Tokyo topped a list of favored destinations in the Asia Pacific region among real estate investors, as sentiment toward mainland Chinese cities continued to suffer from fears of an economic slowdown and rising prices, according to a survey released this week by the Urban Land Institute (ULI).

Tokyo topped a list of favored destinations in the Asia Pacific region among real estate investors, as sentiment toward mainland Chinese cities continued to suffer from fears of an economic slowdown and rising prices, according to a survey released this week by the Urban Land Institute (ULI).

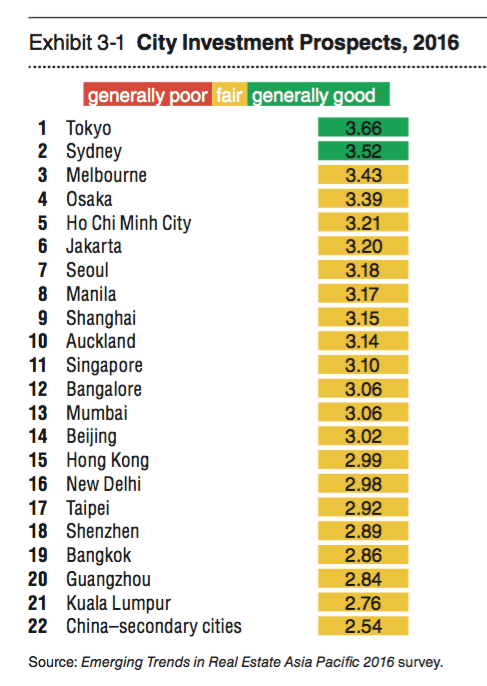

Japan and Australia dominated the top five locations for acquiring real estate assets or investing in new development projects during 2016 among the 343 real estate investment professionals polled by the ULI, with Sydney landing in the number two spot, followed by Melbourne and Osaka. Moving into the top five for the first time was Ho Chi Minh City.

Shanghai was the most favored option in China for the ULI’s respondents, landing in ninth place, three spots below where it ranked in last year’s edition of the industry group’s annual report, Emerging Trends in Real Estate Asia Pacific.

Meet Asia’s Top Five for 2016

Tokyo kept its top position for the third straight year thanks to a favorable economic outlook, at least in the short term, as well as having a deep and highly liquid market for stablised property assets. Sydney was seen as attractive for institutional investors seeking core office properties, despite increasing competition for a limited set of assets.

Melbourne received favorable marks for being more affordable than Sydney while still offering strong growth in asset values. While in fourth place, Osaka was seen as benefitting from demand for Japanese properties from investors who couldn’t seem to find the right spot in the country’s capital.

Ho Chi Minh City’s rating jumped from 19th place in 2014 to fifth this year thanks to a more stable currency and lower inflation, as well as relaxation of restrictions on property acquisitions by foreigners. Despite this rapidly improving rating, the report noted that while many respondents found emerging markets such as the Philippines, Vietnam, and Indonesia appealing, most were steering clear of actually investing there due to higher levels of risk.

Shanghai Loses Its Appeal But Transaction Volumes Rise?

The report found investors becoming skittish about real estate deals in China as concerns grow over a soft economy, depreciating currency, as well as an oversupplied real estate market and high asset prices.

Link REIT liked Shanghai enough to spend RMB 6.6B on Corporate Avenue

Respondents pointed in particular to fears among Western-based investment committees viewing China from afar in the wake of stock market turbulence and a rapidly changing currency situation. The report cited one investor who said, “Everybody is in wait-and-see mode because at the moment it’s very difficult to convince people in New York that China is a good place to park retirement savings.”

Despite these fears, the report noted that Shanghai had enjoyed a rebound in deals for prime office assets in 2015, with a strong pipeline of upcoming transactions expected before year-end.

Regional real estate investment trusts (REITs) have becoming increasingly active in Shanghai this year, with Hong Kong’s Link REIT purchasing Shui On Land’s Corporate Avenue phase one for RMB 6.6 billion ($1.063 billion) during July, and Yuexiu REIT buying the Hongjia Tower in Pudong from Carlyle and CLSA for RMB 2.63 billion ($423 million) in August.

Some analysts estimate that 2015 acquisitions of property assets in the city will have grown 50 percent in 2015 compared to last year.

Shanghai was seen as China’s “only true gateway city” by respondents, scoring as the ninth best city in the region for acquiring property assets, and the tenth best for investing in new development projects. Beijing was 14th for acquisitions and 18th for development, while Guangzhou was 20th for acquisitions and 19th for development. Shenzhen, despite a booming economy and a residential market where home prices have grown 40 percent in the last year was 18th for acquisitions and 20th for development.

Leave a Reply