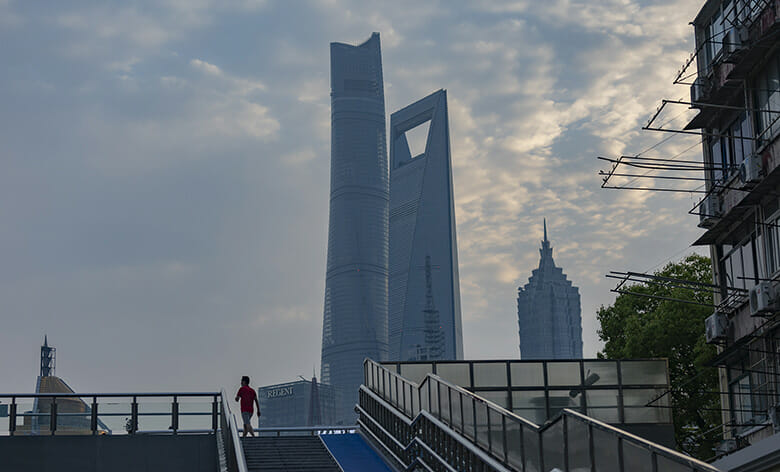

China’s commercial capital saw investment pick up in the fourth quarter of 2022 (Getty Images)

Major trades of investment properties in Shanghai fell by more than one-fifth in terms of value from 2021 to 2022, according to reports by property brokerages, as COVID-19 restrictions and economic weakness derailed deals during the second and third quarters in the mainland financial hub.

China’s commercial capital showed signs of a rebound in the fourth quarter of last year, however, with a pickup in activity as policies to support the real estate sector kicked in. Transaction volume during the quarter totalled RMB 26.4 billion ($3.8 billion), representing 31.6 percent of the year’s total and rising 36.8 percent compared to the fourth quarter of 2021, JLL found in its latest market report.

While the impact of COVID-19 continued to slow signing of new leases and drag on other areas of Shanghai’s commercial property market in the fourth quarter, the brokerage expects that continued supportive measures and the lifting of pandemic restrictions may boost investor sentiment in 2023.

“As the ‘exit wave’ of COVID passes, we expect daily life and business to normalize, setting the stage for a recovery in confidence and market performance later in the year,” said Anny Zhang, managing director for JLL East China, who also heads the company’s commercial leasing business nationwide.

Overseas Buyers Come Back

JLL counted 74 major real estate investment transactions in Shanghai totalling RMB 83.64 billion during 2022, – a sum which was down 22.8 percent from the previous year’s tally of RMB 108.3 billion. Painting a similar picture, rival brokerage Cushman & Wakefield reported 71 en-bloc transactions in the mega-city totalling RMB 88.5 billion during the year, dropping 17 percent from 2021.

Investors chalked up 13 new en-bloc transactions in Shanghai totalling RMB 24.9 billion during the fourth quarter, Cushman & Wakefield found, with office and business park properties accounting for more than 90 percent of deals recorded during the quarter. The property consultancy added that the proportion of investment by overseas buyers gradually increased in the second half of the year.

JLL head of eastern China Anny Zhang

Notable deals during the fourth quarter included Hong Kong-based insurance giant AIA’s purchase of a 90 percent stake in the SIIC Center, an office-retail complex in Hongkou district, for RMB 8.7 billion in December.

Singapore’s CapitaLand notched another major transaction by acquiring The Springs Center, an office complex in Yangpu district, from Tishman Speyer for RMB 7.6 billion, while Singaporean sovereign wealth fund GIC bought a 70 percent stake in Baijiatong Park, a business park in the Zhangjiang submarket, for RMB 2.8 billion, according to Cushman & Wakefield.

Office assets accounted for 82 percent of transaction volume in the fourth quarter, followed by business parks at 11 percent. Senior housing, industrial and hotel deals made up 5 percent, 2 percent, and 1 percent, respectively.

The brokerage found that office assets in Shanghai’s central business districts offered cap rates of 4.5 percent, while those in non-CBD areas averaged 4.8 percent. Business park properties had average cap rates of 5 percent.

Rental Housing on the Rise

Shanghai’s virus outbreak and months-long lockdown in the first half of the year dampened demand for office space, with net absorption of grade A offices totalling just 94,851 square metres (1 million square feet) in the fourth quarter, a plunge of more than 74 percent from the same quarter of 2021, according to JLL.

CBD rents declined 0.9 percent quarter-on-quarter in the fourth quarter, offsetting rental gains earlier in the year, while decentralized rents declined 1.3 percent quarter-on-quarter and 1.6 percent year-on-year, driven by slow leasing and lease terminations by small and medium-sized enterprises.

A report by Colliers, however, found that grade A office market performance picked up in the fourth quarter, with overall leasing demand rising 37.7 percent quarter-on-quarter to 166,000 square metres. Vacancy tightened by 0.5 percentage points to 17.9 percent during the quarter due to take-up in decentralized business districts and a scarcity of new supply.

While office assets accounted for over 64 percent of total transaction volume in 2022, according to JLL, rental housing ranked as the second most popular asset class during the year with 15 transactions. Investors also sought out other alternative asset classes including business parks, hotels, and senior living facilities.

“The investment market is being bolstered by a range of policies such as the recent resumption of financing for listed real estate companies, as well as private equity being allowed to establish private real estate investment funds,” noted Ling Sun, head of capital markets for JLL East China in a statement. “The market also is benefiting from the accelerated broadening of the scope for REITs and broader official measures to revive China’s property sector.”

Leave a Reply