The 732-key St Giles Hotel London (Image: Criterion Capital)

A consortium led by Malaysia’s IGB has sold a 732-key hotel in the West End of London for £220 million ($296.5 million), the developer announced Monday.

The disposal of St Giles Hotel London resulted in a net gain for IGB of MYR 452.6 million ($111.6 million), according to a filing by the listed group controlled by the Tan family behind Kuala Lumpur’s Mid Valley Megamall.

The 1977-vintage St Giles sits at 12 Bedford Avenue near the junction of Oxford Street and Tottenham Court Road, one block west of the British Museum. JLL advised IGB on the sale to Criterion Capital, the London-based firm of Abu Dhabi businessman Asif Aziz.

“St Giles provides a unique opportunity of optionality within central London, offering significant potential across multiple strategic directions,” said William Duffey, head of EMEA hotels at JLL. “With a growing portfolio of hotel assets across the UK, Criterion Capital’s strategic acquisitions, responsible stewardship and focus on long-term value creation make them a strong custodian for an asset of this scale and prominence.”

YMCA Site Reunified

Criterion’s acquisition price values the St Giles at £300,546 ($404,835) per key. The firm said the buy boosted its West End hotel portfolio to over 3,700 operating rooms, with a committed pipeline set to exceed 9,000 rooms by 2029.

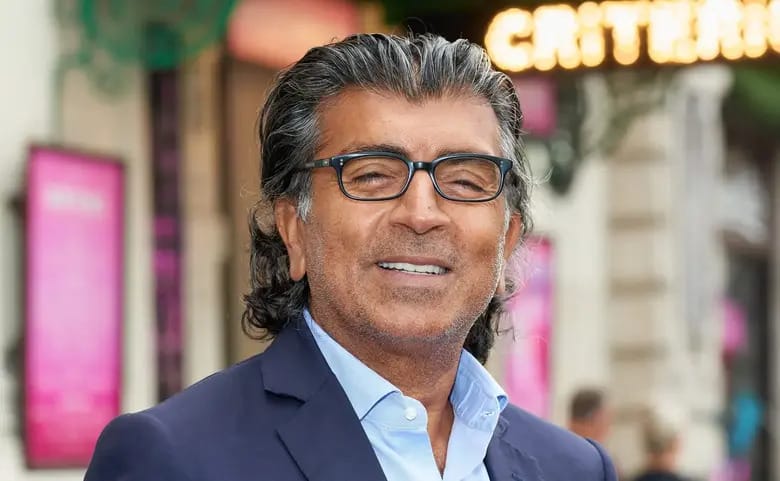

Criterion Capital founder Asif Aziz

Aziz had been a member of the Michael Laurie Architects team that advised the Young Men’s Christian Association on the 1993 sale of the hotel to the IGB-led group. He later founded Criterion and gradually consolidated interests across the wider site as part of a repositioning of the dormant space as England’s first fully underground hotel.

After the YMCA decided to cease operations last year, the organisation approached Criterion regarding the sale of its freehold interest, which Criterion acquired.

“Now, Criterion has completed the reunification of the entire site, restoring single ownership for the first time since its original development, after years of fragmented ownership and operation,” the firm said.

Portfolio Deals Down

London hotel investment volume in 2025 reached £3 billion ($4 billion), up 25 percent from the previous year and 41 percent above the 10-year average, according to Savills.

The capital sharply outperformed Britain’s regional markets, where hotel investment volume slowed to £2 billion from a year-earlier £3.3 billion on fewer portfolio deals, the consultancy said.

Portfolio transaction volume in UK hotels stood at just over £750 million, down from £3.1 billion recorded in 2024, as activity in the single-asset market made up 85 percent of volume.

“UK hotel transactions proved resilient in 2025 driven by a liquid single-asset market, and the enduring appeal of London, which had its strongest year of investment volumes since 2018,” said David Kellett, head of EMEA hotel capital markets at Savills. “Despite continuing cost challenges for hospitality businesses, we anticipate a strong year ahead in 2026 with more portfolio deals, building on the positive momentum in the fourth quarter of 2025.”

Leave a Reply