The latest Wong Chuk Hang site is expected to fetch HK$36 billion

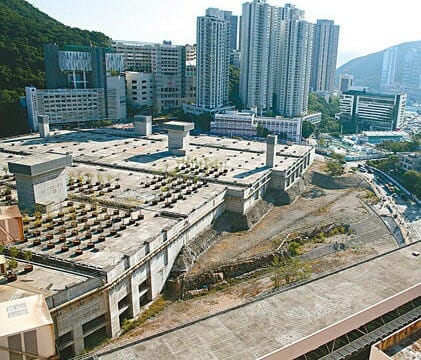

A mixed-use plot atop MTR Corporation’s Wong Chuk Hang station said to be worth up to HK$36 billion ($4.6 billion) has generated 36 expressions of interest from developers including Sun Hung Kai Properties, CK Asset and New World Development.

The love-fest for the 1,200 home South Island site comes despite words of warning from analysts over how an imminent vacancy tax plan on unsold new flats might put a downward pressure on the land parcel’s valuation.

The site is the third phase in a series of sites put up for sale in the former factory hub by MTR Corp after the parent company of Hong Kong’s mass transit operator sold an adjacent 600 home site to Kerry Properties and Sino Land last December.

South Island Project Slated to Complete in 2024

The residential and retail site, named Wong Chuk Hang Station Package Three Property Development, is located four subway stops from Central in a rapidly gentrifying former industrial area. The project can yield approximately 1.5 million square feet (139,900 square metres) of floor area, of which 1 million square feet of space is for residential development and the remainder for retail space. The complex’ maximum 1,200 units would be developed in four blocks which are slated to complete in 2024.

The MTR confirmed to Mingtiandi that a total of 36 expressions of interests were received including pitches from local champions including Henderson Land, in addition to SHK, CK Asset and New World. Contenders from north of the border also expressed interest in the site including China Overseas Land & Investment and Country Garden, according to local media accounts.

After screening the various entrants, MTR will invite shortlisted developers to a tender for the project.

Site to Fetch as Much as HK$36B

The plot is valued at anywhere from HK$31.6 billion to HK$36.1 billion, according to Thomas Lam, Senior Director at Knight Frank.

“In the long run, large scale residential land supply near MTR stations is limited. This project, sitting atop of an MTR station, thus has more advantages,” said Lam in an exchange with Mingtiandi. “As new MTR projects have been very popular among buyers in recent years and developers’ confidence in market outlook, the project will attract developers, especially those with existing developments in the area.”

Depending on the final terms of the tender, potential developers of the project might be required to return the shopping centre to MTR and share profits generated from the mall, Lam added. Lam expects the residential units to be luxury homes priced at HK$35,000 per square foot.

Vacancy Tax Making Developers Cautious

Vincent Cheung, Deputy Managing Director at Colliers International

Despite the site’s convenient location atop a subway station, analysts suggest that the impending introduction of the vacancy tax might prompt developers to be more cautious when making bids.

“The introduction of a vacancy tax will more or less affect developers’ decisions when making bids, given that the project will have 1,200 units, which are quite a lot,” said Vincent Cheung, Deputy Managing Director at Colliers International in a phone interview with Mingtiandi. “Developers will definitely factor in the risks of unsold flats when determining the amount of bids.”

Cheung estimates the value of the entire plot at HK$22 billion and the residential section at HK$15 billion.

The Executive Council has approved the introduction of a vacancy tax on unsold new flats, according to a South China Morning Post account citing sources familiar with the matter. While more details on the plan are expected to be released on Friday, the tax will likely to be levied on new homes that have been left unsold for over a year for twice a flat’s rateable value.

Leave a Reply