At least one international company is willing to bet that the eye of China’s real estate storm is the centre of opportunity as Singapore’s Mapletree last week acquired a site in the troubled city of Ningbo for RMB 1.04 billion (US$166 million).

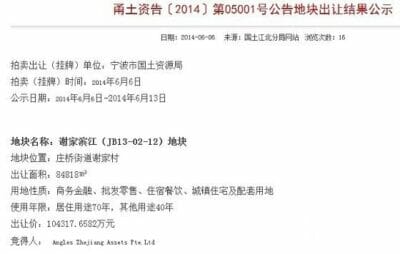

The Singapore-based real estate developer and investor bought the 84,818 square metre location in Ningbo’s Jiangbei district for RMB 20 per square metre over the RMB 5000 per square metre floor price for the auction at a time when news about Ningbo’s once-booming property market is largely negative. The planning guidelines for the plot allow for up to 207,800 square metres of floor area to be developed.

In March this year the city across Hangzhou Bay from Shanghai in eastern China’s Zhejiang province made it into the international news when Zhejiang Xingrun Real Estate kicked off China’s current credit crunch by collapsing under the weight of RMB 3.5 billion in debts. And just last week little known developer Ningbo Futian Properties was acquired by a local competitor after it failed to record any sales during the first four months of this year.

The mixed-use site, which was acquired through Mapletree subsidiary Angles Zhejiang Assets Pte.Ltd is planned to allow for retail, office, hotel and residential uses and is located just north of an existing Wanda Plaza shopping centre by local developer Dalian Wanda.

Second Major Greater China Deal for Mapletree in 2014

The Ningbo acquisition by Mapletree marked the second time that the government-backed Singaporean company has picked up a major property in Greater China this year. During January, Mapletree – which began its history as an industrial developer– set new records for land prices in Hong Kong’s Kowloon district with its purchase of a commercial site for HK$3.77 billion (US$486 million).

During early September Mapletree Investments added US$1.4 billion to the private equity funds competing for China real estate assets when it announced the closing of its Mapletree China Opportunity Fund II. The investment vehicle for last week’s Ningbo purchase was not immediately clear.

According to information from the company China and Hong Kong account for 29 percent of Mapletree’s total real estate portfolio, amounting to approximately US$45.5 billion in assets. As of 2013 the group had projects in Shanghai, Beijing, Guangzhou, Foshan, Tianjin, Wuxi, Xi’an, Zhengzhou and Hong Kong across a wide spectrum of real estate sectors.

The deal for the 84,818 square metre location actually was the second time that a Singaporean developer has taken on a major project in Ningbo this year after the China branch of Mapletree’s hometown competitor CapitaLand acquired a residential site in the port city for US$181.45 million.

Leave a Reply