Chinese applicants won 83% of EB-5 visas in 2015

Demand for investor visas under the US government’s EB-5 program increased 50% in 2015, as aspiring foreign investors rushed to file before potential changes take place to the popular pathway to US residency. While the program attracted record interest in terms of applicant volume, wealthy Chinese investors faced increased competition from wealthy would-be immigrants from Vietnam, India and other locations in 2015.

The threat of changes to the US investor visa programmed helped trigger 17,691 EB-5 applications in 2015, according to US government figures, up from 11,744 in 2014 and nearly triple the 6,554 applications in 2013.

The once obscure program, which provides visas to individuals who commit at least $500,000 to qualified projects in the US, has seen rising demand in recent years, especially among Chinese investors eager to chase higher returns overseas as their economy back home continues to slow.

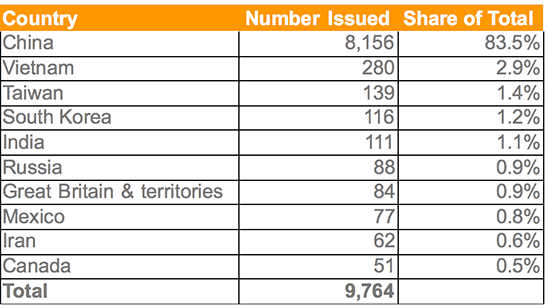

EB-5 Visas Issued by Country – 2015

Source: US Department of State

Among EB-5 visas issued, China yet again topped the leaderboard by accounting for more than 83% of submissions last year, according to official statistics from the US State Department. That share is down from the more than 90% take Middle Kingdom investors commanded in 2014 when the program was less well-known and China almost-singlehandedly exhausted the annual supply of visas for the first time.

While the number of Chinese applicants has continued to rise, wealthy individuals from other countries are increasingly jumping into the mix thanks in part to a ramp-up in efforts to market investor projects, and also due to a developing EB-5 industry globally. Among the program’s top ten countries by applicants, Vietnam, territories of Great Britain and India had particularly strong showings compared to last year.

The broadening of the foreign investor pool is good news for some US officials who had come under fire after EB-5 was publicly portrayed as an express path for wealthy Chinese to obtain US residency. Amid calls for reform, applications had poured in at the end of the year because of rising concern that lawmakers would put tighter controls on where EB-5 funds can be used. Lawmakers had also discussed raising the minimum investment level to $800,000. In December, the US Congress extended EB-5 without modification, but only through September 2016.

Waiting Times Extend to 5 Years

MIngtiandi’a Michael Cole hosting a panel discussion on EB-5 in Shanghai last year

The sudden surge in investors looking to secure US visas has led to a rising backlog of pending applications, with more than 21,988 applicants awaiting visas as of the end of last year, according to the Wall Street Journal. With ever-growing lines of investors at America’s shores, experts say it may take up to five years for qualifying investors to obtain a visa, up from a two-year wait in 2014.

Longer visa processing times has companies in the US that have benefitted from the program concerned it may be more difficult to find future investors. Any drop in applications would also threaten to reduce the flow of billions in capital used to spur US development projects.

The program has funded multiple luxury condominium towers and high profile projects such as the Pacific Park (formerly Hudson Yards) project in Brooklyn, which put upwards of $1 billion in EB-5 investment towards building the largest-ever private real estate development in the US.

Elsewhere, potential Chinese investors are being approached to fund projects including the redevelopment of the former Macy’s headquarters in New York City’s Brooklyn borough, a library redevelopment project, also in Brooklyn, and the latest phase of 2 World Trade Center.

Leave a Reply