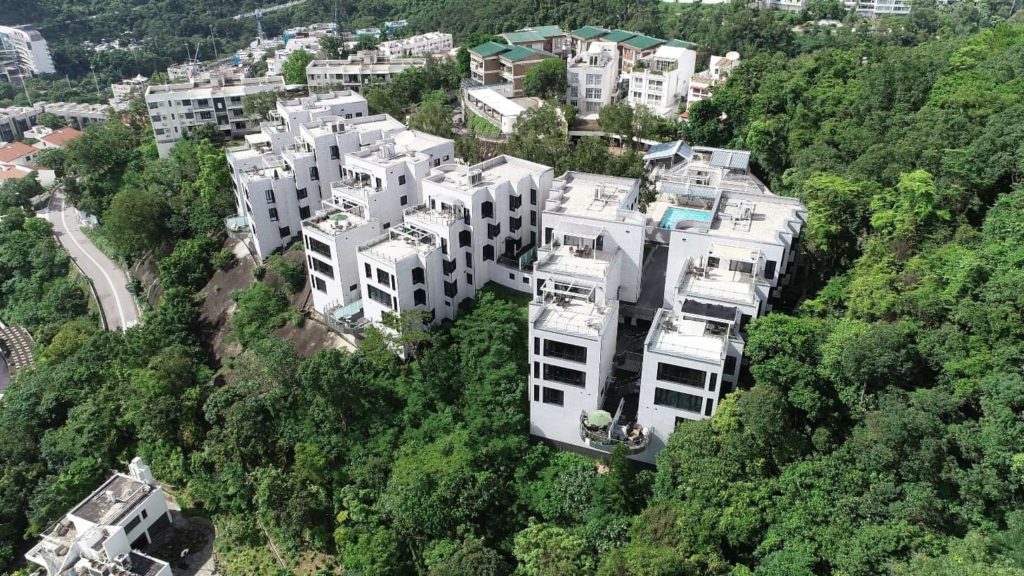

The US government is seeking a buyer for the site at 37 Shouson Hill Road

Amidst growing friction with Chinese authorities, the US Department of State has put up for sale a residential site in one of Hong Kong’s most exclusive enclaves, and it could be set to sell for nearly a quarter less than a neighbouring project fetched two years ago.

CBRE, which has been engaged to market the luxury project, is predicting that mainland developers could be among the leading bidders, while local developers such as Wheelock Properties are also expected to put up a fight for the 94,796 square foot (8,807 square metre) site atop Shouson Hill.

“This is a rare investment opportunity and we expect strong interest from local and mainland Chinese developers,” said Andy Wong, CBRE’s senior director of capital markets in Hong Kong.

With Hong Kong’s residential market slowing over the past year, Vincorn Consulting managing director Vincent Cheung, expects bids for 37 Shouson Hill Road to range from HK$3.1 billion ($400 million) to HK$3.5 billion.

Central government-controlled China Resources Land purchased a neighbouring site in 2018, which has fuelled speculation in some quarters that the Shenzhen-based developer may be eyeing the property used as housing for US consulate staff as a possible bolt-on for a much bigger development.

High End Property Faces Dim Sentiment

Representatives of CBRE pointed to both market forces and the particular virtues of the south-side site in predicting demand for the property, which occupies a 94,796 square foot plot.

CBRE’s Andy Wong is predicting strong interest from local and mainland Chinese developers

“Supply of luxury residential land on Hong Kong island has been scarce, especially sites of close to 100,000 square foot,” said CBRE’s Wong, who added that the site overlooking Deep Water Bay, “ticks all boxes in terms of view, layout and privacy”.

Despite Shouson Hill having attracted some of Hong Kong’s wealthiest residents — Li Ka-shing owns a home there — the lower range of analyst predictions would value the site at HK$65,404 per square foot of finished space, should a buyer decide to redevelop the plot.

Should a buyer secure the site for that low range price, it would mark a nearly 24 percent discount from the HK$85,847 per square foot that China Resources Land paid to two years ago to acquire the adjacent site from the family of Sir Shouson Chow, a Chinese business leader from the colonial era for whom the hill is named.

US authorities have decided to put the plot on the market as part of an ongoing global reinvestment program, according to a US state department spokesperson cited in Bloomberg, however, the divestment effort could face challenges during the current environment.

The luxury residential market in Hong Kong has come to a near standstill in the wake of the COVID-19 pandemic, according to a recent report from UK property brokerage Savills.

Luxury rents have fallen around ten percent across Hong Kong Island since the first quarter of 2019, while transaction volumes slid by 44 percent over the same period. The London-based firm attributed the shift in part to a drop in demand from mainland investors.

During the first three months of 2020, residential investment and leasing deals involving buyers or tenants from the mainland fell by around 80 percent compared to the same period last year, the consultancy said. Transactions involving expatriates have also slid from last year Savills noted, as the US-China trade war, ongoing social unrest and, more recently, the COVID-19 pandemic, have plagued Asia’s most expensive real estate market.

Development Restrictions Apply

Also, dampening the project’s appeal are a number of development restrictions in the property’s current planning permits which dictate that, under its current approvals, construction at 37 Shouson Hill Road can reach no higher than three storeys and cover no more than 25 percent of the site area.

Under the paperwork in place, according to marketing documents seen by Mingtiandi, the site can yield up to 47,397 square feet of gross floor area, although buyers could apply to ease the development restrictions, including bringing the plot ratio up to the area’s current standard of 0.75.

Receiving such approval would be subject to a review process, however, and would also involve payment of additional fees to the government, both of which represent potential barriers to a sale.

State Department Slims Down

The six existing homes which make up the compound were completed in 1983 by the US government after it had originally purchased the site in 1948 for staff housing.

Should the sale succeed, it would mark a reduction of at least 30 percent in the State Department’s luxury residential holdings in Hong Kong, which are currently valued at around HK$10 billion, according to figures cited by local newspaper Sing Tao.

The most valuable of the assets in this portfolio, besides 37 Shouson Hill, is the Consul General’s residence at 3 Barker Road on Victoria Peak. Said to have a value of around HK$3 billion, the property sits on a 51,000 square foot site.

The US government’s collection of luxury Hong Kong properties also includes 13 residential units at 12-14 Macdonnell Road in the Mid-levels, valued at a combined HK$650 million, as well as a four bedroom house at Grenville House on Magazine Gap Road, also in the Mid-levels, valued at HK$140 million.

Research for this story was provided by Diana Li.

Leave a Reply