CSI Properties’ Harbourside HQ in Kowloon Bay. (Photo: CSI Properties)

After a year-long streak of nearly endless contraction, Hong Kong’s office market crawled into positive territory last month in terms of net area leased, with tenants taking up 229,800 square feet (21,349 square metres) more than they gave up, thanks to some large rental agreements in lower-priced properties.

The city’s hospital authority leased 100,000 square feet at CSI Properties’ Harbourside HQ in Kowloon East during August, marking the city-state’s largest office deal so far this year, as the renovated industrial building has struggled to attract tenants in sliding market.

Despite that landmark lease, average grade A office rents in Hong Kong fell by 0.7 percent in August, compared to July, to HK$54 per square foot per month, continuing a year-long slide, according to a report by JLL.

“The overall market recorded a positive net absorption of 229,800 square feet in August,” said Alex Barnes, managing director and head of office leasing advisory at JLL in Hong Kong. “It is a good sign in a relatively low demand office market.”

The decline in demand for office space in Hong Kong, which has traditionally been among the most expensive leasing markets worldwide, reflects broader challenges for the city’s economy, with fundraising through initial public offerings on the local bourse falling to a 20-year low of $2.2 billion in the first half of 2023.

Lower Rents Spark Activity

With tenants taking advantage of declining rents to move into new spaces, Kowloon East accounted for some of August’s largest leasing deals.

Alex Barnes, managing director and head of office leasing advisory at JLL in Hong Kong

In addition to CSI’s new lease at its Harbourside HQ, Sun Hung Kai found a tenant for 12,500 square feet in its Millennium City 1 building in Kowloon East for a rent reported to be between HK$15 to HK$20 per month.

Also signing a new agreement was Wing Tai Properties, which leased 15,200 square feet in its Landmark East project in Kwun Tong at a rate reported to be between HK$20 and HK$25 per month.

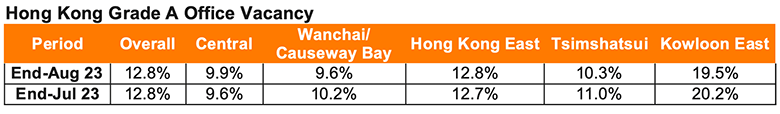

Source: JLL

In Wanchai, a tenant agreed to rent 29,200 square feet in the Dah Sing Financial Centre on Queen’s Road East at a rate between HK$30 to HK$35 per month.

Rents in the Causeway Bay/Wanchai area fell more slowly than the city-wide average last month, sliding by 0.3 percent compared to July. In Central, the city’s most expensive office location, leasing rates fell by 0.8 percent, according to JLL.

By the end of August the average vacancy rate for grade A offices across Hong Kong held steady from a month earlier at 12.8 percent after rising for four straight months.

In Central vacancy climbed to 9.9 percent from 9.6 percent a month earlier, while Causeway Bay/Wanchai tightened by 0.6 percentage points and Tsimshatsui by 0.7 percentage points.

Central Competition on the Rise

With tenants reluctant to commit to new offices leases in Hong Kong, and with many occupiers downsizing at the same time that new buildings enter the market, landlords have been reducing rents to generate more deals. By the end of June, rents in Central were down 31 percent from their 2019 peak, JLL said.

“Office rents will remain under pressure as leasing demand remains subdued and new office supply is increasing,” JLL’s Barnes said. Among the new projects entering the market is Henderson Land’s the Henderson, which remains less than 50 percent committed as it prepares for final completion later this year.

Hongkong Land, the biggest landlord in Central declared a loss attributable to shareholders of $333 million in the first half of 2023, as committed vacancy in its portfolio in the district rose to 6.9 percent at 30 June from 4.7 percent a year earlier.

For the same period the division of Jardine Matheson said that average rents in its Central office properties declined to HK$107 per square foot per month from HK$111 per square foot at the end of 2022.

During the first half of 2023 Swire Properties kept vacancy at its Pacific Place complex in Admiralty at 3 percent, however, during the same period, rates on new leases and renewals averaged 12 percent lower than earlier pricing.

Leave a Reply