Wanda’s exit from AMC may have been hastened by widespread theatre closings during the pandemic

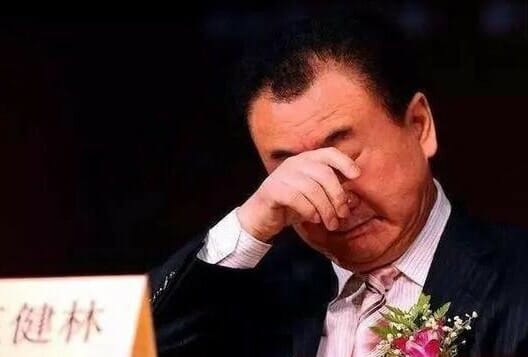

Beijing-based Dalian Wanda Group’s dreams of becoming a Hollywood power player faded further last week with the news that the conglomerate helmed by billionaire Wang Jianlin had ceded majority control of the world’s biggest cinema chain, AMC Theatres.

In a Wednesday earnings call, AMC chief executive Adam Aron said that when Wanda cut its stake to less than 30 percent in the fourth quarter of 2020, the Chinese group’s Class B common shares, each carrying three votes, automatically converted to Class A shares carrying a single vote each. As a result, Wanda — which once owned AMC outright — saw its shareholding and voting power fall to less than 10 percent.

Wanda’s retreat from the theatre company which had once symbolised its global ambitions came at the close of a year in which AMC lost nearly $4.6 billion after attendance at its cinema venues fell by 78.9 percent compared to 2019. While the pandemic caused the closings, AMC had also lost $149 million in 2019 as online streaming services had eroded the theatre business long before COVID-19 began shuttering cinemas.

Reversal of Fortune

As late as last October, Wanda had held 37.7 percent of AMC and with it 64.5 percent of the company’s voting rights. Aron said that with a controlling shareholder no longer in place, AMC would be governed as most publicly traded companies are, “with a wide array of shareholders”.

Wang Jianlin’s Hollywood dreams aren’t working out as planned

“Wanda still has two board seats, and I can genuinely tell you that they have been an absolute delight for me to deal with during the past five years that I’ve led AMC,” the CEO said.

Best known as a property developer, Wanda went on an overseas spending spree in the middle of the last decade, adding trophy assets that included real estate in the US, the UK, France, Spain and Australia.

Wanda bought 100 percent of Kansas-based AMC for $2.6 billion in 2012, part of a global expansion into entertainment, and maintained an 80 percent stake after AMC’s $1.7 billion IPO in 2013.

The Chinese group’s ambition was forced to scale back, however, as mainland authorities targeted Wanda, HNA and other major cross-border investors in 2017 as part of a crackdown on outbound capital flows.

In September 2018, Wanda agreed to sell a $600 million stake in AMC to private equity firm Silver Lake, in the form of senior unsecured convertible notes. A portion of the proceeds — about $421 million — from the convertible paper was to be used by AMC to repurchase 24,057,143 shares from Wanda’s 60 percent stake in the cinema owner.

Last Wednesday, Aron noted that Silver Lake had converted the notes into 44 million shares of stock at a conversion price of $13.51 per share, wiping $600 million in interest-bearing debt off the books and “meaningfully” reducing AMC’s leverage.

That conversion price was down from a multi-year peak of nearly $20 reached in January as AMC’s shares were wafted upward by the so-called “Reddit rally” led by multitudes of message-board users boosting unloved stocks. On the earnings call, Aron avoided tackling the Reddit issue directly, saying only that AMC’s executive team had been focused on “managing our business and directing its recovery”.

Rolling Back the Empire

Wanda’s acquisition of AMC in 2012 marked the first instalment in a cross-border push that from 2013 to 2017 built a $5 billion overseas real estate portfolio. Since that peak, the conglomerate chaired by Wang, Asia’s one-time richest man, has liquidated its properties worldwide.

Last July, the group announced that it had agreed to sell its 90 percent stake in a Chicago property project, the 101-storey Vista Tower, for $270 million, effectively closing the book on Wanda’s overseas property portfolio.

Before that, Wanda Sports Group in March announced that it was selling its Ironman franchise for $730 million to the owner of publishing house Conde Nast — just eight months after the company suffered 2019’s second-worst NASDAQ debut.

Too rich to be ignored as a threat to internal stability, same as Jack Ma.

Rich men want to be king…