Keppel REIT holds a third-stake in Singapore’s Marina Bay Financial Centre

Disruption continues to be a theme at Keppel REIT as the manager of the Singapore-listed trust announced on Friday that its chairman, Penny Goh, will retire on 31 May.

Now 69, Goh is set to be replaced by Keppel stalwart Tan Swee Yiow, who has been named chairman of the S$8.9 billion ($6.53 billion) trust as of 1 June, as the manager puts new leadership in place. The changeover comes after a Temasek Holdings-led consortium frustrated a recent attempt by its sponsor, Keppel Corporation, to buy out the real estate business of Singapore Press Holdings and merge those assets with Keppel REIT.

“On behalf of the Board and management, I would like to express our deepest appreciation to Penny for her strong leadership and valuable contributions to the Board over the past five and a half years,” Tan said in a statement. “Under her stewardship, Keppel REIT delivered strong results, despite challenging market conditions.”

In its annual report issued at the end of March, Keppel REIT revealed a 9 percent increase in distributions to unit-holders after its net property income climbed by 27.3 percent in 2021 compared to a year earlier. Although the trust’s sponsor, Keppel Corp indicated in February that it was pursuing arbitration with Singapore Press Holdings over the failed buyout attempt, no mention of the plan or the proceedings was made in the report.

Strong Returns, Failed Deal

“With the solid support of the Board and the unwavering dedication of the management team, Keppel REIT was able to accelerate its portfolio optimisation and asset recycling strategy,” Goh said in a statement. “I am confident that under Swee Yiow’s astute leadership, Keppel REIT will continue its growth momentum and long-term value creation for all our stakeholders.”

Penny Goh will be leaving at the end of next month

Goh had taken over as head of Keppel REIT in 2017 after serving as a non-executive, independent director of the trust’s manager since the previous year. The law graduate of National University of Singapore had served as co-chair and senior partner with law firm Allen & Gledhill in Singapore from 2017 through 2019, and has since served as a senior advisor to the organisation.

The trust, which holds a portfolio of prime office properties across Australia, South Korea and Singapore delivered total unit-holder returns of 39.7 percent from 2017 to 2021, according to the manager’s figures, as it grew its holdings to 11 properties.

Despite that record of success, however, the manager announced in August last year that chief executive Paul Tham had resigned, with the departure announced less than one month after Keppel Corp unveiled its ill-fated S$3.4 billion ($2.5 billion) deal to purchase the non-media business of Singapore Press Holdings.

The shareholders of Singapore Press Holdings voted to approve the buyout bid by Cuscaden Holdings late last month, with local courts approving the transaction at the beginning of April.

Keppel REIT’s manager announced in September that it had chosen former AA REIT leader Wee Lih Koh as its new chief executive, with Tham later resurfacing as deputy group chief financial officer at CapitaLand.

Safe Hands

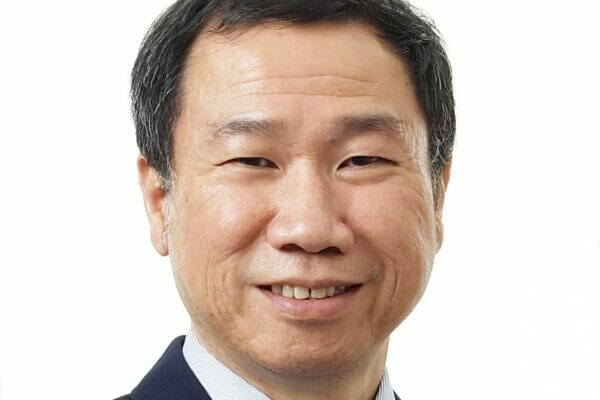

Tan Swee Yiow is well informed regarding the business of Keppel REIT as he prepares to take over over the top position with its manager, after having first joined the trust’s board as a non-executive director in 2017.

Tan Swee Yiow has spent 30 years at Keppel

A 30-year Keppel Group veteran, Tan was chief executive of Keppel Land from 2019 to 2021 and has twice served as CEO of Keppel REIT. The National University of Singapore graduate was the first chief executive of Keppel REIT when the trust was listed in 2006 through to 2009.

Tan then took over the role in a bit of emergency pinch-hitting in 2017 when Jesline Goh departed from the chief executive slot after just 28 days on the job. In that second stint, Tan led the REIT until Tham was promoted into the top role in September 2018.

Leave a Reply