Evergrande’s Xu Jiayin seems pleased with his 2019 results

China Evergrande has retained its crown as China’s largest developer during 2019, as measured by contracted sales attributed to shareholders, as the country’s residential sector endures a period of slower growth.

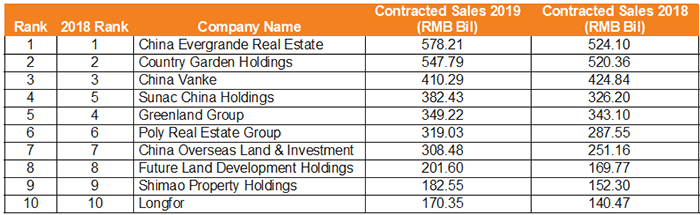

The Shenzhen-based company chaired by mainland billionaire Xu Jiayin saw sales increase by ten percent to RMB 578.21 billion ($82 billion) in 2019, according to a report by data provider China Real Estate Information Corporation (CRIC).

Evergrande’s 10 percent leap in new contracts came as sales growth for China’s 100 largest developers slowed to an average of 6.5 percent in 2019, after expanding by 35.1 percent in 2018 and 40.5 percent a year earlier.

The property information provider noted in its report that, although most large developers hit their annual performance targets, the top builders had traditionally far exceeded their sales goals – a trend which did not hold for 2019.

Top 3 Unchanged Despite Vanke Sales Sliding

With only a 5 percent improvement on 2018’s sales after years of rapid expansion, runner-up Country Garden was not able to close the gap on top dog Evergrande.

Source: CRIC

The Guangdong-based developer brought in new contracts worth RMB 547.79 billion last year — up from RMB 501.88 billion in contracted sales attributable to shareholders for the year before, according to CRIC.

Shenzhen-based China Vanke clung to third place, despite the developer’s sales dropping by 3 percent to RMB 410.29 billion, as it scaled back an expansion drive that saw its contracted sales grow by 30 percent 2018.

According to CRIC, the top three developers hold a ten percent slice of the market, while the top 50 developers command over half.

China’s three biggest builders also led in in terms of overall contracted sales, including joint venture projects, with Country Garden taking the lead by this metric, which also indicates the strength of the company’s sales network.

The Guangzhou-based developer retained pole position by overall sales for the second year running with signed contracts valued at RMB 771.53 billion – a 22 percentage points more market share than was achieved by China Vanke, which ranked second.

Evergrande took third place by total contracted sales, with RMB 608 billion in new deals, holding off Sunac China Holdings, which ranked fourth after signing RMB 555.63 billion in contracts.

Sunac Holds Off Greenland

Sun Hongbin’s Sunac also came in fourth place in terms of sales attributable to shareholders, with a 17 percent boost in new deals last year, which saw the company sign contracts worth RMB 382.43 billion in 2019.

The Tianjin-headquartered developer nudged Shanghai’s Greenland Group down into fifth place, with the government-backed property giant’s haul rising just 3 percent from 2018 to RMB 349.22 billion.

Guangzhou-based Poly Real Estate Group remained in sixth place, despite growing its contracted sales last year by 11 percent to RMB 319.03 billion.

Golden Age of Home Sales Fades

Future Land Development, which has seen its share price gradually recover after tanking in July when the company’s chairman Wang Zhenhua was arrested for sexually molesting a minor, saw contracted sales attributable to shareholders increase by 20 percent to RMB 201.6 billion in 2019 after the developer’s sales had surged by 75 percent in 2018.

Future Land’s year was marred by the imprisonment of chairman Wang Zhenhua

Like Future Land, Shimao Property Holdings also recorded a double digit sales growth, although the expansion was more modest than in 2018. The Shanghai-based developer’s sales grew by 20 percent in 2019 to reach RMB 182.55 billion after its rate of new contract signing had grown by 75 percent the year before.

Propping up the top 10 for the second year running, Chongqing-based Longfor’s contracted sales also increased by 20 percent to RMB 170.35 billion.

Tightening Controls Keep Growth in Check

As China’s central government kept measures in place to control home prices and dampen speculation throughout 2019, the country’s largest developers continued to consolidate their share of the market, according to Savills.

Data from the property consultancy reveals that the top 10 developers held a 21.23 percent market share in 2019 – up from only 15.88 percent in 2016.

James Macdonald, head of research for Savills in China, said that the mainland’s largest developers are leveraging their superior access to financing to continue to grow, as smaller competitors face funding challenges.

“Smaller companies which have not diversified their property portfolios as much as the larger players can be impacted more by regional or sectoral policy changes, and may find it harder to raise funds through traditional channels,” Macdonald said.

The Savills research chief noted that these smaller developers, which may have been able to finance operations in the past through shadow banking, will face difficulties as these financing options are largely shut off.

While maintaining an advantage over their smaller competitors, even China’s largest developers may be facing challenges as a result of financial de-risking by mainland authorities, according to MacDonald.

Publicly listed developers are likely to still be able to generate new financing or to pay off existing debts by issuing new bonds, but even these industry giants may need to pay much higher coupon rates than would have been required a few years ago, the veteran analyst said.

Collapsing Sales amid COVID-19 Scare

With sales growth already slowing over the course of 2019, the outbreak of the coronavirus this year has seen sales collapse in the first two months of 2020.

With 60 percent of sales offices closed and construction suspended in most cities, a CRIC report issued this month showed that in February the monthly sales volume of China’s top 100 developers plunged by 44 percent compared to January, and were down by 38 percent as measured against February 2018.

“There has been an immediate drop in sales in January and February, but the longer term impact of the coronavirus is less certain and will depend upon the health of the economy, financial markets, developers and personal finances,” Macdonald said.

He noted that the market may see a rebound later in the year as a result of pent-up demand built up in the first quarter.

“If that doesn’t materialise, developers which are behind on their annual sales targets will need to step up promotional campaigns, which could mean more incentives or discounts,” Macdonald added.

Already developers including Evergrande have tried to attract buyers with discounts of up to 25 percent. The Shenzhen-based company has also waded into the online market, launching an app called Hengfangtong that home hunters can use to view available homes and even put down a deposit on their chosen properties.

Leave a Reply