Grade A office rents in Tokyo climbed for a fifth straight quarter

The average office vacancy rate in Tokyo’s central five wards eased to 5.4 percent in March from 6.2 percent six months earlier, dropping below 6 percent for the first time in three years, according to DWS.

Average vacancy for newly constructed buildings fell from 42.7 percent to 23.7 percent during the same period, the German fund manager said in its Japan Real Estate Market Outlook Report. The tightening was driven in part by foreign firms relocating to newly opened buildings in Minato as IT and entertainment companies actively expanded in Shibuya.

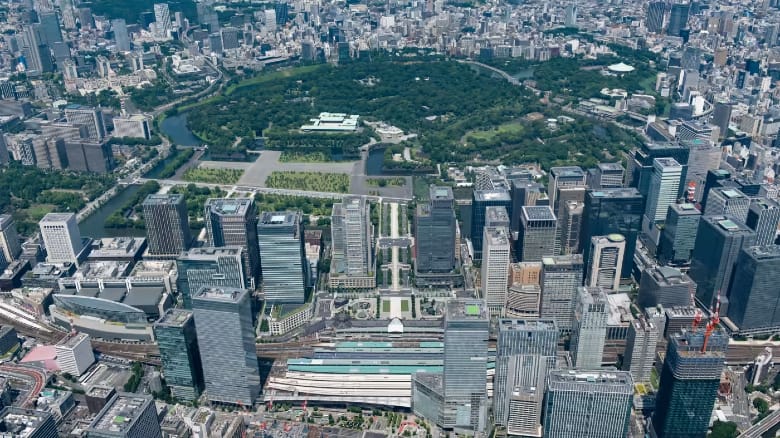

Rents for prime office space in the Marunouchi business district and new Grade A offices throughout the Japanese capital continued their modest growth for a fifth straight quarter.

“Tokyo’s office vacancy rate is expected to remain elevated in the foreseeable future due to the large incoming office supply,” said the report authored by DWS head of Japan real estate Koichiro Obu and analyst Hyunwoo Kim.

J-REITs Move Market

In the capital market, Tokyo’s commercial real estate transactions totalled $22.7 billion in 2023, down 3 percent from the previous year, DWS said.

Koichiro Obu, head of Japan real estate at DWS

Some 22 percent of Tokyo transactions were acquisitions by J-REITs, while cross-border capital contributed to 16 percent of deals. The office sector continued to dominate, accounting for 48 percent of transaction volume, even as the reading fell below the 50 percent mark for the first time in the last 14 years, according to the report.

The largest deal tracked by DWS in the six months from October was Yodobashi Camera’s JPY 300 billion ($1.9 billion) acquisition of the land beneath department store chain Sogo & Seibu’s Seibu Ikebukuro location from Fortress Investment Group.

US private equity firm Fortress bought Sogo & Seibu from Japanese retailer Seven & i Holdings last September. Proceeds from the land sale in Tokyo’s Toshima ward are to be used to help pay off Sogo & Seibu’s debt, the Japan News reported.

Hospitality Stays Hot

Hotel occupancy rates in Tokyo and Osaka steadily improved throughout 2023, DWS said. In the first quarter of this year, Tokyo’s budget hotels achieved an 85 percent occupancy rate, closing in on their previous peak of 87 percent during the fourth quarter of 2018.

“Despite the slower recovery of Chinese tourist arrivals to Japan, the entire Japanese hospitality market experienced significant growth,” the report said. “Tourist arrivals from neighbouring Asian countries and the United States contributed to this rebound, along with increased accommodation spending driven by a weaker yen.”

Average room rates for select key hotels in Japan during the first quarter of 2024 surpassed pre-pandemic levels by as much as 35 percent, according to Nikkei calculations cited by DWS. An even stronger recovery is anticipated in the coming quarters, supported by improvements in international air connectivity and limited future hotel supply, the German firm said.

The red-hot hospitality market drew the attention of global investors last year, led by the $900 million acquisition of 27 resort hotels by a consortium of Singapore’s SC Capital Partners, Goldman Sachs Asset Management and the Abu Dhabi Investment Authority.

Leave a Reply