China led all markets in Asia Pacific for real estate investment levels in 2013 with US$358 billion being spent on land acquisition and development during the year, according to a new study released by real estate consultancy Cushman & Wakefield.

In its report, Investment MarketBeat 2013, the US-based firm found that a record US$487 billion was invested in the real estate sector in the APAC region during last year. Real estate investments (including private equity, corporate transactions, institutional, land, etc.) in 2013 witnessed an increase of approximately 13% over last year, essentially driven by development land sales in China’s secondary cities.

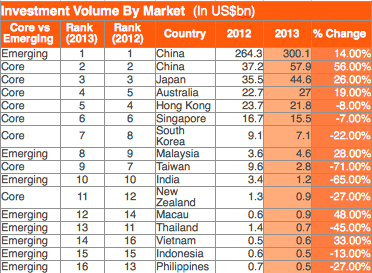

Of the countries surveyed, China recorded the highest volume of investments at US$358bn, followed by Japan which saw US$44.6 invested in its property sector during 2013.

Expenditures on land, which the report refers to as Development Sites, saw an increase of over 17%in 2013, and was the sector that received the most investment across the region with a total of US$372.2bn being invested in this asset class in 2013.

Office assets, which received a total of approximately US$56.9bn in investment, accounted for a 17% share of the total investments across the region.

Industrial assets witnessed the highest percentage increase in investments (21%) among the various asset classes in 2013, recording a total of US$14.4bn, while residential, hotel and retail all recorded negative growth in investment volume, with retail witnessing the highest drop of -23% over 2012.

Sigrid Zialcita, Managing Director of Research, Asia Pacific, at Cushman & Wakefield said: “The pace of land bank accumulation, which saw a fantastic rise in 2013, is not likely to be sustained. The abnormal rise in land accumulation was because of higher supply as well as robust sales for residential projects. However, developers have grown more discerning in land bids due to tightening liquidity and the increase in holding and resale costs.”

China the Leading Investment Destination

China remained the hotspot for investments with volumes of over US$358bn invested in the market. Emerging markets in China (all markets excluding Shanghai & Beijing) constituted 61% of the total investments made across APAC in 2013 and had an investment volume US$300bn.

China’s core markets of Beijing and Shanghai saw a rise in investment volumes of over 50% to US$57 billion.

Japan came in the third place with investments of US$44.6 billion, while Australia emerged as the fourth-highest investment market with total investment volume of US$27 billion.

Leave a Reply