Wanda opened its 45th new shopping centre of 2020 on Christmas day last year

With mainland China already recovering from the effects of the pandemic and looking forward to a vaccine-powered rebound, the impact of the COVID-19 crisis on the country’s retail sector can be seen etched across the financial performance of the country’s top commercial real estate developers.

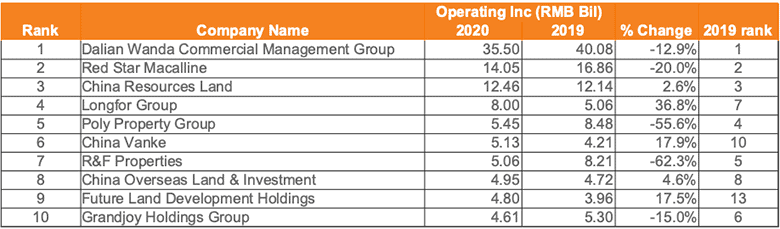

The top ten builders and managers of malls, offices and hotels in China saw their 2020 operating income drop by more than 9 percent, according to data from CRIC, a research unit of local property services firm e-House (China) Holdings.

During last year Dalian Wanda Commercial Management Group, the mall building business of Wang Jianlin’s Dalian Wanda Group, saw operating income drop by nearly 12.9 percent, to RMB 35.5 billion ($5.4 billion) according to the CRIC study. Despite that slide Wanda still managed to outpace the income of its nearest competitor, Alibaba-controlled Red Star Macalline, by more than 2.5 times.

The set of setbacks for China’s top commercial developers was matched by a 3.9 percent drop in retail sales of consumer goods in 2020, according to official figures. That overall retail decline came despite a 14.8 percent increase in online retail sales.

Hotels Not So Hot

Of China’s top commercial developers, China Resources Land, which ranked third by operating income, managed to eke out 2.57 percent growth to reach RMB 12.46 billion for the year. Longfor Group, which operates a chain of Paradise Walk shopping centres and has also expanded into rental apartment properties in recent years, ranked fourth at RMB 8 billion in operating income after scoring 36.8 percent growth in 2020.

Source: CRIC

China Poly Property, which owns an extensive chain of hotels on the mainland, slid from fourth place in the 2019 rankings to take fifth last year, after its operating income fell by 55.6 percent to just RMB 5.45 billion.

Also taking a major hit last year was R&F Properties, which saw its operating income fall by 62.3 percent in 2020 to RMB 5.1 billion. That decrease was enough to push the company from fifth to eighth place in the rankings.

In 2017 R&F had made a bold expansion into the hotel sector by purchasing 77 China hotel projects from Dalian Wanda for RMB 19.9 billion, when Wang Jianlin’s empire was still under pressure to reduce its debt levels.

As 2020 neared a close. R&F was able to find some quick cash by agreeing in November to sell a two-year-old logistics facility in Guangzhou to Blackstone for $1.1 billion.

After diversifying its holdings into retail, logistics and commercial offices in recent years, China Vanke was also able to grow its rental revenue in 2020 with the Shenzhen-based giant recording operating income of RMB 5.13 billion last year, or nearly 18 percent more than what it achieved a in 2019.

Wanda Marches On

Among the reasons that Dalian Wanda was able to boost its operating income last year, was the firm’s continuing pursuit of expansion, despite the coronavirus and its accompanying challenges.

Wang Jianlin (left) sold 77 hotel projects to Li Sze-Lim’s (R) R&F in 2017, as Sunac’s Sun Hongbin looked on

At the close of 2020 Wanda unveiled the Linshu Wanda Plaza in eastern China’s Shandong province, marking the 45th shopping centre which it had opened last year.

That feat kept the company in line with its target set at the beginning of the year to open 40 to 50 new Wanda Plazas in 2020, after opening 43 the previous year. According to Mingtiandi estimates based on earlier statements, Wanda now operates more than 350 shopping centres across China.

After officially abandoning a quest for a mainland stock listing last month, Wanda now appears poised to cash in on its China mall empire through an expected Hong Kong IPO, after raising $460 million in funding from entities controlled by the government of the city of Zhuhai in Guangdong province.

Leave a Reply