Which China real estate developers will live or die in 2014? Credit rating agency Fitch believes it has some answers to that question in a newly published report that rates the credit prospects of 22 China property firms.

Consolidation among China’s real estate developers has been predicted for some time now, as rising costs of land acquisition and tightened loan requirements squeeze smaller players and provide greater opportunities for giant firms to dominate. In 2014 this competition looks set to intensify as the prospects for slower growth further polarise the market between rich and poor developers.

In their report, “2014 Outlook: China Homebuilding,” Fitch predicts that this polarisation will occur not only according to the scale of the companies involved, but also depending on the cities where they are working and whether they are focused on residential, commercial or industrial projects.

Slowdown in Space Under Development

Fitch predicts that the growth in contracted gross floor area from 2013 to 2014 could be only 5-10 percent, compared with the 12 percent growth achieved in the first 11 months of 2013.

There will also be challenges in 2014 due to the uneven spread of price growth during 2013. While most of China’s largest cities have seen double-digit increases in housing costs over the past several months, the rates in the countries third and fourth tier cities have risen much less quickly – a trend that will work against developers undertaking projects in these smaller communities and those unable to secure sites in the first tier cities.

The report also foresees trouble for developers who have recently focussed on commercial projects. The agency sees an oversupply of commercial space in some areas and notes that “yield and occupancy rates remain limited except for well-located properties.”

Extra Leverage Means Additional Risk

With the rising cost pressures, Fitch also stresses that smaller developers are likely to leverage further to expand their operational scale and become more competitive, especially as they may not have the land bank resources at hand which many of their larger competitors enjoy.

As these smaller companies take on this additional leverage, however, not all of them will be able to correctly balance the reduction in business risk with the increase in financial risk. These risks are particularly hard to predict given the uncertainties of government policies and accessibility to funding sources.

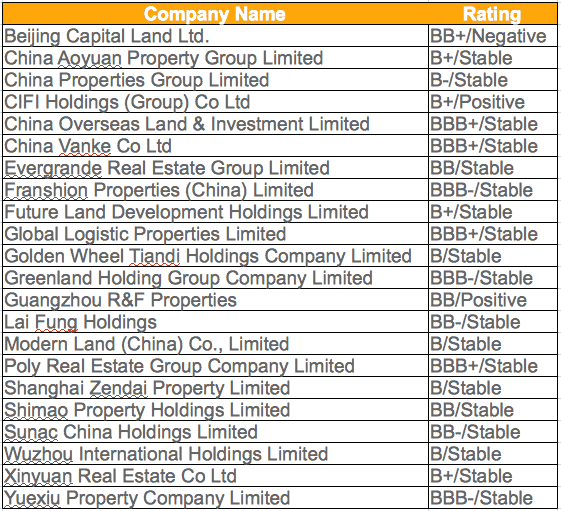

A summary of the reports findings on the 22 developers is contained in the following table.

Ratings May Determine the Future as Well as Predict It

Of course, these ratings alone will have considerable impact on the fate of some of these companies as a higher or lower rating will affect their cost of borrowing, squeezing the margins of the firms rates as more marginal while offering additional leverage to those developers receiving a higher rating.

Please remind me to check back next December and see how Fitch rates these companies for 2015, or if a few of the lower ranked real estate companies have been swallowed up by their more highly rated competitors.

Leave a Reply