Blackstone’s February acquisition of a Kowloon East building was among the rare foreign fund deals this year

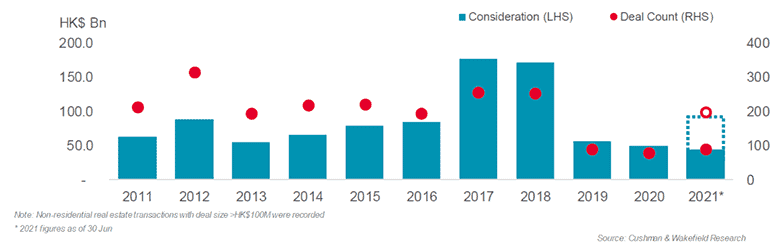

As Hong Kong recovers from the pandemic and its longest-ever recession, investors have resumed the search for real estate returns, helping to drive transactions during the first half of 2021 to a total that already exceeds all of last year, according to a newly released report by Cushman & Wakefield.

So far this year, buyers have snatched up a total of 89 major transactions, amounting to HK$43.1 billion ($5.53 billion) from January through June. Based on that surge, the property agency expects the full-year count of transactions to reach 200 cases — which would make for the busiest year since 2018.

Executives at Cushman & Wakefield held out hope for further growth should travel restrictions ease as the city continues its battle with the COVID-19 pandemic.

“Since the border remains restricted, PRC investors are still scarce in Hong Kong, however, private equity fund activities are picking up and will probably grow further during the second half,” said Tom Ko, executive director and head of capital markets for the property consultancy’s Hong Kong team.

Industrial Leads, Office Rebounds

Growing investor enthusiasm for industrial assets has been a leading source of the rebound, with this year’s count of market transactions already having exceeded 2020’s total of 79 by more than 11 percent.

Tom Ko, head of capital markets for Cushman & Wakefield Hong Kong

C&W attributed the boost in part to programmes designed to encourage redevelopment of ageing workshops and warehouses.

“We can fairly say that the government incentives are sufficient for encouraging redevelopment and conversion for data centre use, as premiums are waived if the buildings are at least 15 years old,” Ko added.

Total investment in Hong Kong’s non-residential properties from January through June nearly equalled all of 2020.

In March, Hong Kong introduced a fresh industrial revitalisation scheme that encourages redevelopment by standardising premiums for land-use modifications for investors seeking to redevelop existing buildings for commercial or residential purposes.

Thanks to these changes, in the first half of the year, warehouses and workshops became the most investable assets and accounted for 30 percent of total deal consideration — a significant increase from the 14 percent average over the past decade.

US fund manager Blackstone was among the few international players to take advantage of the industrial opportunity during the period, with the private equity firm acquiring a 10-storey building in Kowloon East for HK$508 million in February.

While businesses resume near pre-pandemic levels of physical operation, property decision-making has also revived. According to JLL data, tenants have shown fresh enthusiasm for office space, with Hong Kong’s Central district recording a 39.4 percent increase in leasing during the second quarter, compared with the previous three months in terms of area. On an annual basis, office leasing from April to June was up 69.1 percent compared with 2020 by the same measure.

The average vacancy rate also decreased slightly from 7.5 percent at the end of April to 7.4 percent by 30 June.

Locals Rule

Due to the ongoing COVID-19 pandemic restricting travel, local capital accounted for over 70 percent of transactions during the first six months of 2021, which helped to bring average deal size during the period down to HK$485 million from HK$618 million in 2020.

Keith Chan, Cushman and Wakefield’s head of research for Hong Kong, said deals would “mostly be in small in size in the near term”.

SilkRoad Property Partners was among the regional players acquiring a bite-sized piece of the Hong Kong industrial market during the period, with the fund manager buying a cold storage facility in the New Territories for HK$321 million in February.

With much of Asia suffering through a resurgence of COVID cases, Hong Kong’s border policy remains one of the world’s strictest, requiring non-vaccinated arrivals to self-isolate for up to 21 days and keeping most foreign investors away from the city’s assets.

C&W anticipates, however, that investment activity will continue to escalate in the next six months, with Ko noting: “Once restrictions are relaxed, they (investors) will become more aggressive.”

Leave a Reply