Developer Guangzhou R&F Properties continued its overseas expansion this week when it acquired a site in San Jose, California for a $250 million residential project. The move is a continuation of an overseas expansion by China’s cashed-up real estate developers, and marks a rare acquisition by a Chinese developer outside of a major gateway city.

According to accounts in the San Jose local media, Full Power Properties LLC, an affiliate of Guangzhou R&F bought the 2 acre (8,100 square metre) site from Cupertino, CA-based KT Properties for an undisclosed consideration.

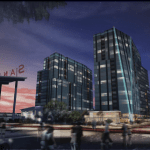

The project, which has been using the name St. James Towers, has yet to secure building permits from the city, but plans to begin construction in 2015. Plans for the St James call for a 643-unit pair of towers, combined with 1,858 square metres of retail in the downtown district of California’s third-largest city.

Guangzhou R&F Expanding Rapidly

Hong Kong-listed Guangzhou R&F, which is co-chaired by billionaire Li Sze-lim, was listed as China’s 10th largest real estate developer last year, and lately has been setting its sights on overseas expansion.

Late last year the residential real estate specialist spent US$1.4 billion to acquire six sites in the Danga Bay area of Malaysia’s Johor Bahru state, just across the border from Singapore.

And earlier this month an Australian developer announced that it would be selling a site that it acquired in Brisbane just six months ago for A$22 million ($20.46 million) to R&F for A$46 million ($42.75 million).

Chinese Expanding Beyond Gateway Cities

The decision by the Guangzhou developer to buy a site in San Jose represents a break from the reigning pattern of Chinese developers pursuing high profile projects in “global gateway” cities.

While San Jose is not a small community in the US, and its position adjacent to Silicon Valley places it in one of America’s strongest economic zones, the inland city of one million people lives largely in the shadow of its more famous neighbor, San Francisco.

In the past many brokers of real estate investment properties have reported challenges interesting Chinese buyers in opportunities outside of major urban centres such as New York, London, or Sydney. According to one investment professional that Mingtiandi contacted, even marketing deals in Chicago has been challenging as recently as the beginning of this year.

So San Jose’s new windfall may just offer some hope for all of you shopping projects to Chinese investors in Minneapolis, Houston or Manchester.

- A rendering of the St James Towers in San Jose

- The towers by night

- A front view of the twin towers

- The developer predicts convenient transportation options

- Looks like an office building to me

- The project would include 643 residential units

Leave a Reply