Investors plan to expand their portfolios this year (Source: Colliers International)

Leading diversified professional services and investment management firm Colliers International has revealed that investors are largely optimistic about a market rebound in 2021, according to the group’s new Global Capital Markets 2021 Investor Outlook.

Colliers anticipates a 50 percent surge in investment activity in the second half of 2021, pointing to a broad-based renewal of confidence in the property market as a result of recent vaccine developments and continued government stimulus.

Tony Horrell of Colliers International

“Based on our global analysis, which gives us a bird’s-eye view of investors’ interests and expected appetite, longer-term tailwinds in the property sector remain intact,” said Tony Horrell, head of capital markets, global, at Colliers International. “With a massive volume of equity raised globally and the need for real assets, investors are eager to deploy pent-up capital and pursue opportunities during the year. We expect to see movement up the risk curve this year, with investors exploring all types of assets from senior care homes to public infrastructure projects.”

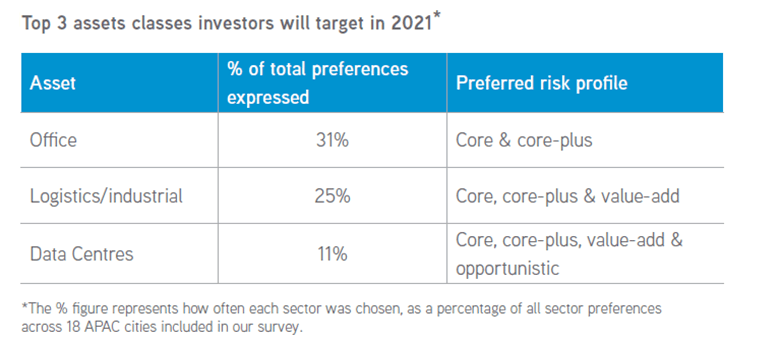

“Grade A offices in gateway cities like Sydney, Melbourne, Singapore and Hong Kong SAR are a key area of focus for regional investors, with COVID-19 seen as likely to accelerate a shift towards higher-quality assets that meet rising demand for health and sustainability,” said Terence Tang, managing director for capital markets and investment services, Asia. “Due to the growth of tech companies and start-ups in the region, there is also a high demand for technology-related real estate including business parks.”

Terence Tang of Colliers International

“In Australia, with a superannuation fund scheme that needs to be invested, the market is not big enough, so some of that money will go overseas, while we also get a lot of attention from global investors because of our stability and handling of COVID-19,” said John Marasco, managing director for capital markets and investment services, Australia and New Zealand. “We are seeing more movement into alternatives, and more co-investment, where foreign investors are partnering with local managers.”

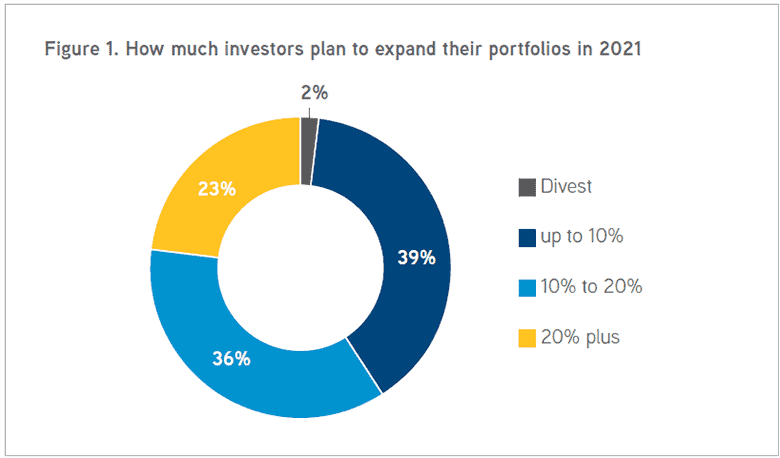

The Colliers report, which drew nearly 300 respondents including major institutional investors, listed property companies, sovereign wealth funds, private equity funds, family offices and third-party money managers, indicates that 98 percent of investors across all regions aim to expand their portfolios, with approximately 60 percent looking to expand by more than 10 percent.

APAC investors favour office and logistics (Source: Colliers International)

Additional key takeaways from the Colliers Global Capital Markets 2021 Investor Outlook report are as follows.

Top-tier city offices remain a primary asset target. Investors with international capital find the scale and liquidity of the office sector in major commercial hubs such as New York, London and Sydney appealing. Having office assets that meet health, sustainability and technical benchmarks is important to investors.

Logistics and residential sectors are thriving. Both sectors were among investors’ top three choices across all regions. Intense demand for these assets will require investors to broaden their geographic focus and build portfolios through joint venture platforms and local partnerships.

Opportunities to repurpose discounted retail and hospitality assets. Investors are expecting to see pricing discounts of over 20 percent in these sectors. They represent a rare opportunity to acquire distressed assets for ambitious repurposing initiatives.

Alternatives, platforms and partnerships are playing a bigger part. Rising demand for alternative real estate such as data centres, senior living and life science assets reflects broader structural shifts amplified by COVID-19.

Sydney ranked as the top investment destination in the region for investors within Asia Pacific, with 55 percent of respondents targetting the New South Wales capital’s office sector. Melbourne came in second place, and Singapore placed third with those answering the survey.

Economic weakness, travel restrictions and limited rental growth were rated as the biggest challenges by our APAC respondents, followed by a lack of supply and concerns over tenant solvency.

For more details, download the full Global Capital Markets 2021 Investor Outlook.

Leave a Reply