The BT Center (right) sits adjacent to World Trade Square on Wong Chuk Hang Road

Once known for its decaying workshops, the Wong Chuk Hang area in southern Hong Kong is gaining popularity as a commercial hub with developers rushing to turn its one-time factory space into hotels, offices and retail space.

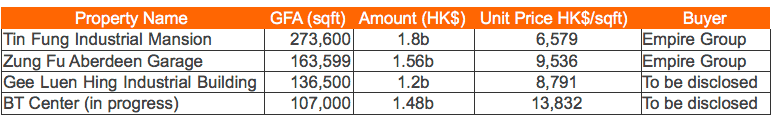

The opening of the city’s South Island MTR line in December last year has led to a boom in the area across the island from Central, with the BT Center, a 15-storey commercial building situated at 23 Wong Chuk Hang Road, said to have recently sold for HK$1.48b ($189 million) to Hong Kong-listed developer and investor Rykadan Capital, according to a report in Hong Kong’s Apple Daily.

The reported deal works out to HK$13,800 per square foot, is said to be close to the seller’s expected selling price for the 107,000 square foot property, according to an account in the Hong Kong Economic Times. The seller of the property is David Chan Ting Chuen, who formerly served as chairman of Hong Kong-listed Symphony Holdings. If confirmed, the sale of the BT Center would mark the fourth sale of an industrial project for over HK$1 billion this year.

Industrial Buildings in Demand for Commercial Projects

The impending sale of the BT Center, which was approved for commercial use in 2015, is part of a trend towards repurposing former industrial buildings in Hong Kong, which has been growing as office rents and property values rise.

The impending sale of the BT Center, which was approved for commercial use in 2015, is part of a trend towards repurposing former industrial buildings in Hong Kong, which has been growing as office rents and property values rise.

The Hong Kong government allows property owners to apply for repurposing their structures, with the owners of the BT Center having paid a land premium of HK$10.5 million to have their asset reclassified.

Earlier this year an 87 percent stake in the Tin Fung Industrial Mansion at 63 Wong Chuk Hang Road was sold to Walter Kwok Ping-sheung’s Empire Group for HK$1.8 billion. In March of 2017 the developer controlled by the former Sun Hung Kai chairman paid HK$1.56 billion for the Zung Fu Aberdeen Garage at 36 Wong Chuk Hang Road in a deal that marked the highest per unit price for any industrial property ever in Hong Kong.

Also this year, the Gee Luen Hing Industrial Building in Wong Chuk Hang was sold to an undisclosd buyer for HK$1.2b transaction.

Former Fit-Out Firm Takes on Commercial Project

William Chan of Rykadan Capital

The Wong Chuk Hang project is the second commercial real estate venture in Hong Kong for Rykadan Capital, which was formerly known as Sundart International.

When it originally listed on the Hong Kong exchange in 2009, the company specialised in fit-out work for residential property, as well as hotels. After changing its name to Rykadan Capital in 2012, the company, which is chaired by William Chan, began branching out into development projects, as well as investing in other developers and their projects.

Rykadan bought its first residential site on Kwun Chung Street in Tsim Sha Tsui in 2012, and launched the Paseo micro-apartment project there in 2015. Since that time the company has invested in two more residential projects in Hong Kong. At one time the company had been the majority shareholder in Kailong REI and through that firm developed the Rykadan Capital Tower in Kowloon’s Kwun Tong area, after first purchasing the site in 2012.

Chan’s company has also invested in Kailong projects in Shanghai, as well as being involved in real estate investments in the US, the UK and Bhutan.

Providing Affordable Office Space for Smaller Firms

After the South Island line opened, Wong Chuk Hang’s less than half-hour connection time to Central began catching the attention of commercial occupiers not ready to take on the world’s highest office rents in Hong Kong’s traditional downtown.

Speaking of the appeal of the commercial projects common in the former industrial area, Cynthia Li, of property consultancy JLL’s Hong Kong Capital Markets team noted in a recent report that, “Medium-sized advertising, trading and technology companies can easily take up a whole floor.” She added that, “These spaces are also attractive for insurance companies and banks looking for back offices, as they provide rare opportunities to secure a whole block and the associated naming rights.”

Leave a Reply