China’s MOHURD chief Wang Menghui says policies remain steady

Home price growth in China declined to its slowest place in nearly a year during the first two months of 2019, according to official government statistics released on Friday, as purchase restrictions put in place last year continued to dampen the residential sector.

Average home price increases in 70 cities surveyed by China’s National Bureau of Statistics declined to 0.5 percent in February, from 0.6 percent in January, as growth of housing sales dropped by more than nine percentage points compared to February 2018.

The decline in housing activity, coupled with a slowdown in China’s broader economy, is seen by some analysts as having already led to gradual loosening of home purchase restrictions, at the same time that financial regulators release liquidity and spark new real estate investment.

Home Prices Still Up Over 10% Since 2018

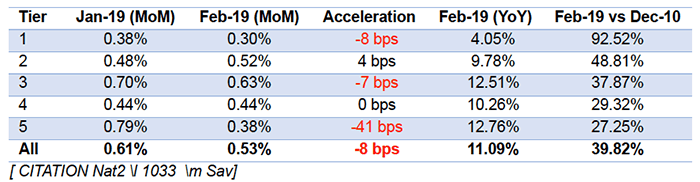

Price growth was slowest in China’s top tier cities, where officials have clamped down on the market most tightly in an attempt to squelch home price inflation. Excluding subsidised housing, increases in the prices of new homes in Bejing, Shanghai, Guangzhou and Shenzhen averaged 0.3 percent in February – down from 0.4 percent growth in January.

In tier two cities, the cost of a new home rose by an average of 0.7 percent in February, while third tier city prices climbed by 0.4 percent.

Despite the slowing rate of growth compared to the previous month, across the 70 cities included in the survey, home prices were still up 10.4 percent in February compared to the same month in 2018.

Policies Loosen in 2018

The incremental slowdown in prices, and the slackening pace of sales, is leading some cities around the country to find ways to spark new home activity with some cities already lowering mortgage rates.

“Local authorities, feeling that price growth has now come under control and wanting to encourage transaction volumes in support of local market and cash-strapped developers, are selectively loosening some of the more stringent restrictions while banks are starting to reduce the cost of financing in selective cities,” analysts at Savills said in a statement reviewing the latest government data.

First-hand residential price movement by city tier. Source: Savills, NBS

“This should provide some support to a market that has been relatively downbeat for the last six-plus months, with the hope of engineering a soft landing,” the consultancy’s research team added.

Banks in Shenzhen have begun reducing interest rates on home loans this month, with average mortgage rates for first-time buyers now at 5.46 percent compared to 5.57 percent a month ago. Already a number of smaller cities are following Shenzhen’s lead by bringing down borrowing rates in an attempt to boost housing sales and take pressure off of financially stretched developers.

Official Line Unchanged

Despite the moves to juice the market, China’s top officials have said that policies, including the government drive to stamp out housing speculation, remain steady.

At official party meetings in Beijing this month, China’s Minister of Housing and Urban-Rural Development Wang Menghui proclaimed that the Xi government’s line of “homes are for living and not for flipping” is still a top priority.

Wang also emphasised the government’s determination to stabilise land prices, home prices and market expectations, while underlining the importance of developing a rental housing market, according to local media accounts.

Cities Expand Buyer Pool, Reduce Levies

Since the lunar new year holiday last month, however, at least 20 mainland cities have taken steps to tweak policies to increase access to credit, expand the pool of eligible home buyers or otherwise enhance market activity.

The cities of Haikou, Guangzhou, Xi’an, Dalian and Changzhou have all introduced “talent recruitment” measures that make it easier for newcomers to the cities to purchase homes under conditions previously available only to long-standing residents.

There have also been changes to taxation rules at the city level with the Guangdong city of Dongguan this month introducing new guidelines that make it possible to reduce levies on second-hand home sales.

Leave a Reply