As surging demand for cloud services from big companies and state agencies drives growth in Asia Pacific data centres, regional capital is building platforms and incubating startups eager to grab a piece of the action.

As surging demand for cloud services from big companies and state agencies drives growth in Asia Pacific data centres, regional capital is building platforms and incubating startups eager to grab a piece of the action.

So far, few operators have achieved region-wide scale with their data centre networks, and quality sites are increasingly hard to acquire in APAC, according to a report and presentation by property services firm Cushman & Wakefield.

But the COVID-19 pandemic, 5G mobile growth and a global sustainability drive have accelerated existing trends as organisations embrace the more flexible and scalable IT structure afforded by data centres — and several APAC markets are benefiting greatly.

“We’re seeing huge M&A across the world, new companies getting created all the time, and a lot of private equity and pension fund capital coming in,” said Kevin Imboden, senior research manager for data centre insights.

Cloud Services Boom

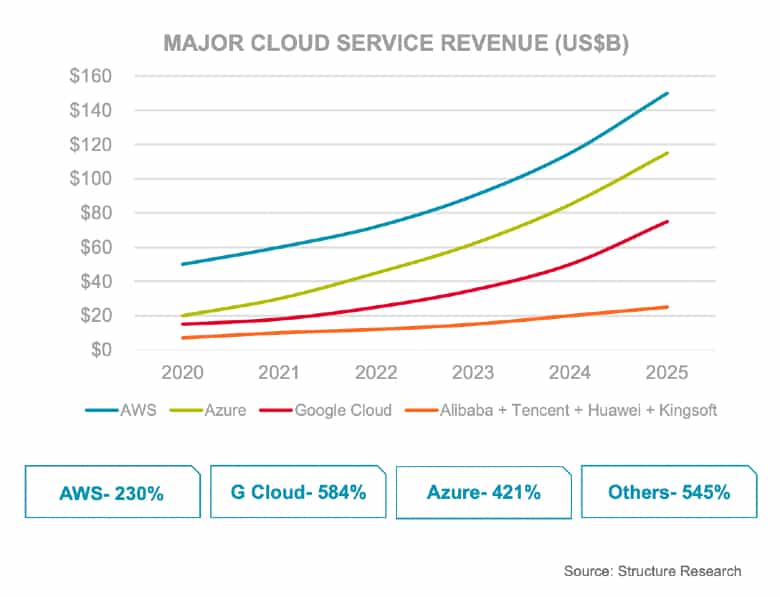

A clear indicator of rising data centre demand is the boom in cloud services provided by some of the world’s biggest tech firms. Year-on-year revenue growth in the first quarter of 2021 hit 32 percent at Amazon Web Services, 46 percent at Google Cloud and 50 percent at Microsoft’s Azure.

APAC developers and fund managers have taken their cue and set about raising capital to invest in server-hosting facilities across the region. Examples include Hong Kong-based Gaw Capital’s $1.3 billion fund for data centres in China, backed by the Abu Dhabi Investment Authority; and an Adani-EdgeConneX joint venture to build data centres in India with a collective 1 gigawatt of capacity.

Despite the increase in activity, building a regional portfolio of data centres remains a daunting task for all but the most established groups: only China Telecom and Japan’s NTT enjoy near-blanket coverage of APAC markets. Nonetheless, Imboden sees some of the region’s younger players beginning to close the gap over the next few years.

Resilient Markets

In its presentation on What’s Next for Data Centres in APAC, Cushman & Wakefield highlights four key markets leading the regional charge: Hong Kong, Singapore, Sydney and Tokyo.

Todd Olson of Cushman & Wakefield

These four hubs have defied expectations throughout the pandemic — none more so than Hong Kong, which has shrugged off geopolitical tensions and COVID woes and continued to attract global investors like Singapore’s Mapletree, which in February announced plans for a data centre after acquiring an industrial site in the New Territories.

And despite a moratorium on new data centre projects in Singapore out of energy concerns, a pipeline of five under-construction projects in the city-state — including Facebook’s 150-megawatt facility in Tanjong Kling — is expected to add 173MW of capacity by the end of 2022.

Todd Olson, leader of the APAC data centre advisory group, says these and other Asia Pacific markets continue to perform well as data centre destinations, owing to the region’s overall growth potential and the rapid development of tech platforms and networks.

“As e-commerce continues to flourish and cloud connectivity becomes a primary business driver, we expect the data centre market growth to intensify in the region with secondary markets gaining prominence and new markets emerging in this space,” he said.

Why 5G Matters

With more data flowing freely between more people, exponential growth in data traffic will drive significant demand for data centres.

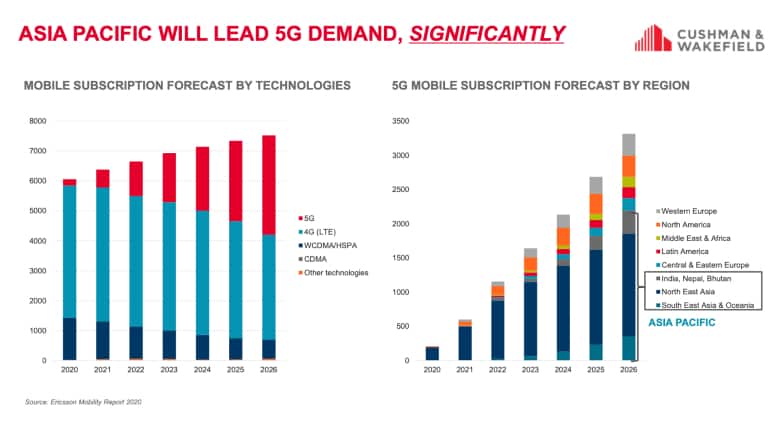

Hideaki Suzuki, director of research and head of business development services in Japan, says Asia Pacific will lead 5G demand over the next five years, accounting for more than 65 percent of the expected 5G mobile subscription growth.

Citing estimates by network equipment maker Ericsson, Suzuki notes that 5G is expected to account for 30 percent of global mobile subscriptions in 2024 and 44 percent in 2026.

“We are already starting to see this materialise in some Asian markets with South Korea now having over 80 cities 5G-covered and China launching 260 million 5G terminal connections,” he said. “Asia is truly leading the world in the 5G space, and it is conceivable that the rate of technological innovation we will experience in the future as a result of 5G will potentially outdo the advancement in the last decade brought on by 4G, in half the time.”

Sustainability Imperative

The data centre industry uses more electricity each year than the energy consumption of some countries — roughly 1 percent of global electricity demand. At least one projection sees the data centre sector consuming a fifth of all the world’s energy by 2025.

In China, the need to comply with the government’s energy-saving directives has set the bar higher for data centre operators and developers, even as they grapple with existing challenges such as the scarcity of land and power sources.

Data centre players will have to take on a greater range of considerations, including renewable energy sources, liquid versus air cooling, building resilience and adaptability, says Summer Chen, senior associate director of valuation and advisory services for Greater China.

“The ever-increasing demand for sustainable practices by corporations and consumers warrants the need to adopt a sustainable approach to operating data centres,” she said. “The sustainability imperative will indeed reshape the market dynamic and will lead the future.”

This sponsored feature is provided courtesy of Cushman & Wakefield. To access the APAC Data Centre Update please click here.

Leave a Reply