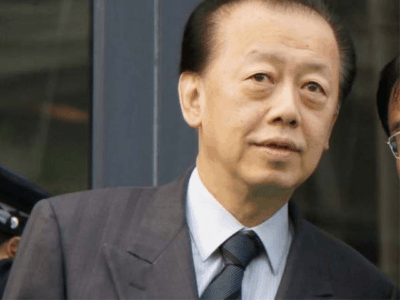

Malaysian billionaire Quek Leng Chan teamed up with his Singaporean cousin for a $744 million property deal

Companies controlled by Singaporean tycoon Kwek Leng Beng and his cousin, Malaysian magnate Quek Leng Chan, have teamed up to buy a prime freehold site in the city’s River Valley neighborhood for S$980 million ($744 million).

The deal is Singapore’s biggest purchase of a collectively sold site in more than a decade, with the condo project changing hands for 4.5 percent more than the reserve price of S$938 million set in early February.

The tender was awarded to a joint venture between GuocoLand (Singapore) Pte Ltd, Intrepid Investments Pte Ltd and Hong Realty (Private) Limited, which respectively hold 40 percent, 40 percent and 20 percent stakes in the new company. GuocoLand (Singapore) is a subsidiary of Singapore-listed GuocoLand Limited, which announced the deal on Monday.

GuocoLand is controlled by Quek, who is co-founder and executive chairman of Hong Leong Group Malaysia. The remaining firms in the joint venture trio are majority owned by Kwek Leng Beng’s Hong Leong Investment Holdings. Kwek, who also leads Singaporean developer City Developments Limited (CDL) and its parent Hong Leong Group, has a substantial stake in GuocoLand through Hong Leong Investment Holdings.

Hong Leong Buys Another Mega-Project

Pacific Mansion site, with Martin Modern under construction across the street

The deal for the Pacific Mansion site is the second time in six months that companies belonging to the Hong Leong Group have bought market-leading projects in Singapore. Last October, City Developments, along with Hong Realty paid S$906.7 million ($667 million) to buy up Amber Park on the city’s east coast, in deal which set a high water mark for freehold residential sites in the city.

Now Hong Leong along with GuocoLand have bought out all 290 units in the project along River Valley Close, nearby to Orchard Road and within walking distance of the upcoming Great World City MRT station.

The site offers a maximum gross floor area of 493,222 square feet (45,822 square metres), equating to a sale price of S$1,987 per square foot – or S$1,806 per square foot if the 10 percent “bonus” balcony space is included.

“The tender drew keen interest from local and foreign developers,” Galven Tan, director of capital markets at CBRE, which brokered the transaction on behalf of the sellers, said in a statement. Each residential unit owner will gross S$3.26 to S$3.48 million ($2.5 to $2.6 million) through the sale.

Mandarin Gardens Owners Said to Ask S$2.5B

The Pacific Mansion deal is the biggest en bloc deal in the last decade, surpassing the S$970 million purchase of Tampines Court by Sim Lian Development last August, and is topped only by the S$1.3 billion sale of Farrer Court in 2007.

All of these deals are already dwarfed, however, by a proposal for a collective sale of the Mandarin Gardens development on Singapore’s east coast. The owners of the 1,006-unit condo project overlooking East Coast Park on Siglap Road are said to be asking S$2.5 billion ($1.9 billion) for the right to redevelop the 1,073,226 square foot (99,706 square metre) 99-year leasehold site.

Singapore’s current flurry of en bloc activity has already totalled S$14.3 billion across 44 deals since the start of last year. The zeal for selling residential complexes en bloc has only increased in the first three months of 2018, which posted 14 collective sales totalling S$5.6 billion — 64 percent of the full-year total in 2017.

GuocoLand Project Gets a New Neighbour

The just-acquired site in District 9 is across the street from GuocoLand’s 45o-unit luxury condo project Martin Modern, which was launched last July and had sold 201 units as of December. The first batch of 90 units, ranging from two- to four-bedroom apartments, sold for more than S$220 million.

Last October, GuocoLand together with its parent Guoco Group placed the winning S$1.622 billion ($1.2 billion) bid for a commercial site on Beach Road, which it is likely to develop into a mixed-use commercial and residential project. At least 70 percent of the development’s GFA is earmarked for office space.

Leave a Reply