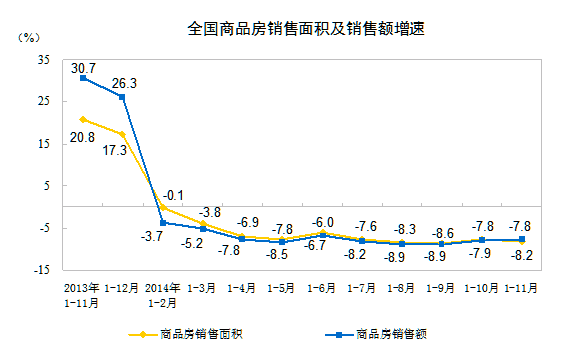

A chart of China’s real estate sales released by the National Bureau of Statistics

China’s attempts to rekindle its real estate industry began to show some results in November, when home sales reached their highest point of 2014, after the central bank spurred more mortgage lending.

According to November home sales figures from the National Bureau of Statistics, Chinese housing buyers picked up 132.2 million sqm of new homes in November, more than any other month in 2014. The numbers are still down 11.1 percent from 2013 levels, when the housing market was setting record highs for prices and transaction volumes.

However, the pickup in sales seems to be coming too late to prevent a further drop in investment by real estate developers, as the revival of transaction volumes remains too low to counter a surge of new projects that have further inflated unsold inventories.

With more homes going unsold and the country’s economy continuing to slow, the mixed results for China’s home sector are seen as providing fresh motivations for the country’s government to cut bank reserve ratios or take other steps towards a more broad-based stimulus.

Government Measures Spark Sales in November

The figures released by the statistics bureau show that property sales were up 13.1 percent in November compared to the previous month, a marked improvement over the 5.4 percent decline in transaction volumes from September to October.

However, October’s numbers were hurt by the week-long National Day holiday, and November is traditionally one of China’s strongest months for home sales.

November’s rise in activity was also in part catalysed by government moves to boost credit availability. On November 21st The People’s Bank of China cut interest rates for the first time in more than two years, and even before that the central bank had been encouraging the return of discounted mortgages, injecting more capital into the banking system, and taking other measures to spur more lending to homebuyers.

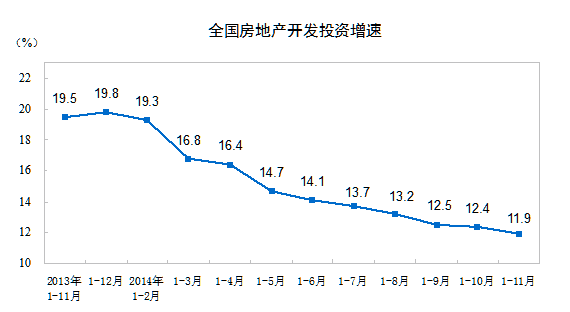

Real Estate Investment Growth Falls to Five Year Low

China’s level of real estate investment continued its ongoing slide in November. (Source: National Bureau of Statistics).

The government has been motivated to revive home sales as the slowdown in a sector that accounts for more than 15 percent of China’s GDP has been making it more difficult for the country to hit its stated target of 7.5 percent GDP growth for 2014.

Despite a slowdown in the rate of home price decline in the last two months, residential real estate rates have nonetheless slid for more than seven straight months, according to private market surveys.

This loss of appetite for new homes has led to a decline in investment by developers, especially as supplies of new homes previously in the construction pipeline have continued to pile up.

The bureau’s figures for November show that real estate investment grew 11.9 percent in the first eleven months of 2014, down from an increase of 12.4 percent in the period from January through October, and the slowest pace of growth in five years.

Rising Inventories of Unsold Homes Will Keep Prices Low

The waning lack of enthusiasm on the part of developers was also reflected in the amount of floor space under construction, which was down by 9 percent compared to October, although this was also due in part to more projects being released onto the market during November.

A report by E-House showed that the country’s largest developer, China Vanke, introduced 44 new projects onto the market last month. In total the Shenzhen-based company released more than 3 million square metres of new space nationwide last month – triple the amount it had launched in October and the highest total so far this year for Vanke.

Other developers, such as Shanghai’s Greenland Group, also released scores of new projects last month helping to drive the level of unsold housing inventory to 597.95 million square metres by the end of the month, up 15.56 million square metres from the end of October.

The ballooning inventories of unsold homes are likely to keep home prices low well into 2015.

Future Stimulus Becoming More Likely

The continuing slide in sales is like to be hurting the government in a number of areas. New land sales for the first 11 months of 2014 are now down 0.1 percent year on year, bringing in RMB 865.7 billion for local governments that rely heavily on land sales for revenue, and have been accustomed to more substantial annual increases in revenue.

Even at the central government level, however, the State Council, which relies on economic growth to maintain its mandate for governing and to support President Xi’s reform agenda is likely to be concerned over the continuing real estate slowdown. With 2014 rapidly running out and growth targets slipping out of reach, there is likely to be more pressure on the central bank for action.

Many analysts are still speculating that the PBOC will follow up on last month’s rate cut by reducing reserve ratios sometime this month, with some observers speculating that an informal relaxation of the banking restriction is already occurring.

Leave a Reply