Dalian Wanda Group, which has recently been in the news for buying theatre chain AMC and shopping for hotels in the US, inked a deal on Friday which will make it the first mainland Chinese developer to invest in India.

Wanda signed a memorandum of understanding with Indian tycoon Anil Ambani’s Reliance Group to set up a joint venture for a strategic long-term partnership according to a statement from Reliance. Among the first ventures of the new partnership will be integrated township projects including commercial buildings and residential apartments, hotels and retail space in Navi Mumbai and Hyderabad.

Although some Hong Kong-based developers have previously funded Indian projects, sector analysts cite this as the first time that a mainland developer has invested in the subcontinent.

The two companies said their venture would examine a land development project in Navi Mumbai, a satellite city of India’s financial capital, and an 80 acres site in Hyderabad, a fast-growing western city.

Under the terms of the memorandum, Reliance will contribute the land and Wanda its expertise in construction and development. The JV is expected to be signed in a few weeks, at which time formal investment figures will be announced. However, one person familiar with the thinking behind the two projects estimated they could ultimately be worth in the region of $1bn-$1.5bn.

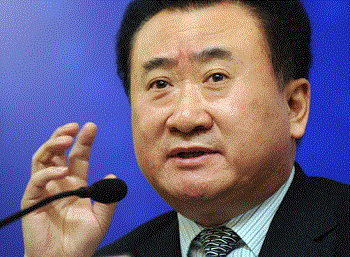

Commenting on the agreement, Wanda’s Mr Jianlin said, “India is the world’s second most populous nation after China, with a rapidly developing economy and huge market potential. Wanda is very excited about the opportunities in the Indian market.”

The two sites planned for the first phase of the partnership include Dhirubhai Ambani Knowledge City in Navi Mumbai, and a new business district in Hyderabad.

The 135-acre Dhirubhai Ambani Knowledge City in Navi Mumbai, owned by Reliance Communications, has a development potential of 10 million square feet (sq ft), subject to necessary approvals.

The Hyderabad project is an 80-acre new business district owned by Reliance Infrastructure, having an unlimited floor-space index for development for commercial and residential purposes, hotels, etc. There are plans to develop up to 10 million sq ft area here in a phased manner.

The Reliance Group already has a track record of working with Chinese banks for financing of its projects. Earlier this year, Ambani’s Realiance Communications borrowed $1.18 billion from China’s lenders to repay its holders of foreign bonds. Reliance Power also secured loans of $ 1.1 billion from three Chinese lenders for a power plant project in India.

Wanda Group has built 130 million sq ft properties in 66 integrated projects across 50 cities in China and 38 five-star hotels.

Leave a Reply