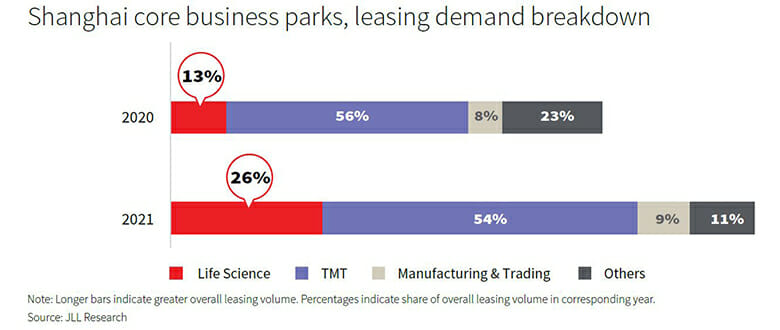

During 2021, 26 percent of office space leased in the Shanghai market came from life science businesses — doubling the 13 percent figure achieved in 2020, according to a new report by JLL.

The study, Shanghai Life Science Property: Primed for Growth, is the result of a survey of 61 life science companies and 19 life science property investment institutions and provides a comprehensive analysis of the fast-growing industry and the impact it is having on office use in the city.

Anny Zhang, managing director for JLL East China and head of office leasing advisory for JLL China

“Innovation-led growth has driven interest and investment in the life science sector, fuelling competition among companies in Shanghai,” said Anny Zhang, managing director for JLL East China and head of office leasing advisory for JLL China. “The life science property sector — as a host for R&D, offices and other business activities — will become increasingly attractive to investors.”

The growth of this innovation industry follows China’s designation of the biopharmaceutical sector as a strategic industry nationally, and regulatory reforms are already promoting faster development and speedier approvals. In Shanghai, local authorities have set a goal of creating a world-class biopharmaceutical cluster by 2025.

Accelerated Development

Source: JLL Research

Official estimates valued Shanghai’s biopharmaceutical market at more than RMB 600 billion in 2020, and the city is looking to grow the market to RMB 1 trillion by the end of 2025. The report points out that high market demand for healthcare services and technologies is the driving force behind the industry’s growth. Other factors favouring growth include:

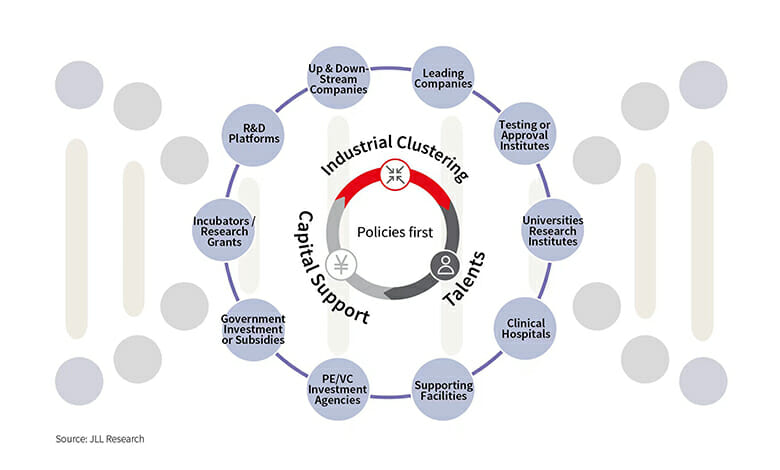

Policy support and system reforms. Strong government support to reform the sector and boost innovation will reshape the market positioning of the biopharmaceutical industry and promote a paradigm shift in the industry.

Recruitment of foreign talent and the return of overseas Chinese. The Chinese government has introduced a series of policies to attract both overseas Chinese and foreign talents, and companies are providing high-value research opportunities and other incentives to enhance their competitiveness in the global talent market.

Continued capital investment to support development. Over the last decade, private equity and venture capital investments in life science companies have grown significantly. Average annual investment in life sciences in the 2018-21 period nearly doubled its level from the previous four years.

“Looking ahead, Shanghai as well as China’s life science industry is expected to prosper further, supported by strong market demand, supportive government policy, better talent acquisition strategies and sustained capital inflows,” said Daniel Yao, head of research for JLL China.

Strong Rental Growth to Continue

Leasing demand from life science companies in Shanghai has continued to expand in recent years, making the sector the second-largest source of demand in the city’s core business parks in 2021. JLL statistics show that leasing demand from life science companies climbed from 13 percent of all industries in 2020 to 26 percent in 2021.

The Zhangjiang submarket saw the most active life science leasing activity among Shanghai’s business parks, recording both expansion demand and new setups from companies over the past two years. In addition, the Zhoukang, Pujiang and Lingang Blue Bay submarkets are becoming popular locations for life science companies.

Some 1.6 million square metres (17.2 million square feet) of life science properties are expected to enter the Shanghai market in the next three years. Although the expected supply is substantial, most of these projects have already been pre-leased or customised by committed life science companies. Overall, the market has achieved an average pre-leasing rate of 70 percent. In the short term, R&D office properties will remain in short supply and the leasable space will remain limited.

“Strong demand from life science companies and scarcity of vacant space has led to a steady increase of the rent level of life science R&D properties,” said Stephen Yu, head of Shanghai business park services for JLL’s office leasing advisory team. “Vacancy rates for these properties in Shanghai will remain below 5 percent over the next three years, and the rent level of R&D properties will continue to rise steadily.”

Institutional Investors Take Note

Life science real estate has gained increasing attention from institutional investors as an alternative investment asset. A JLL survey of real estate investors showed that 90 percent of the respondents were examining opportunities in life science real estate, while 11 percent have already invested in the sector.

“The city will need to pay attention to the growth of large-volume, multi-functional concentrations of life science activity,” said Sun Ling, head of capital markets for JLL East China.

As well as acting independently, investors are considering a variety of potential collaborations, such as with life science firms, PE/VC firms in the life science industry, governments, and other domestic and foreign funds. These collaborations can improve outcomes for both the investors and life science occupiers, resulting in larger-scale concentrations of life science activities and amenities that JLL terms “bioclusters”.

As Shanghai moves further in building world-class life science innovations hubs, JLL expects both independent mixed-use life science developments and larger-scale bioclusters to attract tenants from different stages of business, significantly increasing “corporate cohesion”.

This sponsored feature is provided by JLL. The full report can be downloaded here.

Leave a Reply