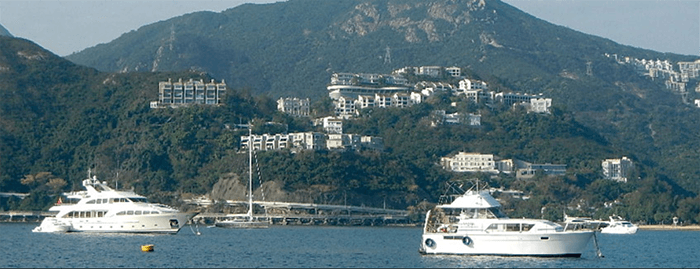

Among the advantages of the Shouson Hill site is the ability to keep an eye on your yacht in Deep Water Bay

Mainland state-owned conglomerate China Resources is said to have snapped up one of Hong Kong’s most prestigious home sites, and has set a land price record in the process.

The Shenzhen-based giant, which invests in businesses from retail to energy resources, reportedly acquired a residential plot in Shouson Hill for HK$6 billion ($765 million), making the site overlooking Deep Water Bay Hong Kong’s priciest residential land ever.

The 92,087 square foot (8,555 square metre) site is currently approved for construction of a pair of buildings of up to three stories with a total floor area of up to 69,065 square feet of floor area, according to Vincent Cheung, a Deputy Managing Director at Colliers International in the city. The transaction price translates into HK$86,800 per square foot of floor area, shattering the previous private land price record set by the HK$5.1 billion disposal of Ho Tung Garden on Victoria Peak in 2014.

The site currently is home to 12 homes spread across two buildings. Should the land parcel be redeveloped, the new homes on the site could sell for from HK$150,000 per square foot to as much as HK$180,000 per square foot, said Colliers’ Cheung in an interview with Mingtiandi.

Becoming Li Ka-shing’s Neighbour Doesn’t Come Cheap

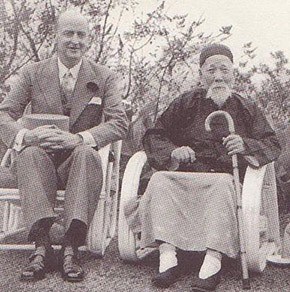

Shouson Chow and HK governor Alexander Grantham during the last time that a home in Hong Kong cost less than 50 years of wages

China Resources is buying the site at 39 Shouson Hill Road from the family of Shouson Chow, one of Hong Kong’s earliest tycoons and for whom the hill, the road and the area are named. The seller had put the property on the market via a tender which closed at the end of April.

While the price of the land and its future housing set new records, the property comes with some high-end intangibles, including the right to become neighbours with billionaire Li Ka-shing, who makes his home on Shouson Hill Road. The exclusive residential street also is also the location of the official residence of Hong Kong’s Financial Secretary.

“The site is at one of the best areas in Hong Kong as it is located along the Shouson Hill Road and nearby the junction of the Deep Water Bay Road. Shouson Hill road is famous for good feng shui and the developments nearby or along Deep Water Bay Road can enjoy a spectacular sea view,” Cheung noted.

The Shouson Hill site was auctioned off to China Resources by the descendants of colonial-era Hong Kong businessman Shouson Chow. Born in 1861, Chow co-founded the Bank of East Asia in 1918 after attending Phillips Exeter Academy and Columbia University in the US. Apart from his businesses, Chow was also an influential figure in politics and was appointed as the first Chinese member of the city’s Executive Council under British rule in 1926.

China Resources Brings Hong Kong Land Deals to HK$9B in 12 Months

Vincent Cheung, Deputy Managing Director at Colliers International

This latest acquisition brings land purchases in Hong Kong by the central government-controlled SOE and its real estate subsidiary, China Resources Land, up to HK$8.8 billion over the past year.

Prior to the Shouson HIll buy, in July last year China Resources Land scored a 5,223 square foot plot in Central for HK$1.1 billion. The Shenzhen-based builder plans to redevelop the residential site at No 1-4 Chancery Lane into a property of up to 47,007 square feet.

The deal in Central came after China Resources bought a pair of buildings in Causeway Bay – the Fair View Commercial Building at 27 Sugar Street and the Grand View Commercial Centre at 29-31 Sugar Street – for HK$1.68 billion ($215 million) in June, 2017.

This buying spree provides the mainland firm, which also operates the Chinese Arts & Crafts and Vanguard retail chains in Hong Kong, with a set of three sites yielding some 163,000 square feet of floor area in the city.

Leave a Reply