While some analysts are predicting that the decision by China’s government to loosen home purchase restrictions will lead to a rapid recovery in the housing market, a recent survey by Standard Chartered shows that the people who need to borrow money to build more housing are increasingly less confident in what the future holds for the country’s real estate industry.

The quarterly Developers Sentiment Index brings together data from surveys on surveys on sales, pricing, construction, financing and policy outlook, showed China’s developers becoming notably more pessimistic in the most recent three months. Specifically, the real estate executives were most concerned over difficulties in borrowing money, and falling demand for their apartments. As a result, plans to buy land were down sharply among the more than 20 developers who responded.

“Our Developers Sentiment Index suggests that the worst times are still ahead for many developers,” the report’s authors, Lan Shen and Stephen Green opined in their conclusion.

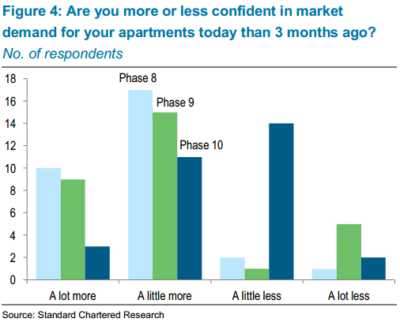

Confidence in Buyer Demand is Down

The survey showed that developers are much less confident in market demand for their apartments than they were three months ago, as illustrated in the figure below. “Phase 10″ refers to the most recent survey, with “Phase 9″ and “Phase 8″ displaying previous sets of results.

This sliding confidence in buyer demand is related to the continuing drop in average home prices nationwide. According to a survey of 288 cities across China conducted by the China Index Academy (a unit of real estate agency E-House) average home prices fell 0.13 percent last month compared to June. The July results were the fourth straight month that the survey had indicated falling prices.

Incentives Become Normal

A majority of the developers surveyed believ that 70 to 90 percent of the companies in the industry are now offering discounts or other buying incentives to try to jump start demand. Besides discounts, enticements such as home decoration, car parking spaces, and lower downpayment ratios were listed as common incentives.

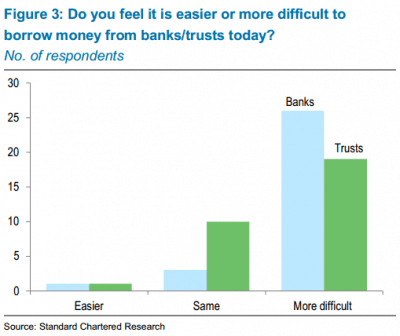

Financing Becoming More Difficult

Although the government has been taking steps to make more mortgage financing available for home buyers, the nation’s builders seem to still face problems accessing cash.

In the survey, the vast majority said that it was more difficult to borrow money from banks now than it was three months ago, and trust financing was also seen as more difficult to obtain.

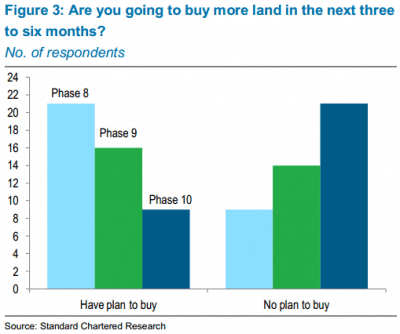

Appetite for Land Slides

With the falling demand and difficulties getting credit, the developers also seem to have lost their appetite for new land purchases.

The findings of Standard Chartered’s survey reinforce the anecdotal evidence from several recent land auctions where plots that once would have been the subject of fierce bidding have gone unwanted.

The build-up of unsold inventory of housing has also made developers leery of taking on new projects. According to data from the National Bureau of Statistics, by June 30th the floor space of unsold new apartments nationwide had jumped 25 percent compared to the same date in 2013.

Given the pessimism among the developers who are closest to the market, it is likely safe to assume that it will be at least several months before demand for housing starts to recover, and the current downward trend in home prices begins to reverse itself.

Leave a Reply