China’s government has responded to the COVID-19 outbreak by implementing fee reductions, liquidity injections and other breaks for business, at the same time that the country’s central bank has eased monetary pressure, in a multi-faceted effort to offset the short term impact of the virus outbreak on business.

China’s government has responded to the COVID-19 outbreak by implementing fee reductions, liquidity injections and other breaks for business, at the same time that the country’s central bank has eased monetary pressure, in a multi-faceted effort to offset the short term impact of the virus outbreak on business.

These urgent measures, combined with the ongoing growth of China’s service industries – particularly the tech and finance segments – are expected to help counteract current downward pressure on the country’s office real estate sector in 2020.

At the same time, changes in how businesses are operating, can be expected to have an impact on tenant requirements for their workplaces, as well as on how landlords design and manage their office properties.

Office Demand Likely to Dip in 2020

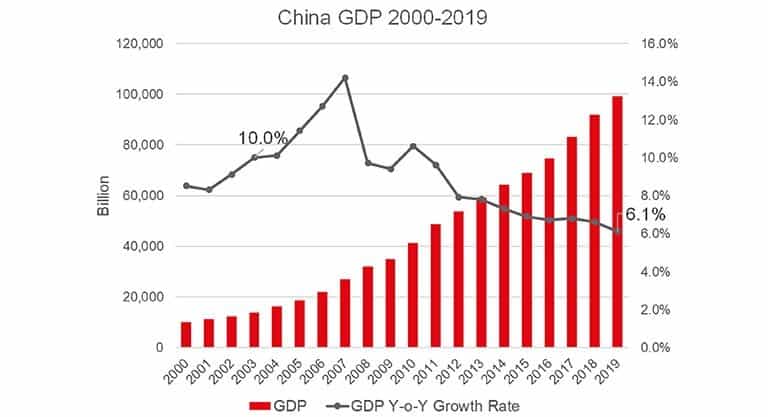

China has adopted its economic and business relief measures out of necessity, as COVID-19’s global and domestic challenges are expected to pose an even greater hurdle for the economy than the country endured in 2003’s SARS outbreak.

While the government’s response to SARS, at a time when the economy was growing at close to double-digit rates, resulted in a rapid rebound in activity, the larger scale of the COVID-19 situation, combined with China’s maturing economy, means the current measures will focus on returning the situation to pre-crisis levels with a spike in growth post-crisis appears less likely.

In the short term, China’s office sector is likely to see a significant downturn in demand across major cities, particularly from segments such as travel and retail. With global growth likely to dip in 2020, manufacturers can also be expected to delay office requirements.

Sectors on the Upswing

While developers and investors should prepare for the economic challenges presented this year, they should also look at the long term future of the industry and be aware of some positive outcomes in the near term.

China’s insurance and healthcare sectors, which were already making up a growing share of office demand, have continued to perform exceptionally well in 2020. Current government efforts to streamline regulation and accounting standards in the insurance industry can be expected to further encourage growth which can be expected to drive new office leasing and investment requirements from players in this sector.

The TMT segment, especially mobile gaming has grown at a compound annual growth rate of 24 percent over the past five years, which has accelerated still further during this year’s outbreak. Corporates from this sector have already been taking up larger leases, and in some cases developing or acquiring the own office premises, and this trend can be expected to increase this year.

While the first quarter has led to a reduction in new office leasing and investment with China’s economy beginning to come back to life, to capture the widest range of opportunities, corporates and landlords will need to review what business has been lost, and which requirements have been put on hold and can still be won as the economy recovers.

The Future of Work Becomes Reality

With much of China’s office economy having run via remote working during the first quarter, landlords will also have to prepare for a shift in tenant requirements.

After being forced to work by video conference and employ online collaboration tools to conduct most business so far in 2020, office tenants across China are likely to keep using these tools and continue to embrace more flexible use of space in their premises.

The COVID-19 experience can also be expected to further accelerate interest in healthy office environments and wellness certified projects, at the same time that occupiers are likely to require new building elements to ensure team safety against future outbreaks.

During this year landlords have implemented new health-related solutions for building management, including thermal imaging cameras and digital building control systems to help ensure the safety of both tenants and team members. These new tech features can be expected to continue to be utilised when the current outbreak has passed, and tenants have also responded positively to simple solutions such as health stations with hand sanitiser, public area sterilization protocols, controlled access gates, automatic elevators, and improved ventilation.

The changes that 2020 has brought can also be expected to encourage the adoption of proptech solutions by tenants and landlords as industry players look for ways to control office environments more efficiently.

With tenants accelerating the trend toward replacing in-person meetings with conference and video calls this, demand for bandwidth can be expected to grow, and landlords will need to be ready to incorporate technology into designs for new buildings, while retrofitting existing assets to meet tenant demand and evolving government mandates.

Tenants can be expected to invest in new technologies that allow remote access to company resources, such as network drives and cloud applications, as well as online employee management software. These occupiers can also be expected to look for systems that monitor and control flow of employees and visitors through their offices, as well as into buildings.

Outlook

In the near-to-mid-term, measures to control construction will likely delay a large portion of 2020 office supply previously expected to be completed this year into 2021, which will restrict the growth of available supply.

At the same time that new supply is delayed, government stimulus policies in China will continue to support the economy as the country works to contain COVID-19 in the near-term. Further ahead, long-term demand will still hinge on continued financial and market reform, innovation, and technological progress.

Even more than in recent years, emerging industries and the government’s fast-tracked opening of the financial services industry to foreign players are expected to serve as engines for growth in China’s Grade A office market.

China’s digital economy is like to maintain average annual growth of 10 to 15 percent moving forward, which would continue to drive up interest in office investment and leasing as traditional industries continue to digitalise their services.

Within China, regional development initiatives are already accelerating development in city clusters such as the Greater Bay Area, the Beijing-Tianjin-Hebei corridor, the Yangtze River Delta and the Chengdu-Chongqing area in the southwest. In the future, the government can be expected to continue allocating resources to build up these areas as key nodes of China’s economy.

In both its impact within China as well as its global spread, COVID-19 is likely to test the market to an even greater extent than SARS in 2003. However, the country’s active policy responses, expanding demand from high growth sectors and strong long-term fundamentals demonstrate the market’s capacity to reward landlords and tenants prepared to stay informed and react in an agile manner.

Long after the current outbreak recedes, both occupiers and investors should be prepared to give closer attention to wellness-related office strategies, flexible working and systems for control of buildings and workplaces.

An earlier version of this story appeared on JLL’s website. For more information on the impact of COVID-19 on real estate, please visit JLL’s gloval COVID-19 resource page here.

It isreally goid information to

Change the industry trend due to

The covid19.

Your expectatipn.is coorect. And

Huge change will be done as you

Checked. Pls do best to check more

The new trend after covid19.

It is very important and serious to

The property owners.

Yks again