Cities with high average workplace densities such as Hong Kong may be in for some changes (Source: JLL)

As the world’s largest work-from-home experiment fades in the face of mass vaccinations, offices in central business districts are expected to regain their status as primary hubs of commerce, according to a study released this month.

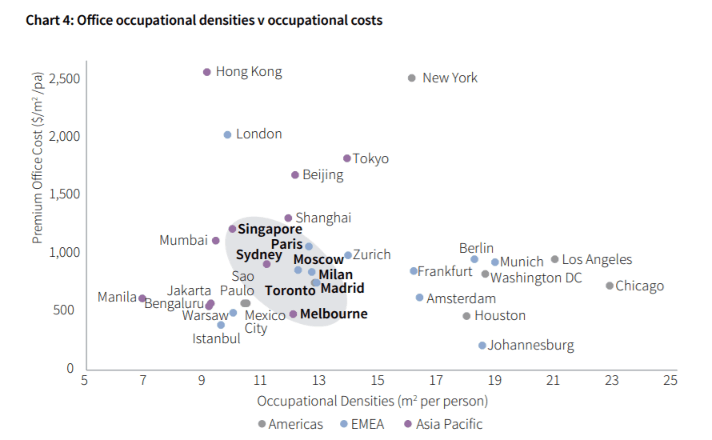

Many workers are likely to return to offices with fewer people per square metre, however, as businesses rethink a shift over the past 20 years towards greater workplace density in order to mitigate health risks, researchers from JLL found in their Benchmarking Cities and Real Estate report.

High-cost cities that had tight occupational densities pre-COVID, including key office hubs like London, Hong Kong and Singapore, will be particularly pressed to de-densify, the property consultancy found.

“Metrics that measure human experience are becoming increasingly important to businesses and cities,” said Jeremy Kelly, lead director of global cities research at JLL. “As we move into the next cycle of recovery, we expect offices in central business districts will again become social and business hubs, adapting to accommodate the way people want to work and live in the future.”

Close Quarters in Asia

JLL’s global benchmarking services surveyed 32 world cities with office space of 9 million square metres (96.9 million square feet), housing nearly 800,000 employees. The global mean density was 13.3 square metres of office space per person.

Jeremy Kelly of JLL

Chicago enjoyed the least dense office environment at 22.8 square metres per person, followed by Los Angeles (20.9), Munich (18.9), Washington DC (18.5) and Johannesburg (18.4).

At the other end of the scale, Manila easily had the most confining office specs at 6.9 square metres per person, followed by Hong Kong (9.1), Bengaluru (9.2), Jakarta (9.3) and Mumbai (9.4).

In Asia Pacific, the cities included in the report with the most space per worker were Tokyo, which had 13.9 square metres per person, and Beijing, which provides 12.1 square metres for each team member.

Singapore’s Edge

For Singapore, whose 10 square metres per person placed it as the eighth most dense, relatively lower rental costs could mean a more favourable calculus for increased breathing room.

“While major cities like Hong Kong and London’s high office rental costs could reduce occupiers’ propensity to de-densify, fortunately for Singapore, our relatively lower office rental cost would render the opportunity cost of de-densification more compelling,” said Tay Huey Ying, head of research and consultancy at JLL Singapore.

According to JLL data, occupiers of premium offices in Singapore pay an average of $113 per square metre per year to accommodate their workers, compared to $240 per square metre per year in Hong Kong’s Central district and $192 per square metre per year in Beijing’s Finance Street area. The data did not break out data for Singapore’s financial district to provide comparisons to prime locations in other cities.

Tay said occupiers in the Lion City should consider de-densification options when designing their workplaces, given that two-fifths of Singapore-based workers polled by JLL expect a less dense work environment in the future.

Sustainability Metrics

JLL predicts a shift in space occupation patterns as the pandemic fades and sustainability issues come to the fore. Even so, occupiers that restructure their use of space in favour of lower worker density may also face issues around energy and water consumption, the report said.

Although utility costs per square metre are broadly similar across global regions, energy consumption per person in Asia Pacific is much lower than in other major regions due to tighter occupational densities. For example, North American offices consume 333 kilowatt-hours of energy per square metre while APAC offices use just 206 kilowatt-hours per square metre.

JLL notes that efforts towards more sustainable workplaces will also have to factor in health considerations driving a shift to lower worker density, with occupiers striving to achieve what could be conflicting goals.

Leave a Reply