In the first half of 2019 Singapore will auction off sites that could yield 2,025 new private homes

A set of five fresh residential sites are confirmed to go up for bidding in the first half of next year under Singapore’s land sales program, with the government aiming to fill the lots with a total of 2,025 private residential units and 4,000 square metres (43,055 square feet) of accompanying commercial space.

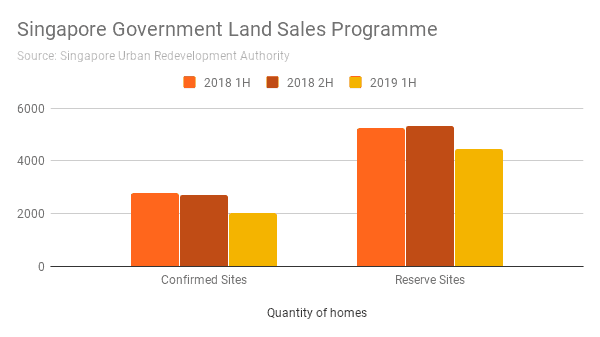

The confirmed supply of new homes going into Singapore’s development pipeline, as presented by the city-state’s Urban Redevelopment Authority, represents a more than 25 percent reduction from the programme for the second half of 2018 and represents a cut of more than 77 percent from the programme for the first half of this year.

The reduction in land supply by the Singapore government comes as the city’s 2018 collective sale wave ebbs and developers become more cautious about taking on new residential projects after policy-makers raised duties on home sales by up to 50 percent in early July this year.

Nine Projects Held in Reserve

The 2,025 homes approved for next year are included in a set of four private home sites and one Executive Condominium project. Executive Condominiums are a type of hybrid public/private housing in Singapore that offers more amenities than traditional public projects, but less luxury than typical private projects.

Another nine land sites on the reserve bidding list — six of them residential, two “white sites” (which provide developers with flexibility in how to develop the project) and one intended for a hotel — could yield up to 4,450 private residential units, 82,000 square metres of commercial space and 1,115 hotel rooms. Bids on these sites could be accepted by the government if a developer offers an indicated minimum price and there is sufficient market interest in the site.

Moderating Demand Leads to Reduction in Supply

The pipeline of homes provided for on the confirmed list of sites represents a reduction from the 2,705 units the government targeted in the land sales program in the second half of this year, and shows a still steeper drop from the programme for the first half of 2018, when sites sufficient for building 2,775 homes were confirmed for development.

The supply of projects added to the reserve list has also been reduced, with sites sufficient for building 4,450 new homes added to the stand-by roster for the coming six months, down by nearly 17 percent from the reserve supply designated in the second half of 2018.

In announcing the land tender programme, the Singapore government said developer demand for land had “moderated” and that transaction volumes in the residential housing market had declined.

Sales of new private homes during October were down by 36 percent compared to the same month a year earlier, according to URA figures released last month, although this was due in part to a dearth of new project launches. The government housing regulator said its 2019 plan was sufficient to “cater to the housing needs of our population,” while also pointing out that developer pipelines in the city already include some 45,000 homes, with 28,000 already built but still vacant.

Analysts at global property consulting firm Colliers International called the government’s plans for the first half of next year, “cautious.”

Prime Sites Expected to Draw Developers

Colliers’ Tricia Song said at least three of the sites up for bid would “garner a healthy level of interest.”

Several of the plots in the 2019 plan are expected to draw a “healthy level” of interest from developers, despite cautious market sentiment.

Tricia Song, head of research for Colliers in Singapore, said that of the confirmed land sites up for bid, three — one on Tan Quee Lan Street, another on Bernam Street and a third at Canberra Link — would “garner a healthy level of interest from developers.” The Canberra Link site is targeted for executive condominiums.

Colliers said the Bernham Street space was a “rare fresh site” near the future Greater Southern Waterfront Development that offered great potential, with recent transactions of 99-year leasehold residential projects in the area going for S$ 1,700 to 2,500 per square foot on average. It said the site could offer 250 residential units and 2,000 square metres of retail space, with a top bid on the site expected to come in at SGD 400 million, or SGD 1,700 per square foot per plot ratio.

The top bid on the 385-residential-unit Canberra site — which Colliers expects will draw “ample” interest — is expected to be about S$215 million, equivalent to S$520 per square foot per plot ratio. The most attractive site on the reserve list — the expansive Dunham Road site — could attract a bid of S$1.15 billion, or S$1,200 per square foot, Colliers said. It has the potential for construction of up to 1,070 units, although Colliers said its huge size would be of some concern to developers.

The 575-room hotel site on Sims Avenue “offers hoteliers a first-mover advantage … to cater to the growing business community” in the Paya Lebar hub, Colliers said. A top bid of S$244 million is expected on the site. The plot joins a white site holdover from the 2018 2H reserve list at Marina View and forms part of the government’s plan to rejuvenate the Paya Lebar area into a commercial hub.

JLL Eyes Tan Quee Lan Street Site

Property consultancy JLL said that in its view, the Tan Quee Lan Street site holds the most potential, given its location next to the Bugis MRT station. “The fact that the government has moved the site from the Reserved List on the 2H2018 programme to the Confirmed List on the 1H2019 programme indicates its desire to build on the momentum gathered from the completion of new skyscraper developments such as South Beach and DUO,” JLL said.

JLL added a note of caution regarding the site, though, saying its prime location “could translate to a rather substantial capital outlay that could limit the number of interested bidders to those with larger risk appetite.”

JLL also agreed with Colliers that the Bernham Street site would draw a healthy level of interest from developers owing to its “bite-size plot size,” which it said “would be more digestible for small and medium-sized developers amid the current cautious market sentiment.”

Leave a Reply