Average rents in Central fell by 3.2% in February

The COVID-19 pandemic continues to batter Hong Kong real estate, with rents in the world’s most expensive office spaces suffering the steepest month-on-month drop in more than a decade, according to a report this week by JLL.

The property consultancy said that with the coronavirus outbreak forcing tenants to reconsider or postpone new leases, Hong Kong’s grade A office market suffered negative net absorption of 189,300 square feet (17,586 square metres) in February, with the few deals still moving forward being signed at lower prices.

“Rental decline in the overall market worsened in February, down 2.2 percent month on month, as a drop in leasing demand contributed to higher vacancy rates across all major office submarkets,” said JLL’s head of research for Greater China, Nelson Wong.

“Rents in Central contracted by 3.2 percent month on month to HK$116.1 ($14.97) per square foot, the sharpest monthly decline since the Global Financial Crisis in 2008-09.”

Central Heads Downhill

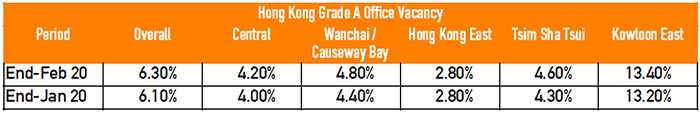

Vacancy in Central stood at 4.2 percent at the end of February with only Hong Kong East, where Swire Properties’ One Taikoo Place project has helped to draw multinational tenants east to Quarry Bay, having held steady during the month at 2.8 percent vacancy.

JLL’s Nelson Wong sees more empty offices in Hong Kong

Office vacancy in Wan Chai and Causeway Bay climbed at the highest rate from January, rising from 4.4 percent during the first month of the year to 4.8 percent in February, while empty space in Tsim Sha Tsui rose from 4.3 percent to 4.6 percent and Kowloon East went from 13.2 percent vacancy to 13.4 percent during the same interval.

“The current situation will weigh on sentiment and near-term business planning across a number of industry sectors, which will lead some firms to hold back on relocation and expansion plans, where they have the time to do so,” Alex Barnes, JLL’s head of markets for Hong Kong, said this week.

Source: JLL

The rise in empty offices comes after JLL showed last month that vacancy in Central had already reached its highest level since 2014.

JLL’s grim forecast has been echoed by other property giants. Commercial real estate consultancy CBRE estimated in its annual Hong Kong outlook that capital values in the city’s grade A office market would decrease by 10 to 15 percent next year, while rents were expected to fall by 5 to 10 percent

Cushman & Wakefield, a leading real estate services company, said concerns about Hong Kong’s slowing economy had prompted tenants to postpone relocations and expansions. In October, the firm told the South China Morning Post that vacancy in Central was already at a 14-year high.

‘Bucking the Trend’

Amid the falling demand, JLL’s team noted a continuing occupier migration to lower cost locations outside of Central in February with some of the month’s most noteworthy new leases being signed in areas away from the city’s traditional commercial core.

The JLL report noted that TransUnion Asia had leased 17,700 square feet at The Gateway Tower 5 in Tsim Sha Tsui, to relocate and expand its premises within Wharf’s Harbour City portfolio.

The report added that the migration had resulted in more space becoming available in Central as negative net absorption amounted to 36,300 square feet last month.

According to JLL, most tenants are now prioritising locations outside of premium office buildings, such as are found in the city’s traditional business district, as they remain cautious in managing their real estate costs. Two law firms currently based in core Central in February agreed to lease new premises in Admiralty and Quarry Bay, the report said.

While Hong Kong’s commercial leasing market has slowed during 2020, JLL indicated that occupiers signing new leases have enjoyed more flexibility from the city’s famously aggressive landlords.

“Some businesses are bucking the trend and taking advantage of greater transactional flexibility and deal structures,” said Barnes in the JLL report. “Ultimately, businesses with near-term lease expiries will need to address these, alongside business plans, regardless of the immediate situation.”

Leave a Reply