The Salvation Army picked up units at the Tung Chun Industrial Building in Kwai Chung (Image: JLL)

Warehouse rents in Hong Kong declined 0.5 percent year-on-year in the third quarter of 2023 as logistics demand continued to diminish and warehouse tenants refrained from actively seeking expansion opportunities, according to Savills.

The Asian finance hub’s logistics sector has struggled in recent months, with imports and exports falling 2.8 and 6 percent year-on-year respectively in the July-to-September period, the agency said in its latest industrial sales and leasing report. Although air cargo throughput rebounded with a 7.6 percent rise in the quarter, container throughput tumbled 13.4 percent.

High interest rates and associated funding costs have made it increasingly challenging for expiring tenants to justify relocations for cost-saving purposes, with third-quarter leasing activity primarily focused on lease renewals rather than new acquisitions, Savills said.

“The leasing market continued to see weak demand with relocations hard to come by,” said Jack Tong, director of research and consultancy for Hong Kong at Savills. “Rate of take-up of newly completed warehouse would dictate the rate of recovery of the sector over the next 12 months.”

Cainiao Duty-Free Bust

Overall warehouse vacancy saw a slight increase to 3.7 percent in the third quarter as modern warehouse vacancy held steady at 3.5 percent, the report said.

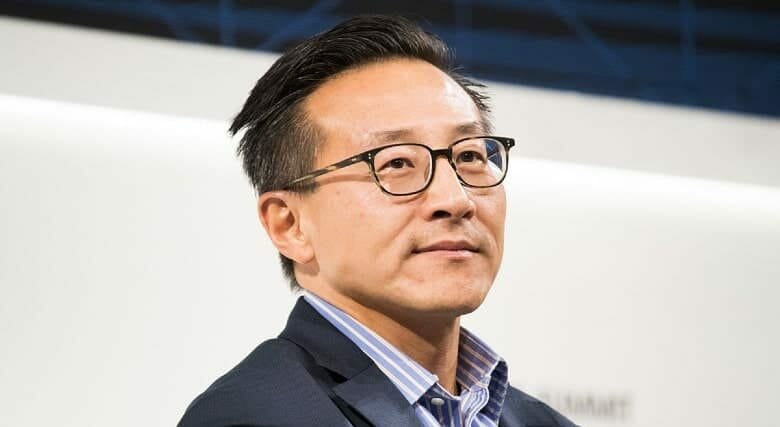

Joe Tsai, chairman of Cainiao and executive vice chairman of Alibaba

The completion of Alibaba’s Cainiao Smart Gateway logistics complex at Hong Kong International Airport, which offers 4.1 million square feet (380,902 square metres) of lettable area, was marred by the collapse of a rumoured leasing deal with a duty-free operator, adding to the sector’s supply overhang.

With commercial mortgage rates ranging from 6.7 to 7.7 percent, property investment has become less attractive and only end-users have shown interest in the market, according to Savills. As an example, the Salvation Army recently bought units for self-use across several floors of the 1981-vintage Tung Chun Industrial Building in Kwai Chung for HK$122 million ($15.6 million).

“The high cost of funds continues to constrain the sales market, leading to further limitations on transaction volume,” said James Siu, deputy managing director and head of Kowloon industrial development and investment at Savills. “Positive signs in the investment market may only be observed when interest rates begin to decline, which is anticipated to occur around the end of 2024 or early 2025.”

E-Commerce Boost

Despite disappointing retail sales and external trade, sustained growth in e-commerce is likely to provide some support to Hong Kong’s logistics sector in the coming months, according to Savills.

Warehouse landlords facing tenant expiries in the next two years are seen showing flexibility with rental terms to maintain occupancy, given the scarcity of new logistics demand.

“The market is expected to resume growth from 2025 onwards as new warehouse completions gradually become occupied and China’s economy fully recovers, bringing more supply chain solutions back to the country, with Hong Kong benefiting significantly,” Savills said.

Leave a Reply