China’s PBOC wants to limit lending for mortgages

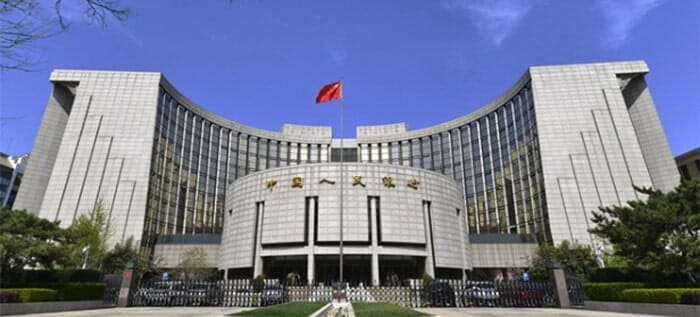

The People’s Bank of China has unveiled a new minimum interest rate system for home loans according to an announcement on the central bank’s official WeChat social media account, as the mainland government continues to clamp down on the housing market.

The new floor level for mortgages was the second move this month by China’s central bank to rejig lending as the country seeks to expose credit use to market forces while also counteracting investor favouritism for buying houses.

In its social media post, the PBOC noted that its latest lending rules would help to prevent home price inflation as the bank tries to reform lending rates for the economy as a whole.

Lending Reform Cues Up New Mortgage Regulation

The new mortgage policy came after China’s central bank on 17 August unveiled a new benchmark interest-rate system aimed at lowering borrowing costs for the overall economy.

The long-awaited reform of the interest-rate system, which bases lending on what is called the Loan Prime Rate, or LPR, was announced with officials saying at the time that the changes would not affect the pricing of mortgage loans.

PBOC governor Yi Gang has set new minimum mortgage rates

In a statement on Sunday, the PBOC said that, starting from 8 October, mortgage rates for purchases of first homes must not fall below the LPR and rates for loans backing purchase of second-homes must be at least 60 basis points above it.

The average mortgage rate for first-time home buyers in China was 5.44 percent in July, about 1.1 times the benchmark interest level, according to the Rong360 Big Data Research Institute. For second-home buyers, the figure was 5.76 percent.

Rate-setting restrictions in some cities had meant that their average rates were below the benchmark, a discount which the new mortgage rules will eliminate. Minimum mortgage rates in cities where banks could previously lend at 10 percent below the benchmark will now rise to 4.85 percent — the current five-year LPR — from 4.41 percent. The one-year LPR is 4.25 percent.

Depressed Markets May Earn Exceptions

The central bank will guide local authorities to set specific lower limits on mortgage rates to reflect local real estate market conditions, the central bank said.

“We should ensure the effective implementation of regional differential housing credit policy, keep individual mortgage rates basically stable and safeguard the legitimate rights and interests of both borrowers and lenders,” it added.

Under the new rules mortgage loans signed before 8 October will be implemented according to original contracts, according to the statement.

Pumping Cash into the Economy

“Defining the lower limit of mortgage interest rates reflects the structural characteristics of the monetary policy and can more effectively guide the flow of credit resources to the real economy,” said Fan Ruoying, a researcher at the Bank of China’s Institute of International Finance, told the local media.

China still needs to reduce loan rates for brick-and-mortar companies, Fan added. The research noted that high home prices have led to higher homeowner leverage ratios in China and added to the fragility of the country’s financial system, raising concern among policy-makers over accelerating cash flows into the property market.

Since 2016 China’s central government has continually ratcheted up measures to reduce speculative investment in the housing market over fears that rising prices might one day lead to a crash that would set back the broader economy.

LPR System Could Lead to Cheaper Lending

China’s new LPR system, as a market-based alternative to China’s benchmark lending rates, base interest rates on levels that a handful of the country’s large commercial banks charge their most creditworthy borrowers.

Under the new system, banks will submit their prices in terms of basis points added to the interest rates on funding they receive from the central bank in the open market to form an LPR, representing a shift away from the current practice of referring to the more expensive one-year benchmark lending rate. The reform was considered as a milestone in loosening state control of the economy.

According to the LPRs released last week, this latest adjustment of the interest rate mechanism could bring new mortgage loan rates lower than current floors, according to calculations by the Wall Street Journal based on official data.

Economists have widely estimated that the LPRs will trend down in coming months as the government moves to stimulate borrowing amid a domestic slowdown and re-escalating trade conflict with the US, the paper said.

Beijing Maintains Housing Price Clampdown

Analysts read the latest move as further indication that Beijing is concerned that China’s already high home prices would surge higher if borrowing rates were lowered.

Earlier in August, the China Banking and Insurance Regulatory Commission (CBIRC) issued a circular outlining plans for a targeted inspection in 32 cities including Beijing, Shanghai and Shenzhen, to ensure that banks are lending according to official guidelines for mortgages and loans to developers.

In June of 2018 China’s Ministry of Housing and Urban-Rural Development began an inspection tour of the country’s major cities which led to to tighter enforcement of home purchase restrictions on the mainland, as the government continues to push its policy that homes are for shelter rather than for speculative investment.

Leave a Reply