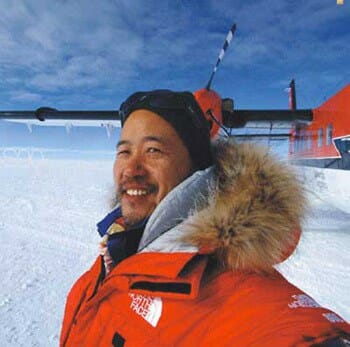

And Wang Shi thought that Everest climb was going to be his biggest challenge

China Vanke, which has been fighting off an unwanted takeover attempt by a privately held mainland conglomerate, announced today that it may potentially be issuing new shares in the developer as part of a plan for acquiring an unnamed company.

The announcement from Vanke appears to be a way for the company’s management, led by chairman Wang Shi, to dilute the holdings of the Shenzhen-based Baoneng Group, which took over a controlling 24.3 percent stake in the developer by aggressively buying up shares in the company over the preceding weeks.

Vanke already appears to have recruited minority shareholder Anbang Insurance as an ally in its fight against Baoneng, and the developer today found it necessary to issue a statement denying rumours that the three parties had worked out a deal for Anbang to buy out Baoneng’s stake in Vanke.

Finding Ways to Push Baoneng Out

Baoneng’s unwanted courtship of Vanke has set off a flurry of moves by the developer’s management, which had traditionally enjoyed a relatively free rein to run the company under former controlling shareholder China Resources.

Specifics were scarce in today’s announcement to the Hong Kong exchange, with Vanke following up on the halt of trading it announced on December 18th, with the news that on Christmas Day it had entered into a letter of intent “for cooperation, regarding a possible transaction with a potential party” for a “transaction.”

The announcement does indicate that the potential transaction involves Vanke acquiring a company held by the vendor, and that the vendor would be compensated with newly issued Vanke shares, as well as cash.

The news of this potential transaction, and the share issuance that would go with it, follows Vanke’s December 21st announcement that it would restructure the company, including issuing new shares. That announcement was seen as move get out from under Bao Neng’s control by bringing in new shareholders, or allowing existing shareholders to up their stakes in the developer.

On December 24th, Anbang Insurance Group, which recently raised its holdings in Vanke from 4.5 percent to 7 percent, said that it stood behind Wang and his management team, and that it was not in favor of Baoneng’s takeover attempt.

Is Baoneng Being Paid to Go Away?

The battle to control Vanke, which is one of China’s two largest developers based on most measures of sales and market value, has become a major story in an industry where takeovers are rare.

Now the drama has become such a hot topic that Vanke felt it necessary to issue a statement today denying rumours that it had met with Baoneng and Anbang recently to find a way to pay Baoneng to go away.

According to the statement from the developer, rumours that the three companies discussed Anbang buying out Baoneng’s shares, and that the Beijing-based insurer would then become Vanke’s controlling shareholder, are unfounded. Vanke said that it never participated in any such meeting.

Whether or not any such deal has been made, Wang Shi has been openly critical of Baoneng, particularly pointing out its lack of high-level real estate expertise and its limited financial resources. Baoneng is said to have largely financed its acquisition of Vanke shares through margin buying, and now faces a heavy debt burden.

Leave a Reply