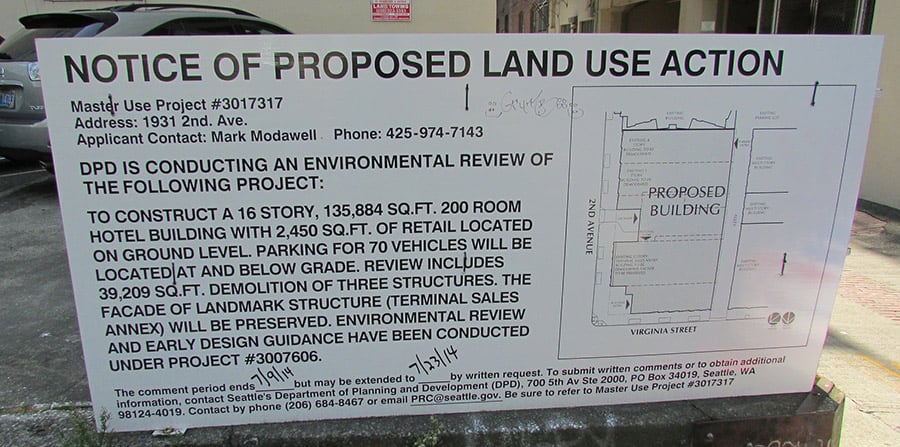

What an $18 million site looks like in Seattle

Pacific Eagle, a US real estate developer controlled by Hong Kong’s Great Eagle Holdings today announced the acquisition of five contiguous land parcels totaling 19,440 square feet (1800 square metres) in Seattle’s Belltown neighborhood. The off-market purchase is the latest in a series of west coast acquisitions for Pacific Eagle, which is controlled by Hong Kong’s Lo family.

Pacific Eagle purchased the site at the southwest corner of Second Avenue and Virginia Street in the Pacific Northwest’s largest city for $18 million, with plans already approved for construction of a 17-storey hotel on the property.

Pacific Eagle, which is a sister company to the Lo family’s Langham Hotel group, makes this most recent acquisition amidst a rising tide of interest in Seattle real estate from Asian investors.

Great Eagle Bets on Seattle’s Downtown

Adam Aasen of Pacific Eagle

The cross-border real estate developer bought the site at 1931 Second Avenue from a local family office which had owned the property for the last 50 years. The downtown site close to the city’s Pike Place market, and Amazon’s global headquarters, as well as the city’s Waterfront Park redevelopment.

“We feel the property’s location is perfectly positioned to take advantage of the ongoing transformation towards the downtown core,” Adam Aasen, Vice President of Acquisitions at Pacific Eagle said of the newly purchased site. He added that, “Seattle has established itself as a premier urban gateway market.”

The transaction represents the second downtown Seattle purchase by Pacific Eagle in just over a year, after the company purchased the Dexter Horton Building, a 336,000 square foot historic office building last November for $124.5 million.

Earlier this month, Pacific Eagle announced that they will open a Seattle office in the Dexter Horton Building sometime in the first quarter of this year, as the company continues to focus on opportunities in the city. The developer’s headquarters is in San Francisco.

In addition to its Seattle deals Pacific Eagle manages the Pacific Eagle (US) Real Estate Fund, a North American-focused property investment vehicle. The company’s current projects include the Cavalleri condo development in Malibu, Calfornia; The Austin luxury project in San Francisco and the Langham hotel in Chicago.

Asia Loves Seattle

The Lo family and Great Eagle are not alone among Asian investors looking for opportunities in Seattle real estate.

Plans for the property seem to already have been spelled out

In December, Hong Kong’s Gemini Investments bought a 480,389 square foot (45,000 square metre) office complex in suburban Seattle for an undisclosed sum through its US-based joint venture, Gemini Rosemont. That Gemini deal was preceded by China Vanke, which in May had invested $200 million to begin developing its own office tower in the city.

Another Hong Kong investor, Gaw Capital, in late 2015 bought an office building in Seattle for $49.5 million through a US-based affiliate.

Leave a Reply