The UK is selling off a slice of its embassy in Japan

Less than four years after the disposal of its embassy site in Bangkok, the UK Foreign Office continues to pare back its real estate footprint in Asia, announcing Thursday that it had agreed to sell a section of the British Embassy compound in central Tokyo to developer Mitsubishi Estate for an undisclosed amount.

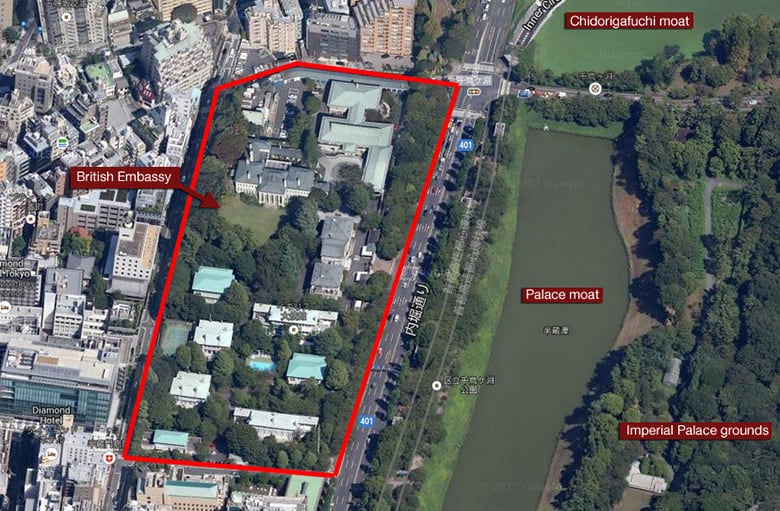

The British Embassy sits east of Hanzomon metro station and west of the Imperial Palace, directly across from the moat that surrounds the Japanese emperor’s residence in Chiyoda ward. After earlier downsizing, the compound currently measures 28,000 square metres (301,389 square feet) and no decision has yet been revealed regarding how much or what parts of the compound which the UK has occupied since 1872 will be sold.

“The proceeds of the sale will go towards making the embassy more modern and sustainable, including through solar panels and improving energy efficiency, and to upgrading the FCDO’s wider diplomatic estate in New Delhi and elsewhere,” the UK’s Foreign, Commonwealth and Development Office said in a press release.

The partial sale will help further the Foreign Office’s programme of selling assets to raise cash for modernisation projects in the office’s diplomatic estate, which includes 270 overseas missions and 5,400 properties worldwide.

Bangkok Model

The Foreign Office in early 2018 announced that it had sold its 3.5 hectare (9 acre) embassy site in Bangkok to a joint venture of local mall developer Central Group and Hongkong Land for over £420 million ($595 million) in Thailand’s biggest-ever land deal.

The UK government is giving up a bit of sovereignty to pay the bills

The office said at the time that the nearly century-old embassy building required a significant upgrade and refurbishment to fit a modern working environment, with large parts of the building no longer usable.

Central had already bought one-third of the Embassy’s then 12 acre compound for $95 million in 2006, after the Foreign Office put the site on the market the previous year. That parcel has been transformed into the Central Embassy complex, which now displays Chanel and Gucci and operates the Park Hyatt Bangkok hotel where diplomats used to stroll around the garden.

The larger slice of the former embassy site is being developed into a mixed-use project linked to Central Embassy. The Foreign Office has relocated the British Embassy to a commercial space in the 29-storey AIA Sathorn Tower near the Thai capital’s Silom business district.

In 2013 the UK had agreed to hand back some 20 percent of its then 35,000 square metre site to the Japanese government. Following the sale

Global Developments

One of Japan’s largest developers, Mitsubishi Estate is likely to develop the embassy site into high-end condos, Nikkei Asia speculated. The division of conglomerate Mitsubishi has stayed active this year, including with a series of overseas investment deals across various property segments.

The British embassy compound as it stood in 2013

Nikkei Asia reported in February that Mitsubishi Estate planned to build seven US data centres near Washington DC by the end of the decade at an estimated cost of JPY 200 billion ($1.8 billion), getting a jump on one of 2021’s hottest asset classes.

In mid-2021, the Japanese group set up a joint venture with Australia’s Lendlease to develop the Residences Two, a second residential tower at the One Sydney Harbour project, with Mitsubishi Estate acquiring a 25 percent interest in the tower to match its 25 percent interest in Residences One.

In July, Mingtiandi reported that Mitsubishi Estate had taken an equity stake in Beijing Diamond Plaza, an office project in Beijing’s Zhongguancun area, alongside Shanghai-based ACR Asset Management.

Leave a Reply