looming economic uncertainty” given the rental income they generate, the likelihood for capital appreciation and exemption from stamp duty for second homes.

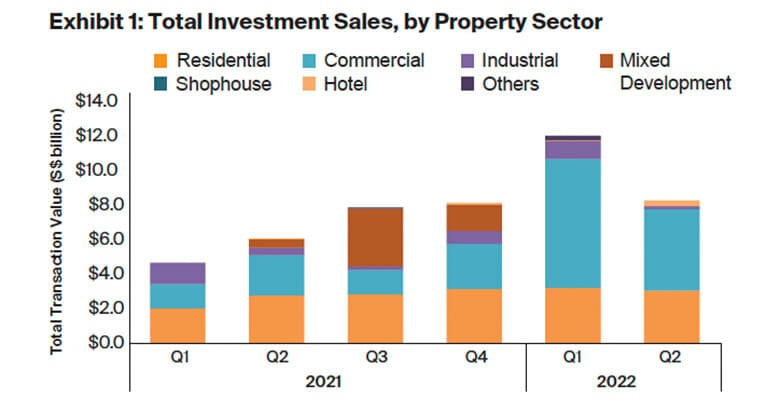

Second quarter investment sales reached a total of S$8.2 billion, which represented a 37 percent surge from the same period last year, but a slowdown from the first quarter’s $12 billion.

Source: Knight Frank

In the residential market, international investors appeared to be unfazed by the cooling measures imposed by Singapore regulators in December after news reports last month showed a Chinese national bought 20 units at CanningHill Piers for S$85 million, while US private equity firm Angelo Gordon is in the process of selling 22 apartments at Draycott Eight to an unidentified Indonesian family for S$168 million.

The report pointed to the city’s “stable and conducive location” as attracting international high net worth individuals and corporate investors.

On a quarterly basis, however, investment activity from April through June eased from the S$12.4 billion worth of deals booked in the first three months of the year – with the January through March period having seen Lendlease Global Commercial REIT’s takeover of the Jem complex in Jurong East and the sale of office tower at 79 Robinson Road to CapitaLand Integrated Commercial Trust.

Developments Projects on the Rise

Land-hungry developers also helped drive up investments with a string of development projects purchased through government land tenders and collective sales between April and June.

Last month saw SingHaiyi Group win the tender for a residential site on Dunman Road for S$1.28 billion – the largest transaction in the quarter – while a joint venture by UOL Group and Singapore Land Group topped the bid for Pine Grove (Parcel A) residential parcel at S$671.5 million.

The S$700 million sale of Golden Mile Complex ranked as the third largest acquisition last quarter after a consortium among Perennial Holdings, Far East Organization and Sino Land agreed to buy the conserved cruise ship-like structure in a collective sale in May.

Reflecting ongoing investor confidence, even big ticket projects readily found suitors.

“While bite-sized land parcels might be preferred due to its palatable quantums, recent events have pointed to developers’ increasing willingness to explore larger land sizes,” said Chia Mein Mein, Knight Frank Singapore’s capital markets head for land collective sale.

Double-Digit Growth Seen This Year

While acknowledging external headwinds that could dent business sentiment, Knight Frank is projecting that Singapore investment sales will range from S$32 billion to S$35 billion, barring any unexpected slumps.

That volume would surpass last year’s total of S$26.6 billion by 20 percent to 32 percent, and already this month there have been major deals including Chinese investment firm Bright Ruby agreeing to buy 16 Collyer Quay near Raffles Place from NTUC Income for over S$1 billion.

Leave a Reply