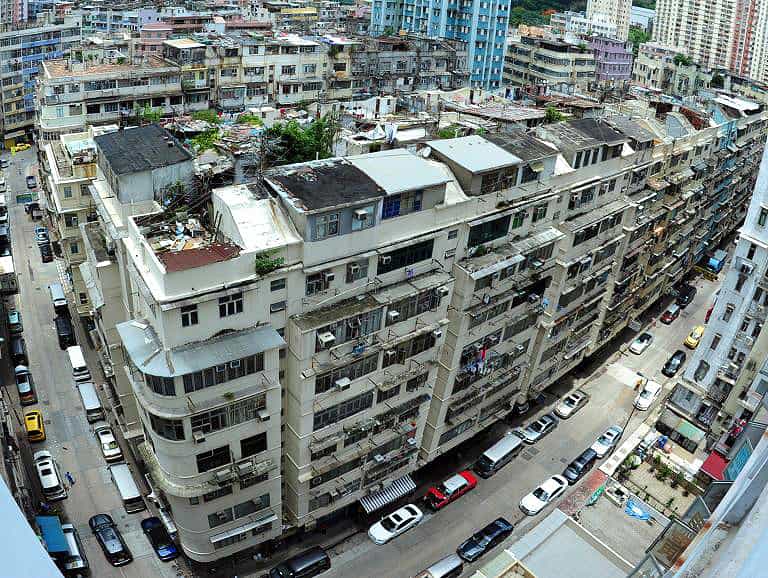

Kerry picked up the URA project on Hung Fook and Ngan Hon Street in To Kwa Wan

Hong Kong’s To Kwa Wan further cemented its position as a development hotbed this month, with Kerry Properties winning a tender for an Urban Renewal Authority redevelopment project in the Kowloon neighbourhood for HK$5.58 billion ($716.1 million), according to an announcement on the URA website on Thursday.

The developer controlled by the Kwok family of Shangri-La Hotels fame shouldered aside seven competing bids to win the rights to build up to 443,785.2 square feet (41,229 square metres) of new homes and retail space by offering to pay the equivalent of about HK$12,591 per square foot of new construction area for the project at 1-51 Hung Fook Street and 2-42A Ngan Hon Street in the area just west of Kai Tak.

Upon its expected completion in 2025 or 2026, the mixed-use project is expected to provide as many as 750 residential units in an area that is benefiting from the extension of Hong Kong’s metro rail network. The project, including the retail portion, is estimated to have an investment value of around HK$8.3 billion, said Alex Leung, senior director at local surveying firm CHFT Advisory and Appraisal Limited.

The developer’s To Kwa Wan development, which is only its second URA project in 16 years, comes as prices for mass market homes in Hong Kong are predicted to grow as much as 5 percent in the upcoming year, after having risen by 4.4 percent in 2021, according to a JLL property market forecast published this month.

Kerry Enters To Kwa Wan

Kerry Properties’ winning bid, which bested offers from developers including CK Asset and Henderson Land Development, fell within market expectations of between HK$4.7 billion and HK$6.0 billion for the 49,309.4 square foot site opposite Ko Shan Road Park, according to Leung.

Kerry’s Robert Kuok

The developer controlled by the family of Shangri-La Hotels founder Robert Kwok, together with the URA will develop about 73,657 square feet of retail on the site, with the remaining 370,128 square feet available for residential development, according to the URA’s proposed redevelopment plan.

Upon completion, Leung predicted that the 750 residential units could sell for more than HK$27,000 per square foot each, which would be slightly higher than the average selling prices of neighbouring second-hand properties, such as The Vantage on Ma Tau Wai Road, at over HK$22,000 per square foot based on saleable area.

“The Hung Fook Street and Ngan Hon Street Development marks another major collaboration of Kerry Properties with URA,” said Calvin Tong, general manager at Kerry Properties Hong Kong. “Our joint development in 2005 brought an upscale residential project, Island Crest, to Sai Ying Pun which was undergoing renewal at that time.”

“Other than a small portion of about 500 square feet to be kept by the URA, the retail portion will be jointly operated by Kerry Properties and URA at interest shares of 70 percent and 30 percent respectively,” said CHFT’s Leung. “The developer, Kerry, is restricted to sell the retail portion within the first 10 years, and afterward, [the arrangement] would be subject to further agreement with the URA.”

Growing Hong Kong Pipeline

The Kowloon site purchase is the latest move by Kerry Properties to replenish its development pipeline in Hong Kong, with its To Kwa Wan acquisition coming just four months after it was reported to have spent nearly HK$500 million for 17 agricultural sites in the Kwu Tung area in the New Territories with part of that expanse to be converted for residential purposes.

In July, the developer had picked another spot in the New Territories with its announcement of the acquisition of a 50 percent equity interest in two land parcels in Yuen Long from Top Spring International Holdings Limited for about HK$310 million.

Kerry Properties, which in the first half of the year saw its profit attributable to shareholders jump by 251 percent to HK$3.77 billion, from HK$1.07 billion in the same period last year, is expanding in Kowloon with what local reports have indicated is its first To Kwa Wan development project.

With the extension of the Tuen Ma MTR line, which is part of the Shatin to Central link, To Kwa Wan is becoming a popular area for redevelopment and the district is currently home to 11 projects being redeveloped by the city’s Urban Renewal Authority.

A completed section of the Tuen Ma line, which stretches nearly 13 kilometres (8 miles) from Tai Wai in the New Territories to Hung Hom in Kowloon, was opened for service in June after a 2-year delay.

In September, Henderson Land acquired its own in To Kwa Wan URA project, as it won a site along Ma Tau Wei Road for HK$8.1 billion. Earlier that same month, Hong Kong-listed Grand Ming Group had acquired a housing project at 41-45 Pau Chung Street in To Kwa Wan for HK$320 million.

Leave a Reply