Swire Properties has begun offering discounts to tenants at Pacific Place shopping centre

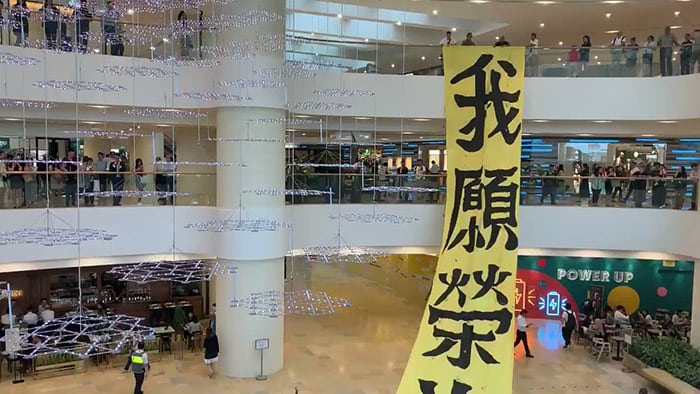

Hong Kong’s retail sales declined more sharply in August than during the 2003 SARS outbreak, according to a report released this week, as the city’s shopping sector suffered from the joint effects of tighter economic conditions on the mainland, the US-China trade war and ongoing social unrest.

In comments on the recent performance of the retail sector, analysts from property consultancy Savills, which produced the report, described the August data as “grave” with a citywide index of rental rates for street shops plunging 54 percent from their peak in the first quarter in 2013 and down an average of 15.4 percent in the third quarter of this year, compared to the preceding three month period.

“It is difficult to see any upside at this point, with poor macro-economic conditions compounded by social unrest undermining Hong Kong’s traditional role as a retail hub in Asia,” said Simon Smith, senior director of research & consultancy for Savills in Asia Pacific.

Luxury Sales Down 50%

Consumer sentiment, which has been dampened by the US-China trade war since the beginning of this year, was further chilled in August by the on-going anti-government protests with a decline in sales hitting across shopping segments.

Savills Nick Bradstreet says Hong Kong’s retail landlords aren’t showing much flexibility

Sales of jewellery and watches were down 47.4 percent in August compared to the same month in 2018 and turnover in footwear and related products slid by 32.1 percent during the same period. Sales of cosmetics and medicine were also hard hit, falling 30 percent during August.

Savills indicated that luxury retailers in the city had complained of revenues dropping 50 percent, while food and beverage revenues are suffering as fewer patrons venture out in search of dining opportunities amid ongoing protests and transport shut-downs.

Rents Fall on the Street and in the Mall

With Hong Kong’s Causeway Bay carrying the world’s highest rents for street level shops for the past several years, the shopping district was the hardest hit in the city during the third quarter with Savill’s rental index showing a 17.5 percent drop, against the 15.4 percent slide citywide. Central, which held up best among the traditional shopping hubs, still fell by 13.9 percent.

The street-level retail-pocalypse has caused some landlords to take steps to ensure their tenants stay in business. “We see some street shop landlords are offering short term and ad hoc relief in the form of rental reductions of 15-20 percent for three months or occasionally longer,” Nick Bradstreet, Head of Leasing for Savills in Hong Kong said.

Rental costs in shopping centres fell only slightly more slowly than on the street — with Savill’s rental index showing a 14.2 percent decrease citywide compared to the previous three months. Rents for malls in the New Territories fell most precipitously at 16.4 percent compared to the previous quarter, and wer down by the same margin compared to the third quarter of 2018.

Mall owners have already begun taking steps to keep their tenants from fleeing right alongside the shoppers with Swire Properties saying last month that it would provide temporary rental adjustments to shopkeepers at their Pacific Place mall in Admiralty district, according to a report in the South China Morning Post. Savills indicated that Swire has been conceding 10-30 percent reductions in rent on a case by case basis.

This week, both Sun Hung Kai Properties and Hang Lung Properties said that they would waive rental fees for days when their shopping centres were closed in the face of protest activity.

Hotels Also Take a Hit

As more than 10 countries and regions have issued advisories warning potential visitors against travelling to Hong Kong and several major events having been cancelled or postponed, the city’s hotel occupancy rate also dropped sharply in August from the previous month, falling to just 66 percent citywide.

With Hong Kong’s chief executive Carrie Lam maintaining a rigid stance in the face of ongoing protests during her annual policy address in Hong Kong, opportunities for a quick resolution to the city’s political impasses appear slim.

Without a resolution in sight, Savills predicts that Hong Kong’s current retail market conditions could prevail into next year, and highlighted that the negative impact of the Occupy Movement, which paralyzed parts of the city for 79 days in late 2014, was felt for at least 12 to 18 months.

Long term, Savills expressed confidence that Asia’s wealthiest city was not likely to disappear entirely, despite the current turmoil

“Looking ahead, it is worth noting that Hong Kong is expected to remain a key market for retailers in the region and that while the trade war has undermined local and overseas consumption, the local residential market has remained relatively resilient and interest rates remain low,” Smith said in one of the report’s more positive notes.

Leave a Reply