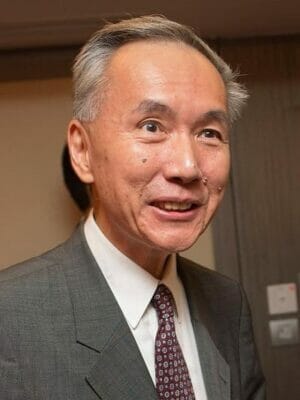

Singaporean Chee Siong (Robert) Ng, chairman of Sino Land, is selling off a Chengdu project

Sino Land became the latest Hong Kong developer to unload a mainland project by selling off 80 percent of a residential-led development in the southwestern China city of Chengdu to a Shenzhen-listed developer for HK$10.51 billion ($1.34 billion).

Shenzhen Overseas Chinese Town is buying the majority stake in The Palazzo, a 244,359 square metre project in the capital of Sichuan province, while Sino Land will retain 20 percent of the project, according to a Thursday filing to the Hong Kong stock exchange by the Hong Kong developer.

The stake sale makes Sino Land the latest Hong Kong builder to sell off a mainland project to a mainland competitor, as foreign firms struggle to deal with the policy and currency risks of building housing on the mainland.

Sino Land Gets a Chengdu Project off Its Hands

Sino Land, which is chaired by Singaporean Chee Siong (Robert) Ng, indicated that it is selling down its stake in the mega-project in a bid to strengthen its balance sheet.

“The Disposal enables the Group to realize cash and unlock the value in its investment in the Project at fair market value,” Sino Land stated in the filing. “All the net proceeds to be received by the Vendor from the Disposal will be applied towards the working capital requirements of the Group.”

Sino Land bought the Palazzo site in Chengdu in July 2007

The site, which Sino Land acquired at a land auction in July 2007, is located at 9 Second Yufeng Road in Chengdu’s Chenghua district and combines two separate parcels of land.

Scheduled for full completion by 2023, the 1.24 million square metre integrated complex will include 11,300 residential units, covering 1.12 million square metres of space, along with a smaller amount of commercial space for grade A offices, a hotel and a shopping mall.

In its 2016 annual report released this past July, Sino Land said that 3,700 residential units in the project had been launched for sale since September 2013 and that about 69 percent of those units had been sold. The hotel is expected to be completed by the end of 2019 with operations commencing the following year.

The project is being scooped up by a subsidiary of Shenzhen Overseas Chinese Town, a Shenzhen-listed property and hospitality firm, which opened mainland China’s first theme park in 1989. Since then, the state-owned company has expanded across the country from its home base in Shenzhen, bringing its Happy Valley theme park chain to Chengdu in 2009.

Shui On Leads Parade of Hong Kong Builders Selling Mainland Projects

Sino Land joins a growing list of Hong Kong developers that have sold off projects to mainland rivals in recent years. Most recently, Hong Kong-listed Shui On Land sold a portfolio of projects forming its Chongqing Tiandi complex to Shenzhen-based developer China Vanke for RMB 4.1 billion ($598 million) in May. Shui On, best known for opening the Xintiandi commercial complex in Shanghai, disposed of a nearly 80 percent stake in the 1.26 million square metre portfolio in the city in southwest China.

Shui On was also reported to have signed a memorandum of understanding to sell its Ruihong Xincheng mixed-use project in Shanghai to Vanke for about RMB 8 billion ($1.16 million) this past March. In May, Shui On was reportedly still seeking a buyer for the 1.74 million square metre, residential-commercial project.

In 2016, the developer sold its Lingnan Tiandi project in Foshan to China’s Country Garden for RMB 1.73 billion ($267 million), declaring a loss of approximately RMB 90 million ($13.9 million).

New World, Chinese Estates Also Selling in China

Hong Kong’s New World Group and Chow Tai Fook Enterprises, both controlled by tycoon Cheng Yu-tung, sold off seven mainland projects to China’s Evergrande Real Estate for RMB 20.4 billion ($3.15 billion) in 2015.

In October of that same year, Chinese giant Evergrande Real Estate spent HK$7 billion ($903 million) to buy a 205,000 square metre project in Chongqing from three Hong Kong developers, including Joseph Lau’s Chinese Estates.

State-owned developers in China often have an edge over their Hong Kong competitors on mainland projects in obtaining financing for construction projects, especially as the Hong Kong Monetary Authority clamps down on bank loans to property developers to curb risks in the local market.

Moreover, a weakening Chinese renminbi squeezes returns for Hong Kong developers building mainland projects, when they convert their yuan-denominated profits into greenback-pegged Hong Kong dollars. The yuan has depreciated against the dollar by over seven percent from its January 2014 level, despite rallying since the beginning of this year.

Leave a Reply