Hui Ka-yan’s Evergrande is number one yet again

China Evergrande maintained its position as China’s top developer in 2020 with the real estate giant growing its sales even more quickly during the pandemic, but seeing its profits slide by more than a quarter, according to a review of annual financial results for the real estate industry’s top players.

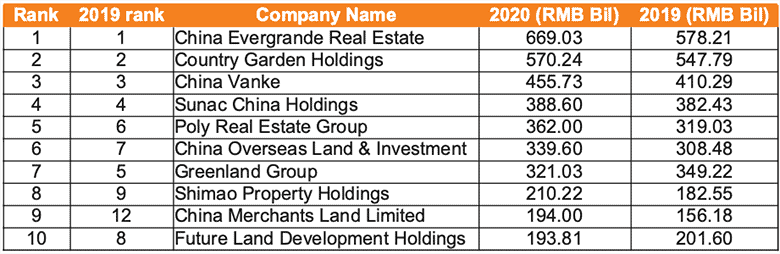

Evergrande recorded contracted sales attributable to shareholders of over RMB 669 billion ($103 billion) last year — a number which was up more than 13.5 percent over the RMB 578 billion that it recorded in 2019.

That achievement allowed the developer led by billionaire Hui Ka-yan to outpace its closest competitor, Country Garden Holdings, by nearly RMB 98.8 billion, as that Guangzhou builder ranked second for the third year in a row, according to figures from CRIC, a data division of mainland real estate agency e-House.

China Vanke and Sunac China Holdings maintained onto their respective third and fourth place positions last year to hold steady from 2019, as the ranks of the top mainland real estate firms stayed largely stable.

Poly Real Estate was the only exception among the largely static upper echelon, as it pushed its way back into the top five by sales as last year’s fifth place player, Shanghai Greenland Group, saw the value of its new contracts signed drop nearly 8.8 percent to RMB 321 billion last year.

Growing Across the Red Lines

After sales were dented by the COVID-19 pandemic in the first four months of 2020, and dampened by new lending restrictions introduced under the Three Red Lines initiative introduced in August, China’s top ten developers still managed to achieve an average 7 percent sales growth last year.

Developer ranking by contracted sales attributable to shareholders (Source: CRIC)

Among the elite group returning from 2019, only Longfor Properties slipped out of the top decile as it slid from tenth place last year to the eleventh spot in 2020, despite growing its sales by over 10 percent.

China’s top developers became more aggressive with their sales policies in 2020, expanding online sales channels to overcome COVID-19 restrictions on physical visits, and began offering steeper discounts, including a program introduced by Evergrande in September which took 30 percent off prices for one month.

Despite these promotional efforts, the average growth rate for China’s top developers last year, in terms of contracted sales, was 7.0 percent — a figure which was down by over 3.5 percentage points from 2019.

After ranking 12th in 2019, China Merchants Land expanded its sales by 19.5 percent to move into the ninth spot last year with the highest growth rate among the top ten. Both Shanghai-based Shimao Property Holdings and Evergrande were able to achieve growth of over 13 percent.

Debt Dives, Sales Rise

The continuing resilience of China’s housing market despite last year’s challenges makes it likely that the government will persist in its efforts to clamp down on debt which could pose systemic risks to the economy.

A report issued last week by CRIC found that a group of 67 mainland developers recorded average growth in interest-bearing debt of 4.6 percent last year, which was down nearly 12 percentage points from the 16.5 percent expansion recorded a year earlier. In 2018 those 67 developers had enlarged their debt levels by 21.2 percent and those liabilities had grown by over 40 percent in 2016 and 2017.

After frightening the Greater China financial industry with a plea for financial assistance last year, Evergrande, which had long led the list of the real estate sector’s biggest debtors, joined the shift toward fiscal prudence in 2020.

According to an annual financial statement released at the end of March, Evergrande reduced its total debt by 14 percent in the second half of last year to RMB 717 billion at 31 December. By the end of March, those obligations had been shrunk still further to RMB 674 billion.

In a statement, the company said it will further tame its balance sheet in the years to come, with a goal of bringing total debt down to RMB 350 billion by mid-2023.

While Evergrande has been able to reduce its debt and maintain its sales lead in China, the returns from the business suffered last year, with core profit falling 26 percent from a year earlier to RMB 30.1 billion for 2020.

Leave a Reply