Tang and Co plan to redevelop Maxwell House into a mixed-use project

A pair of Singapore-listed firms controlled by a mysterious mainland investor with links to the younger brother of former US president George W Bush has teamed with a Hong Kong construction firm to win a tender for a mixed-use project in the Lion City’s Tanjong Pagar area.

SingHaiyi Group, which is controlled by mainland-born billionaire Gordon Tang and wife Celine, joined with Chip Eng Seng Corporation, which the Tangs also control, and an affiliate of Hong Kong-listed Chuan Holdings in a joint bid for the en bloc purchase of the building known as Maxwell House at a price of S$276.8 million ($207.8 million) on Thursday, according to a filing with the Singapore Exchange.

The partners were awarded the tender for the collective sale on Friday and now plan to leverage recent policy moves aimed at rebooting Singapore’s urban core to redevelop the 13-storey commercial complex at 20 Maxwell Road into a combined residential and commercial tower.

“As the Tanjong Pagar area is poised for rejuvenation with the upcoming planned development of the Greater Southern Waterfront precinct in the vicinity, the Property, being located at the fringe of the Tanjong Pagar planning area, is expected to benefit from the spill over effects from the rejuvenation of the area,” Chip Eng Seng said in a statement to the Singapore exchange.

Building Higher in Tanjong Pagar

An ageing strata-title commercial project, Maxwell House is within minutes’ walk of Tanjong Pagar MRT station and the future Maxwell MRT station in central Singapore.

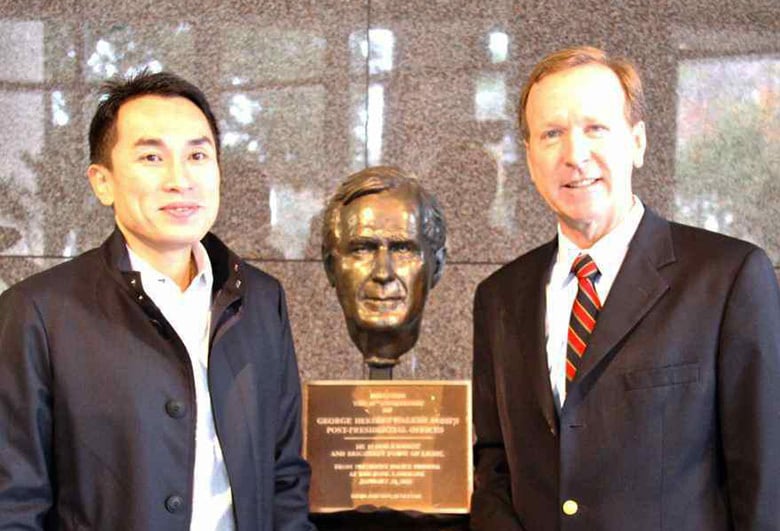

Gordon Tang (left) joins Neil Bush in polishing a George Bush bust

The joint venture partners plan to seek approval to redevelop the 3,883 square metre site into a commercial and residential mixed-use development with a gross plot ratio of up to 5.6 and a gross floor area of at least 21,746.48 square metres (234,077 square feet), or about 30 percent larger than the existing structure.

The residential element of the new project would be 80 percent, with the commercial component taking up no more than 20 percent of total GFA.

Under the terms of the joint venture agreement, Chip Eng Seng will hold 40 percent of the new entity, SingHaiyi 30 percent and Chuan Holdings the remaining 30 percent.

The Tang-controlled partnership makes use of the Singapore government’s CBD incentive scheme, which grants higher plot ratios for asset owners who agree to add a residential or hotel component when redeveloping existing commercial properties in the city centre.

Under its current zoning, Maxwell House is permitted a plot ratio of 4.3, with the new owners also planning to seek approval in principle for refreshing the asset’s 99-year leasehold.

Second Time Lucky

Maxwell House was initially put up for collective sale last year at a reserve price of S$295 million, but the price was reduced to S$268 million after failing to attract a buyer in the initial tender.

The Maxwell House project will soon be 80% residential

“The launch of the earlier tender in September 2020 was uneventful as the market was still reeling from the economic fallout due to COVID-19,” said Christina Sim, director of capital markets at Cushman & Wakefield Singapore, which ran the tender. “The progressive roll-out of vaccines and the gradual return to business normalcy has sparked hopes for 2021 and much brighter days ahead.”

The three partners will pay about S$12,728 ($9,550) per square metre of GFA if granted approval for the redevelopment scheme. The project may also benefit from the city’s Greater Southern Waterfront project, a plan to convert the area around the current container port into a residential and recreational area that will add 9,000 new homes along with a new waterfront park in the area south of Tanjong Pagar.

Billionaire Investor

For the Tang family, the redevelopment project will add to holdings that include 9.5 percent of SGX-listed Suntec REIT, 7.32 percent of OUE Commercial REIT and 9.47 percent of ARA US Hospitality Trust, as well as stakes in OUE Hospitality, OKH Global and Eagle Hospitality Trust. Gordon Tang’s father, Tang Jialin, also owns about 6 percent of Suntec REIT.

Neil Bush, the third son of late US president George Bush and younger brother of George W Bush, serves as the non-executive chairman of SingHaiyi, with Celine Tang filling the chief executive role. Bush and Tang also work together in leading American Pacific International Capital, a California-based firm that invests in US properties.

Originally from Shantou in Guangdong province, Gordon Tang is reported to have moved to Singapore in 1995 and has stated in a US media interview that he was a professional windsurfer in China in the 1980s, at a time when much of the country still dressed in Mao suits.

Now a Singapore permanent resident, Gordon Tang established trading and investment company Tang Dynasty Pte Ltd in Singapore in 1995, though the original source of his wealth has been thinly documented in public accounts. Information on Tang’s age has also not been published widely; Forbes last year estimated his wealth at $940 million.

Revving Up Redevelopment

According to Cushman & Wakefield, 20 Maxwell Road is one of the rare residential development opportunities to be put on the market, especially in a location dominated by retail, dining and offices. Meanwhile, a nearby thoroughfare, Robinson Road, has become a magnet for redevelopment-minded investors in recent years.

In April, US-based PGIM Real Estate picked up an ageing 12-storey tower at 108 Robinson Road, formerly known as the Finexis Building, for S$143 million from local private equity firm Sin Capital Group.

In mid-2019, local real estate firm Sun Venture bought a 13-storey office tower at 71 Robinson Road from a unit of Germany’s Commerzbank for S$655 million. Later that year, ARA Asset Management completed the purchase of the 20-storey Robinson Centre at 61 Robinson Road for S$340 million through the Singapore firm’s ARA Real Estate Partners Asia II value-add fund.

Last August, Tuan Sing Holdings agreed to sell the 21-storey Robinson Point office building at 39 Robinson Road for S$500 million, or 34 percent over the property’s book value, notching an above-market deal in the wake of the COVID-19 crisis.

Leave a Reply