ESR and GIC’s $2.9B acquisition of the Milestone logistics portfolio helped drive industrial deal volume

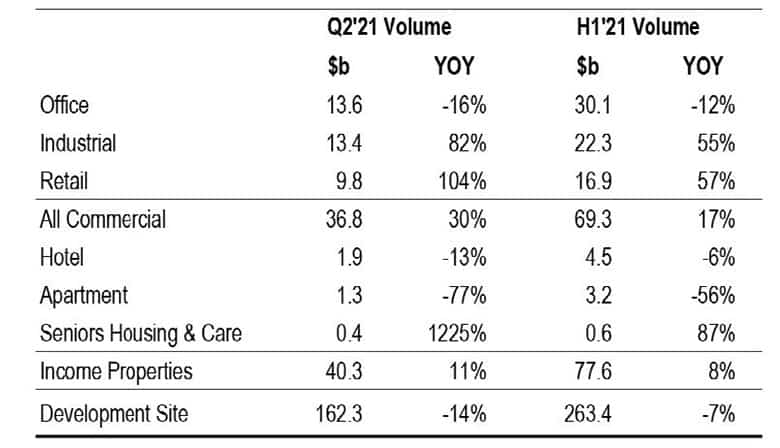

Transactions of warehouses, data centres and other industrial property assets in Asia Pacific’s key markets jumped 82 percent year-on-year in the second quarter of 2021 to a new high of $13.4 billion, within striking distance of the $13.6 billion in office deals in the same period, according to Real Capital Analytics.

In its Asia Pacific Capital Trends report released last week, the property information provider said the margin of $200 million between the two sectors was the narrowest on record, while industrial yields have fallen sharply in the past year to sit firmly in line with office cap rates.

“The industrial sector continued to smash all sorts of records, with a new quarterly high of $13.4 billion, making it only the third time that the $10 billion mark was broken,” RCA analysts said in the report. “The strength of investor appetite for industrial assets was well on display, as volumes grew by substantial margins across each of the major APAC economies.”

The upswing in industrial transactions during the quarter was led by an ESR-GIC joint venture paying $2.9 billion to purchase the Milestone logistics portfolio from Blackstone in a deal signed during April. PGIM, Manulife and M&G also signed major logistics deals, with data centre acquisitions, which also count under industrial for RCA’s survey, also reaching new heights.

Office Deals Still Lag

Compared with the preceding three-month period, investment volume rose across all property segments in Asia Pacific for a third straight quarter during the period from April to June to reach $40.3 billion, according to RCA’s numbers.

David Green-Morgan of RCA

That number was up 11 percent from last year’s comparable period during the peak of the COVID-19 crisis. Total activity in the first half of 2021 climbed 8 percent year-on-year to $77.6 billion.

“The recovery in Asia Pacific’s real estate investment market extended to nearly all the major countries, except for Japan,” said David Green-Morgan, RCA’s managing director for APAC. “While the magnitude of transaction volume growth may seem modest, it is worth remembering that activity did not plummet in the Asia Pacific region, as seen elsewhere in the world in 2020.”

Source: Real Capital Analytics

Despite the quarterly progress, office deals from April to June totalled just $13.6 billion, or 16 percent less than the quantity closed during the same period in 2020. For the first half of 2021, office transactions came to $30.1 billion, down 12 percent from the first six months of last year.

Office transactions for the first half of 2021 amounted to 40 percent less than the total recorded during the same period two years ago.

Retail investments during the second quarter reached $9.8 billion, which was more than double the amount recorded a year earlier.

Sheds Stack Up

In addition to the boost it received from the Milestone transaction, the industrial sector saw deal volumes rise thanks to logistics and data centre investments by major fund managers and developers.

The largest deal for a single industrial asset during the second quarter was GLP’s $942 million purchase of the GLP Songjiang Internet Data Centre in Shanghai from Zhejiang Century Huatong Group, with Beijing-based GDS contributing the second-largest industrial deal for a single property with its purchase of the GDS BJ15 Data Center from CITIC Group for $587 million.

Portfolio deals helped drive the totals as well, with Blackstone’s $767 million acquisition of Soilbuilt REIT’s Singapore assets and its $705 million buy of India’s Embassy Industrial Parks from a Warburg Pincus-Embassy Group joint venture pushing volumes upward.

Average investment yields for industrial assets across Asia Pacific’s major markets have fallen between 75 and 100 basis points over the past 12 to 18 months, RCA said, noting that the decline in cap rates has brought returns for logistics, manufacturing and data centre assets to levels on a par with office properties.

Leave a Reply