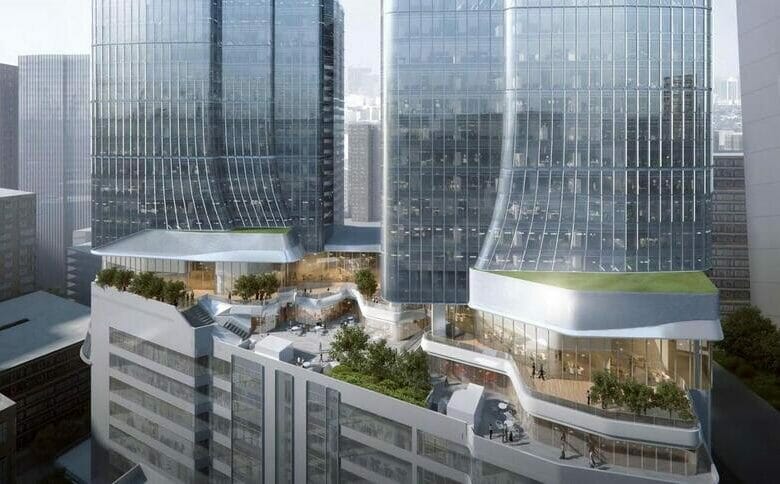

Singapore-based Doo Group leased a floor at Sun Hung Kai Properties’ The Millennity (Image: SHKP)

New leasing in Hong Kong’s Grade A office market is being driven mainly by upgrade demand amid more completions this year, according to JLL.

An estimated 3.2 million square feet (297,290 square metres) of new Grade A space is scheduled for completion in the city this year, a condition that would typically drive vacancy up, but new completions are attracting tenants to relocate and upgrade their offices, said Alex Barnes, managing director at JLL in Hong Kong.

“Tenants are viewing it as an opportune time to upgrade on the back of more choices, variety of floor plate sizes, and the latest green and technological facilities,” Barnes said.

In April, tenants gave back 245,100 square feet more than they took up as some sizeable spaces returned to the market during the month, the consultancy said in its latest Market Monitor report. The overall vacancy rate rose to 12.3 percent from 12 percent at the end of March and 9.4 percent a year earlier, with the amount of unused space in the prime Central district remaining flat at 9 percent.

Rents Continue Skid

After a 0.2 percent decline in March, net effective rents in April fell 0.3 percent compared with the prior month’s levels to reach HK$54.50 (now $6.96) per square foot per month.

Alex Barnes, managing director at JLL in Hong Kong

Among the major office submarkets, rents in Central and Kowloon East slid 0.5 percent in April while Tsim Sha Tsui’s edged up 0.3 percent.

The handful of new lettings tracked by JLL included Doo Group’s lease of an entire floor at The Millennity in Kwun Tong with a gross floor area of 12,600 square feet, as the Singapore-based financial firm upgraded and consolidated its offices within the same district.

Sun Hung Kai Properties and sister firm Transport International completed construction of The Millennity in late 2022, introducing 650,000 square feet of Grade A office space at SHKP’s Millennium City commercial hub in Kowloon East.

In the capital market, two mid-zone units at Convention Plaza in Wan Chai were sold to Surrich International for HK$255 million, or HK$31,075 per square foot of gross floor area, for self-use. Surrich is a wholly owned offshore subsidiary of Guolian Group, a state-owned enterprise based in Wuxi.

Retail Revival

Hong Kong’s retail market saw an uptick in leasing activity as consumer and tourist spending improved, JLL said.

Overall retail sales leapt 40.9 percent year-on-year in March, bringing the quarterly sales increase to 24.1 percent. Sales in all major categories rose except for supermarkets, where trade fell 11.4 percent on the month.

In one notable deal, a 1,500 square foot ground-floor shop at 59-61 Russell Street in Causeway Bay was reportedly leased to a local pharmacy for a monthly rent of HK$700,000. That amount represents a 12.5 percent discount on the rent of the space’s last long-term lease tenant, crystal jewellery seller Swarovski.

“Retail leasing activities accelerated in high streets in core locations following the return of tourists, with committed leases mostly on the standard two- to three-year terms, compared to the short-term leases prevalent during COVID, and the strengthening leasing market has helped to improve the retail investment market sentiment,” said Cathie Chung, senior director of research at JLL in Hong Kong.

Leave a Reply