Wanda bought Gold Fields House from Blackstone for $329 million.

Chinese real estate investment has spread from banks and sovereign wealth funds which bought trophy assets in the world’s biggest markets, to property developers looking for project opportunities in the world’s gateway cities.

Now according to a recently released report, China’s property-hungry investors have formed a third wave of buyers, made up of insurance companies, medium-sized enterprises and wealthy individuals, and this third wave is targetting the Australian market.

This new level of interest in Australian property is driven by ties between the two countries and a depreciating Aussie dollar, which have combined to drive a string of high profile deals as well as dozens of smaller acquisitions.

Australia and the Second Wave

While the first wave of China’s international property investment may have focused on London and New York, the second wave brought a number of headline deals to places such as Sydney and Melbourne. Late last year China’s largest commercial developer, Dalian Wanda acquired the last of three adjacent Sydney sites which the Beijing-based company plans to develop into a new $1 billion residential project.

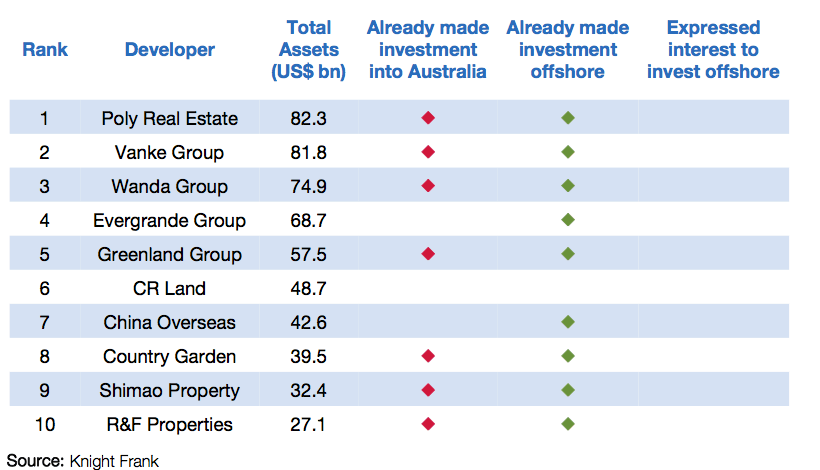

In all, eight of China’s ten largest property developers now have projects in Australia, according to the study by Knight Frank, which foresees the country’s insurance giants rapidly following suit.

Now with values in downtown Sydney and Melbourne already reaching record levels, the global real estate consultancy sees a third wave of Chinese investors and developers diversifying into second-tier Australian markets such as Brisbane, Gold Coast, Adelaide, Perth and the suburbs of the country’s largest cities.

Eight of Top 10 Chinese Developers Already in Australia

The report documents the surge of Asian, and particularly mainland Chinese, investment into Australia’s property sector over the last two years, during which time investors from Asia have accounted for 55 percent of international purchases of Aussie property assets.

In all Asian investors picked up $16 billion worth of real estate down under during 2013 and 2014, with office and hotel properties being the most common purchases.

Among the Asian investors getting into Australia’s property market, 42 percent of the purchase by value have been by Singaporean companies with mainland Chinese investors coming in second at 35 percent. By comparison, Malaysian, Hong Kong and South Korean investors contributed only single digit percentages of the capital inflows into Aussie property.

20 percent of the capital invested from Asia over the last 12 months has been put toward acquiring development sites, with eight of China’s top 10 developers by asset value having now taken on new projects down under.

Eight of 10 of China’s largest developers already have projects in Australia (Source: Knight Frank)

Currency Depreciation a Leading Factor

While China’s year-long real estate slump has driven the country’s investors overseas searching for returns, Australia’s rapidly depreciating currency has also made investments down under more attractive.

Knight Frank points out that, since Shanghai’s Greenland Group acquired its first Melbourne site in October 2013, the Australian dollar has depreciated roughly 18 percent against the Chinese yuan, making Aussie assets more attractive.

Investment in Australia, particularly in Sydney and Melbourne are also helped by the ties developed between the two countries after a generation of children from China’s elite have attended Australian universities.

Out of the thousands of Chinese who have matriculated from Australian schools, many have stayed behind in Sydney and Melbourne, often starting businesses or opening up branches of their family companies in the country’s global gateway cities.

New Wave of Investors Headed to Australia

With Chinese investors already playing a leading role in Australia’s core investment areas, Knight Frank foresees the mainlanders fanning out into more opportunistic markets, as well as projecting a greater presence among the country’s insurers.

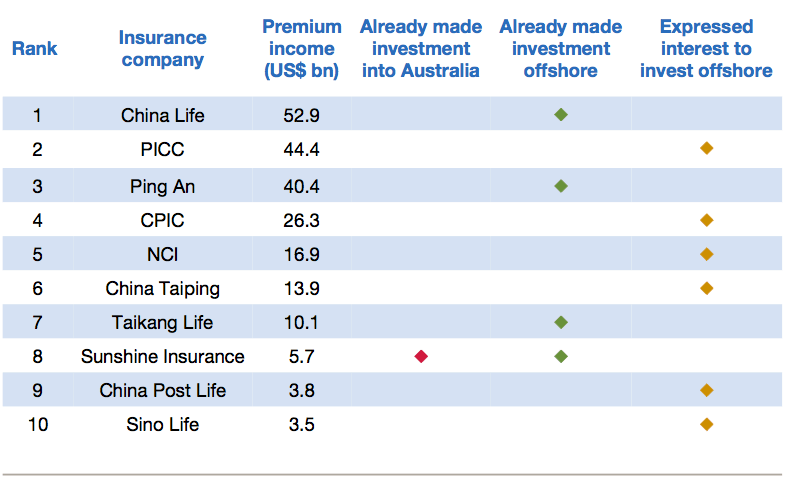

Only one of China’s insurance giants has invested in Aussie real estate so far (Source: Knight Frank)

Since China began allowing its insurance companies to invest overseas in 2012, four out of the company’s ten largest insurers have already purchased overseas assets, including Sunshine Insurance, Ping An, China Life and Taikang Life.

To date, Sunshine, which bought Sydney’s Sheraton on the Park last year for $401 million has been the only Chinese insurer to invest in Australia. However, with the industry’s pool of set to more than double over the next five years, and in light of the rapidly compressing yields in cities like New York and London, Knight Frank expects more purchases of Australian real estate assets by China’s insurers during 2015 and 2016.

The study also predicts more activity by small to mid-sized Chinese companies in Australian real estate, as investors become comfortable with the market. For individuals, the country’s Significant Investor program, which was introduced in 2012 and provides a permanent visa for investors putting more than A$5 million into Australia, has been dominated by Chinese applicants.

Among Australia’s submarkets, Knight Frank expects more Chinese to rush into the suburbs of Sydney, Melbourne and Brisbane, as well as branching out into niche sectors such as student housing and industrial facilities.

Leave a Reply