Greentown chairman Song Weiping may be celebrating his $1.3 billion land buy in Beijing

Chinese homebuilder Greentown Group has won a piece of residential land in western Beijing for RMB 8.6 billion ($1.3 billion), paying a premium of nearly 20 percent over the reserve price to grab the city’s most expensive site on offer this year.

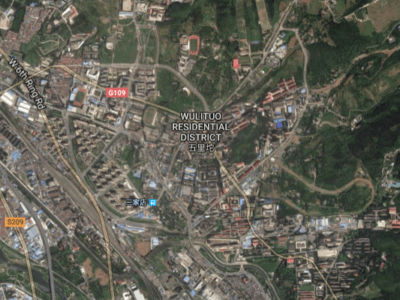

The plot in Shijingshan district spans 21.6 hectares (216,400 square metres) and allows for a low-rise residential and commercial development of 347,900 square meters, with 20 percent of that space earmarked for rental housing, according to an announcement by the Beijing Municipal Bureau of Land and Resources.

Greentown shouldered aside an array of mainland developers for the site, paying the equivalent of RMB 24,720 ($3,723) per square metre of buildable area. The site, which had a starting bid price of RMB 7.19 billion ($1.07 billion), was auctioned along with two other plots in the Wulituo sub-district of Shijingshan on Tuesday.

Greentown Spends Big on Beijing Housing Land

Shijingshan Wulituo Lot No. 1 (1601-029) has a plot ratio of just 0.8, allowing for 251,600 square metres of residential development, 93,4000 square metres of infrastructure and 2,880 square metres for an elementary education facility. Thanks to Beijing’s current market controls on housing, when completed, Greentown is forbidden from selling the homes at more than RMB 54,625 per square metre.

The site is located in the Wulituo neighbourhood of Beijing’s Shijingshan district

The home price cap and the dedicated rental housing space are part of a government campaign to guarantee housing affordability in China, where residential values have soared beyond the reach of many citizens. Ranked last year as the least affordable city in the world by the UK’s Global Business Cities Alliance, Beijing has been targetted with some of the most aggressive housing market curbs.

Despite the market controls, Hangzhou-based Greentown won the site against fierce competition from Ping An Real Estate and at least three other consortium bidders, including Poly Real Estate, Beijing Capital Development and Gemdale; Beijing Shixing Tengfei Property Development, Sino-Ocean Land, Future Land Development and Financial Street Holdings; and China Vanke, CIFI Holdings and Henderson Land Development.

All of Greentown’s identified rivals are mainland-based firms except for Hong Kong development giant Henderson. The starting bid price for the site is said to be the highest in Beijing this year, according to a local media report.

City Government on Land Sale Drive

Developers aren’t always so keen to snap up land in China’s capital, as the sale comes less than a week after the first failed auction of a Beijing residential plot in more than two years. A 3.6 hectare (36,000 square metre) mixed-use site including a residential parcel in the city’s fringe Pinggu district failed to attract a buyer last Friday, according to an account in the South China Morning Post.

On the same day, two sites closer to the city centre met with tepid interest, with plots in Chaoyang district and Haidian district selling for RMB 4.98 billion (RMB 25,547 per square metre) and RMB 5.36 billion (RMB 28,709 per square metre), respectively – at or just above the starting bid price – after attracting only one or two bidders each.

The lack of developer enthusiasm for the three sites may relate to the remoteness of the Pinggu parcel, and the mandatory price cap of RMB 37,000 to 38,000 per square metre for the homes sold on the Chaoyang and Haidian sites.

The municipal government has ramped up the release of land parcels for auction this year as it strives to boost housing supply and curb soaring home prices. In January through October, 60 residential plots have been sold in Beijing with a total gross floor area of 7.54 million square metres – nearly five times the 1.53 million square meters of land sold in all of 2016, according to figures cited by the newspaper.

Another three residential plots totalling 267,000 square metres in Chaoyang district, Yanqing district and Shunyi district are scheduled to go on the block on November 30, with a combined starting price of RMB 6.6 billion ($994 million).

Hangzhou-Based Builder Sticks to Domestic Projects

Greentown may be looking to step up its projects in China as the residential builder has made no discernible progress on a RMB 20 billion ($2.9 billion) overseas investment plan trumpeted by its chief executive this past January.

The firm, whose largest shareholder is state-owned China Construction Communications Group (CCCG), was the ninth-largest developer by sales as of this past April, and has a land bank spanning over 30.57 million square metres.

Great photo. Stay classy, Song Weiping.