Hong Kong’s economy is well placed to experience the strongest growth in the coming years, fuelled by eight key drivers.

That’s the finding of a new JLL report examining how the city is positioned for the future.

Titled New Heights: Is Hong Kong Poised For Future Growth?, the report looks beyond the oft-quoted “shallow analysis” predicting the city’s demise, instead taking a more pragmatic view of its success factors and how this narrative might be carried forward.

As explained by Gavin Morgan, Managing Director at JLL in Hong Kong and Chief Operating Officer in Greater China, Hong Kong has always had the ability to recover early and fast from economic downturns.

Gavin Morgan, Chief Operating Officer, Greater China, JLL Hong Kong

“Despite being hit by Covid-19 and social tensions over the past two years, we have confidence that the city’s growth in the coming years will be strong,” he says. “With China now firmly established on a renewed growth trajectory, Hong Kong is set to benefit. Already this year, total trade in the first two months has grown approximately 30 percent year-on-year.”

The first growth driver identified in the report is Hong Kong’s economic and business agenda. JLL’s analysts note that the powerful science and technology cluster within the Shenzhen-Hong Kong-Guangzhou region (ranked second in the World Intellectual Property Organization’s Global Innovation Index in 2020) will open up huge opportunities for business services in Hong Kong, while with fiscal reserves of HK$900 billion, the government has the resources to take care of immediate economic strains and invest in the future.

Continuing to develop infrastructure facilitating the inextricable melding of Hong Kong into the Greater Bay Area is highlighted as a key priority for the city. Further, the decisions made by businesses already rethinking how their operations and assets in Hong Kong fit into their Greater Bay Area, China and global strategies will have implications for landlords’ and occupiers’ real estate investment needs against the backdrop of rising opportunities.

Hong Kong’s “can do” attitude is cited as creating momentum around initiatives and projects that will produce successful outcomes.

To its advantage, the city remains open and welcoming to global talent, and its business-friendly environment, free from foreign ownership restrictions, with a low and simple tax regime and the rule of law, incentivises inward investment. In addition to a growing number of regional headquarters from companies domiciled in mainland China, France, Germany, the UK and Singapore in recent years, JLL’s report notes InvestHK data showing a 50 percent increase in start-ups establishing in Hong Kong in 2020, compared to 2017.

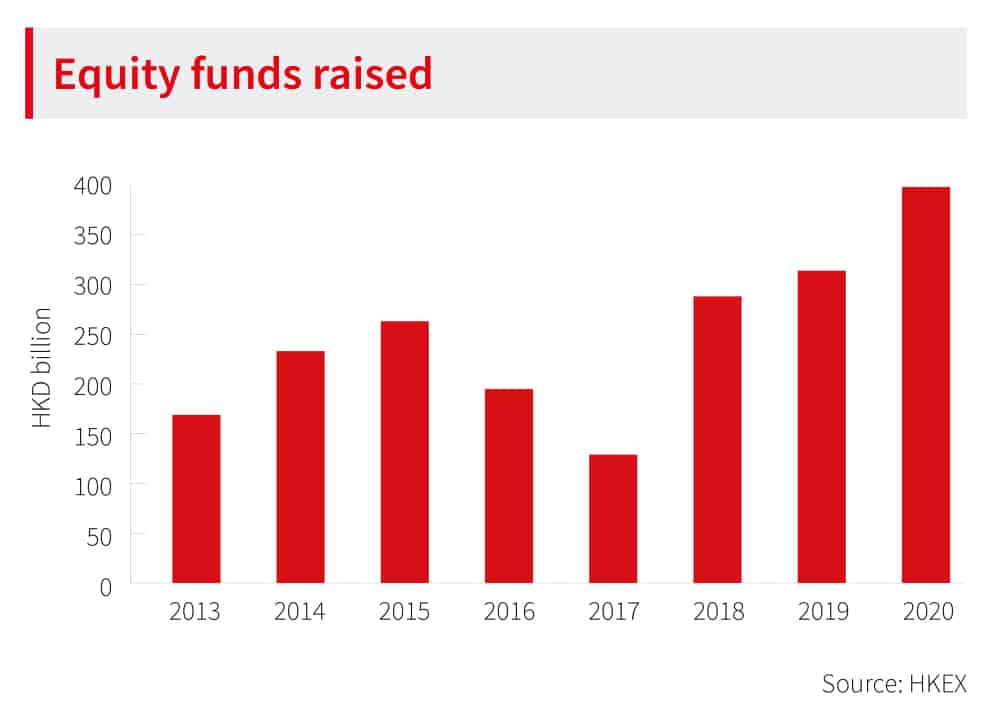

According to the report, Hong Kong’s status as a global financial hub, with its well-regulated banking system and role as an RMB trading centre, make it an ideal IPO launchpad for Chinese businesses looking to raise international capital, as well as a platform for multinationals to connect with Chinese and global trade and capital market opportunities.

Transportation infrastructure headlined by the Hong Kong-Macao-Zhuhai Bridge and the upcoming third airport runway further cement Hong Kong’s reputation as a regional hub and “a true global connector”, JLL’s analysts opine.

The development in East Kowloon of Hong Kong’s “CBD2” will give further impetus, providing the new office space and associated services for businesses to thrive.

Nelson Wong, Head of Research at JLL for Greater China and Hong Kong,

However, Nelson Wong, Head of Research at JLL in Greater China, qualifies that it is imperative the government follows through on policy initiatives to create new land and repurpose farmland and brown field sites for forward-looking uses. “The private sector should also engage in innovative and sustainable mixed-use developments, helping to diversify the city beyond its traditional urban centres, enhancing lifestyles with choices ranging from affordable housing, to co-living, experience-based retail and modern-day asset types such as data centres, which will help propel Hong Kong to the next level,” he said.

For more details, download the full New Heights: Is Hong Kong Poised For Future Growth?

Leave a Reply