Author: Fiona Ngan, Head of Occupier Services, Colliers Hong Kong

From Central’s glass towers to Kowloon East’s rising hubs, the mood is neither bullish nor bleak, it’s measured. As 2025 unfolds, tenants are navigating a market that offers more options than urgency. Even with rents softening and incentives on the table, most are choosing to remain in place, trim their budgets cautiously, or negotiate quietly behind the scenes.

According to the Colliers Occupier Survey 2025, the third such report, 64% of respondents plan to avoid moving, 27% plan to downsize, and just 18% intend to expand. The hesitation should not be viewed as inertia. Tenants are hesitant because the ground beneath them is still shifting. Hong Kong’s economic recovery, although technically underway, remains viscous and uncertain. Export confidence has dipped. Retail sales are down. The PMI has hovered below 50 for months. And while many officials at the US Federal Reserve discuss interest rate cuts in 2025, they have yet to materialise.

There’s a misconception that landlords can just cut rent to fill space. But for many, especially institutional owners, rental income underpins asset valuations, financing terms, and long-term investment strategies. While tenants may expect deeper discounts, landlords are walking a tighter rope. Many are already contending with rising vacancies, ageing stock, and a wave of new supply, but slashing rents outright isn’t always an option.

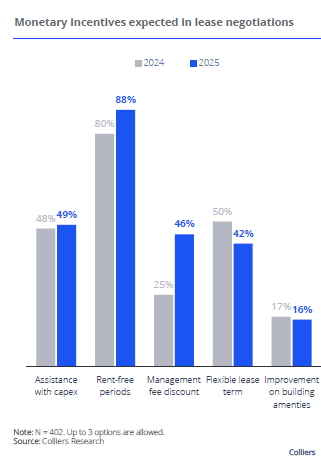

While more than 90% of tenant respondents are focused on total occupancy costs, landlords are drawing the line at certain concessions. Management fee discounts, now expected by 46% of tenants, are rarely up for discussion. Many landlords are generally concerned with rising operational costs and the need to preserve service standards and thereby omit them from negotiations.

Capital expenditure support is also selectively granted. While larger tenants, especially those occupying more than 20,000 square feet, are more likely to request capex assistance, landlords remain cautious. In most cases, support is reserved for strategic renewals or anchor tenants with long-term commitments.

Instead, landlords are relying on more flexible tools, such as rent-free periods, shorter lease terms, and turnkey units, which reduce upfront costs without undermining face rents or asset valuations.

Tenants are more focused on essentials than extras

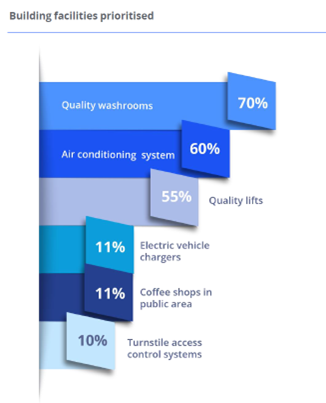

In 2025, tenant expectations are clear and increasingly non-negotiable. Gone are the days when a sleek lobby or rooftop garden could tip a leasing decision. Today, the fundamentals matter most.

According to Colliers’ survey, 70% of tenants cite professionally maintained washrooms as essential. Reliable, efficient and cost-effective air conditioning ranks second, cited by 60% of tenants, reflecting comfort expectations and cost sensitivity. In older buildings, inefficient systems can drive up utility bills and disrupt operations. Lift quality follows closely at 55%, underscoring the importance of reliability, speed, and modern infrastructure – especially in skyscrapers where delays can affect productivity and tenant perception. Many occupiers view these facilities as indicators of how well a building is likely to be managed.

Larger tenants are raising the bar even further. Among firms occupying more than 30,000 square feet, 41% require their building to have ESG certification, compared to just 5% of tenants occupying less than 5,000 square feet. These flagship occupiers are also more likely to expect responsive management, modern infrastructure, and capex support as part of the deal.

Thus, value is not solely focused on rent. It’s about the total experience – how a building performs, how it’s maintained, and how well it supports its tenants’ evolving needs.

Landlords prioritise upgrades

As tenant expectations sharpen, landlords are being forced to rethink how they invest in their buildings. But not all upgrades are treated equally, and not all are happening fast enough.

According to Colliers’ landlord interviews, improving washrooms and air conditioning is relatively straightforward and offers visible returns in tenant satisfaction. But when it comes to lift modernisation, the response is more muted.

Due to their cost and complexity, lift upgrades are not easy. Yet for tenants, especially in older towers, slow, unreliable lifts are a daily frustration and a signal of broader neglect.

Flexibility is the new currency

In these market conditions, flexibility has become the most valuable currency in lease negotiations. Tenants’ preference for stability should not be mistaken for a sign of stagnation, it’s a strategic hedge against uncertainty. They seek control over complexity, choosing buildings that work, deals that flex and landlords who deliver tangible benefits.

For landlords, this means that traditional incentives like headline rent reductions are no longer the only lever. Instead, rent-free periods, shorter lease terms, and the ability to scale space up or down are becoming standard expectations. These tools allow landlords to preserve face rents while offering tenants the agility they need to navigate a still-uncertain macroeconomic environment.

Colliers’ Quarterly Market Report Q2 2025 reinforces this trend. Despite a modest uptick in net take-up, primarily driven by activity in Central and Admiralty, vacancy rates remain elevated at 17.3%, with projections pointing to 19% by year-end. With more than 3 million square feet of new supply entering the market in the second half of 2025 alone, and an additional 2 million square feet projected for 2026, landlords are under pressure to differentiate not just on price, but on terms, service, and speed to occupancy.

While the supply wave is real, so is Hong Kong’s capacity to adapt. This market has always rewarded those who move early, think creatively and invest with intent. For those willing to engage with the moment, rather than waiting to see, there’s plenty of room to lead. Now is the time to redefine value, rebuild trust and reshape what a modern office experience looks like in Hong Kong.

Download a copy of the Colliers Hong Kong Occupier Survey 2025.

Leave a Reply